- Peppermint Innovation (PIL) is gearing up to raise more capital, after placing its shares in a two-day trading halt

- The fintech business expects to resume trading on Thursday when full details of the proposed fundraise are released to market

- PIL ended the September quarter with $2.7 million in the bank, enough cash to keep it running for an additional 3.7 quarters

- Since quarter-end, Peppermint Innovation has been focused on the rollout of its bizmoPay micro-enterprise loans

- Company shares were last trading at 2.1 cents each on Monday

Peppermint Innovation (PIL) is gearing up to raise more capital, after placing its shares in a two-day trading halt.

The fintech business expects to resume trading on Thursday, November 11, when full details of the proposed fundraise are released to the market.

The potential raise comes after PIL ended the September quarter with $2.7 million worth of cash in the bank.

The payments business spent roughly $731,000 on operating expenses during the period, meaning it has enough cash to keep it running for an additional 3.7 quarters.

Since quarter-end, Peppermint Innovation has been focused on the rollout of its bizmoPay micro-enterprise loans.

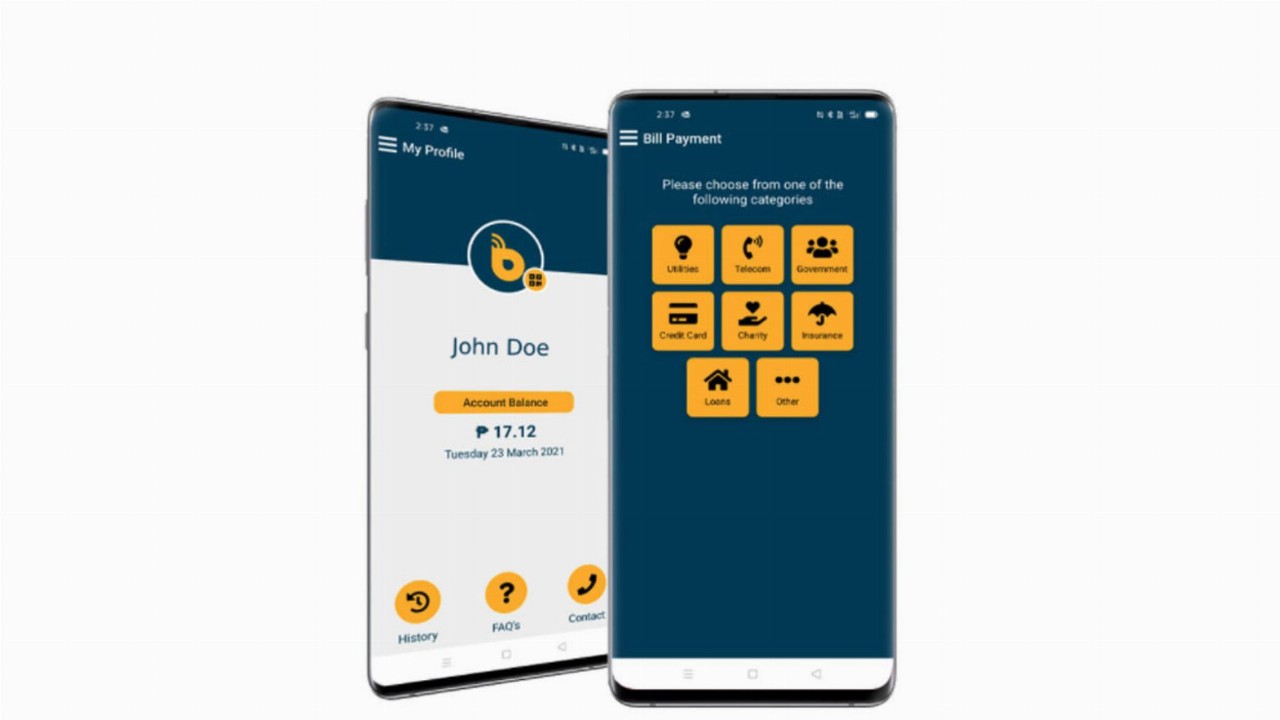

The launch of bizmoPay allows the product’s 56,000 agents to access any of three micro-loan products via the bizmoto mobile app.

PIL CEO Chris Kain said he expected around 1000 loans to be signed over the next three months, amid a surge in demand within the Phillipines.

All of Peppermint Innovations banking, ecommerce and finance products are designed and targeted towards that region region.

Before today’s trading halt, shares in PIL were trading at 2.1 cents each on Monday, November 8.