- Metals Australia (ASX:MLS) shares have jumped on the discovery of a high-grade graphite flake

- The flake was found in a sampling campaign at the company’s Quebec graphite acreage but samples averaged closer to 11 per cent graphite

- MLS is keen to supply graphite for EV batteries to North America but domestic ability to create spherical graphite is nebulous

- Shares last traded at 3.6 cents

Commodities thematics have been well-defined this year, so far. Lithium is down, nickel is down, iron ore is declining, and uranium is up.

But what about graphite? Only late last year, China introduced a soft graphite export ban, kicking off a short-lived period of speculation we could be on the cusp of a graphite bull run.

Graphite – often called a “forgotten battery mineral” – regularly struggles to endear the same enthusiasm that other metals do for retail traders.

Perhaps this is because the end-products required in batteries are notoriously difficult to make; because graphite mining is dirty, or because its ultimate value lies in graphene, a product that the human race can’t really make yet.

Just look at yearly returns for First Graphene (ASX:FGR) – up 3.08 per cent at 11:30 am AEDT today, but, down 33 per cent YoY.

Regardless, one company in the graphite space today has shown at least some shareholders are paying attention to the thematic, even as the ASX sees all sectors in the red during the second hour of trade.

Which company is up today?

Metals Australia (ASX:MLS) shares are up 5.88 per cent heading into lunchtime trades, with the microcap’s shares up to 3.6 cents.

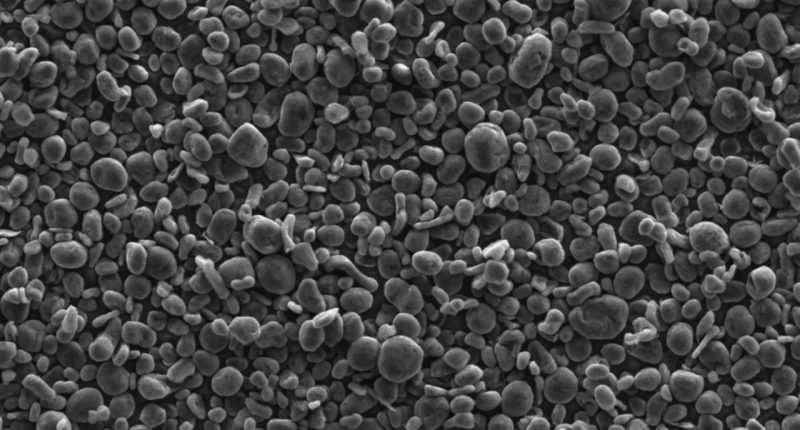

The key catalyst is one “exceptional” grade graphite flake recovered from a sampling campaign – coming in at a concentration of 64.3 per cent.

This, the company said, highlights the “tier-1 resource potential” of the company’s Lac Rainy project in Quebec, Canada.

In addition to one high-grade flake, the geotechs are also highlighting 10 results from the sampling campaign over 20 per cent graphitic carbon (Cg), though, averaged a grade of 11 per cent Cg across a 36-kilometre strike length.

That strike length is comprised of “graphitic trends identified within the project”.

Lac Rainy boasts a total resource of 13.3 million tonnes of ore at 11.5 per cent Cg, which “has been defined from drilling over just 1 kilometre of the expanded 36-kilometre strike-length.”

“The latest exceptionally high-grade 64.3 per cent flake graphite result further reinforces our belief that our Lac Rainy Graphite Project has the potential to be a globally significant, Tier-1 flake-graphite resource,” Metals Australia chairman Mike Scivolo said.

“This is further supported by the fact that the existing high-grade resource we have defined to date is from drilling over just 1km of the over 36km of graphitic trends now identified on the Lac Rainy project.”

Drilling kicks off in Feb

Shareholders will be watching to see what drillers turn over when the company kicks off a new drilling program in February.

The drilling campaign launches around the same time Metals Australia is now kicking off a pre-feasibilty study (PFS) for commercial production of flake graphite from Lac Rainy.

That PFS will add to an existing Scoping Study that boasted “economic cashflow potential at over 100 per cent margin based on production” with nearly 100,000 tonnes per year over a 14 year period.

Metallurgical purification considerations continue to be figured out by the company, with that realm of affairs to get its own study for sale into “North American lithium-ion battery and EV markets”.

Metals Australia, a microcap explorer, perceives it can challenge China as a supplier to North America. In the context of the world’s second-largest economy introducing graphite export restrictions, that seems less ambitious.

The question remains, of course, on how MLS intends to make spherical graphite – needed for inclusion into EV batteries where it’s made into a foil – here at home.

MLS shares last traded at 3.6 cents.