- Shares in Newcrest Mining (NCM) are continuing to surge after one of the world’s largest gold miners, Newmont Corporation, tabled its “best and final” takeover offer of US$19.5 billion (A$29.4 billion)

- It follows a share price rise of more than 12 per cent across the past five days to April 11, up 23.8 per cent over the past month, and more than 70 per cent across the past six months

- If the deal goes through, it would lift Newmont’s gold output to almost double the world’s largest gold miner and rival NSYE-listed Barrick Gold

- Under the revised takeover offer, Newcrest shareholders would receive 0.4 Newmont shares for each share held, valued at $32.87 apiece

- Shares in NCM were up 0.25 per cent, trading at $29.82 at 11:15 am AEST

Shares in Newcrest (NCM) have continued to surge this week after one of the world’s largest gold miners, Newmont Corporation, tabled its “best and final” takeover offer of US$19.5 billion (A$29.4 billion).

It brings the Australian gold miner’s share price rise to more than 12 per cent across the past five days to April 11, up 23.8 per cent over the past month, and more than 70 per cent across the past six months.

If the deal goes through, Newmont’s gold output will lift to almost double that of the world’s largest gold miner and rival, NSYE-listed Barrick Gold.

This in turn would reap benefits for Newcrest shareholders, combining to form what would be the biggest gold miner globally.

The deal also marks one of the biggest mergers ever involving an Australian company, and would rank amongst the biggest deals globally in 2023.

Under the revised takeover offer, Newcrest shareholders would receive 0.4 Newmont shares for each share held, valued at $32.87 apiece – up from the previous offer of 0.38 that Newcrest’s board rejected back in February.

Newcrest also announced it has opened company books to Newmont following the all-share bid.

Newmont CEO Tom Palmer said the deal would strengthen the miner’s status.

“This transaction would strengthen our position as the world’s leading gold company by joining two of the sector’s top senior gold producers and setting the new standard in safe, profitable and responsible mining,” he said.

The final bid is 16 per cent higher than Newmont’s initial proposal and represents a 46 per cent premium to Newcrest’s share price on February 3, prior to the first bid being announced.

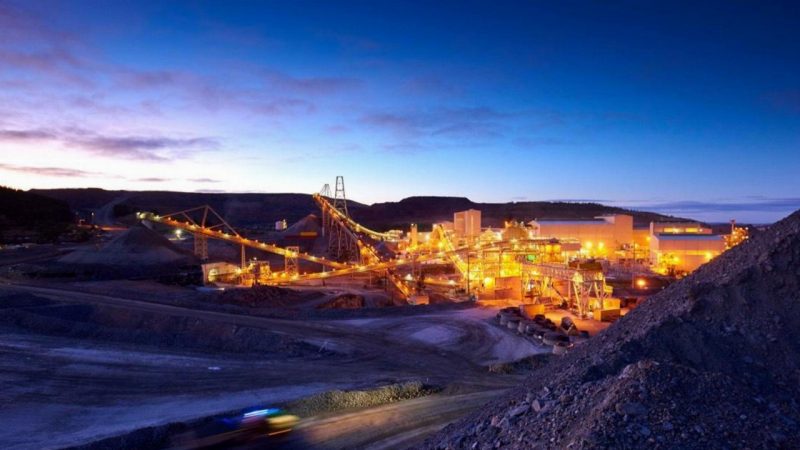

Newcrest’s operations include its Cadia operation and Havieron project in Australia, its Burcejack and Red Chris operations in Canada, and its Lihir operation in Papua New Guinea.

Ironically, Newmont founded Newcrest in the 1960s, but demerged around 30 years ago.

The latest bid by Newmont will see Newcrest shareholders take hold of 31 per cent of the company.

Newcrest shares were up 0.25 per cent, trading at $29.82 at 11:15 am AEST.