Battery tech developer Li-S Energy (ASX:LIS) has become the first Australian company to produce lithium metal foils, and ahead of schedule to boot.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

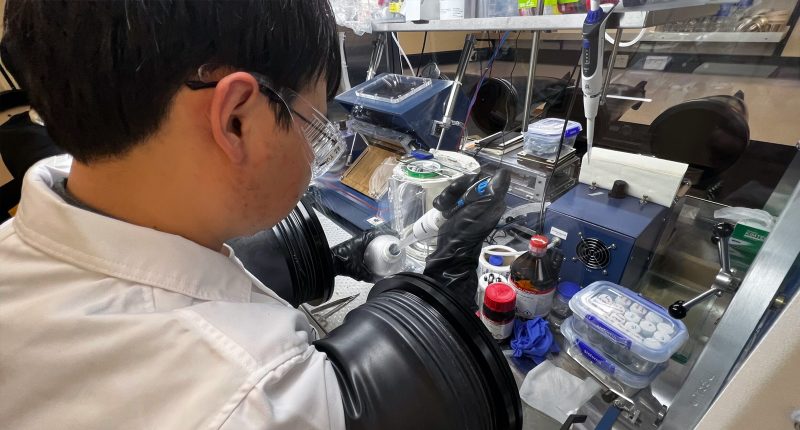

Li-S Energy recently installed new extrusion equipment at its Geelong battery cell production facility and leaned on that expansion to produce the first 100-micron-thick pure lithium metal foils in the country.

The milestone development now allows the leading Aussie battery tech developer to eliminate all reliance on imported lithium foils. These are usually used to make anodes for lithium-sulphur and batteries.

Material lead times and costs should come down with the foils made in-house; quality and consistency for its battery cells are also expected to increase.

“By producing foils in-house, we have tighter control over thickness, purity, and handling conditions – all of which are critical to performance and safety,” Li-S Energy’s chief technology officer, Steve Rowlands, explained.

It also “opens doors” for Li-S to find top-dollar export opportunities right as international demand for high-purity lithium foil continues to grow globally.

“We’re proud to be the first country in the company to produce lithium foils, [which are] a critical component for the future of high energy density batteries,” said Dr Lee Finniear, the company’s CEO, after sharing the news.

That pride comes alongside some top revenue opportunities, Dr Finniear added.

More market news

Meet GeoGeorge: The HotCopper poster so accurate he got hired as an analyst

Against the grain: RBA holds cash rate in defiance of expectations

Li-S will now move on to its next development phase: Adding capability for foil rolling, laminating, and coating. Focus will also be on expanding the company’s product range and supporting nanomaterial scale-up.

It’s been a good morning for Li-S, with the dev’s shares jumping 19.2%.

Join the discussion: See what HotCopper users are saying about Li-S Energy and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.

-1200x645-380x200.jpg)

-1200x645-380x200.jpg)