- East Coast gas shortages are affecting business operations and confidence

- Metgasco is on the cusp of bringing a new source of gas to the market.

- The Vali field in Cooper Basin will commence delivering gas by Q4 CY22.

- Four production wells in Vali/Odin now completed.

- A Gas Sales Agreement with AGL ensures customers for the Vali gas through 2026.

- Pre-payment on the contract has begun and is funding infrastructure in the field

- Inaugural revenue for Metgasco on gas sales.

- The Odin field gas reserves are uncontracted and attracting strong customer interest

- The Odin field will be tied into the Vali infrastructure and on stream mid CY23

- Purchase of Patriot waste-to-energy hydrogen developer diversifies and strengthens Metgasco’s sustainability claims as well as potential earnings.

- Is Metgasco under-valued?

It’s no secret that the East Coast natural gas market has been in turmoil lately, and the security of supply has become a major issue.

So it will no doubt come as a relief to many east coast gas consumers that Metgasco (MEL) and its joint venture (KV) partners “are well on the pathway to start production” in the form of up to gross 12 million standard cubic feet per day (MMscfd) of raw gas before the end of this calendar year.

Recent agreements have been signed with energy giants including Santos (gas processing agreement) and AGL (gas sales agreements) enabling Metgasco to help alleviate the gas shortage head-on, with first gas to come from its 25 per cent stake in the gross 2P 100 PJ Vali gas project in the Cooper Basin this year.

Further deliveries from the company’s 25 per cent share in the sizeable Odin field, also in the Cooper Basin, are anticipated in the middle of CY23.

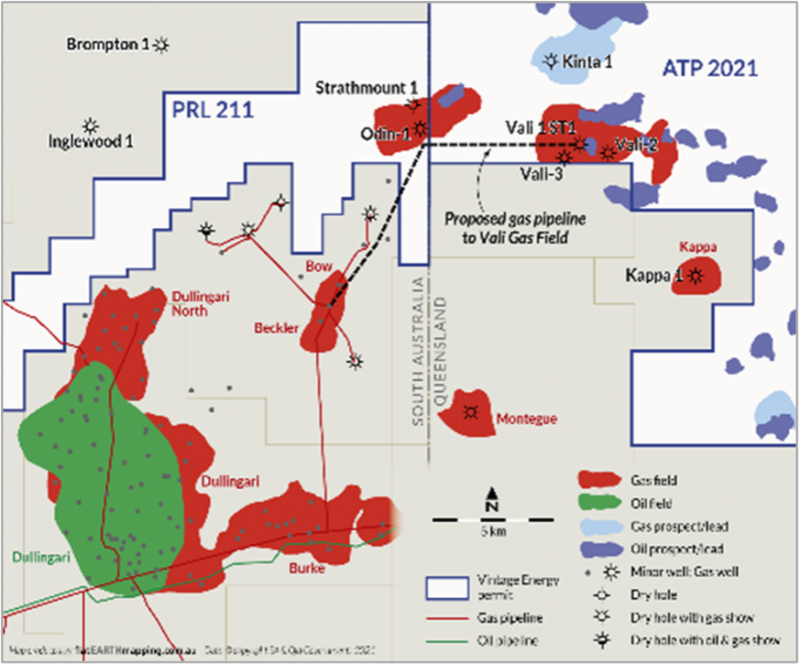

The Cooper Basin – a “String of Pearls”

The Vali field will begin producing commercial quantities of gas by Q4 2022 and is expected to quickly rise to its peak of up to a gross of 12 million cubic feet per day (MMcfd) from three wells. The field has an assumed life of 30 years.

The JV has now completed three production wells (Vali-1 ST1, Vali-2, Vali-3 a) and all are ready for connection and gas production.

Work is underway on the construction of the pipeline and the necessary production facilities.

Commissioning of all three Vali wells will proceed through November 2022, with first gas on schedule for delivery in October.

The Cooper Eromanga Basin area in which the Vali field is located has already yielded another sizeable gas exploration success (2C gross 33 BCF) by drilling Odin-1.

The ATP2021 licence has further prospects and leads in what has been described as a “string of pearls”.

Metgasco and its partners intend to continue exploring the region and are planning a new 3D seismic prospect in CY23.

Metgasco’s share in the Odin field is estimated at some eight billion standard cubic feet (Bscf) of gas, according to an independent certified estimate of the contingent resources.

The gas in the Odin field is uncontracted and attracts strong customer interest. Work on the optimum development is continuing with the goal to fast-track gas production, and there’s potential for some exciting announcements before the year is out.

Vali Gas Sales Agreement and pre-payment secured

As 25 per cent owner of the Vali gas hub, Metgasco has already signed a definitive Gas Sales Agreement (GS) with AGL, based on projected sales of between 9 and 16 petajoules (PJ – one PJ is equal to approximately 947.8 million standard cubic feet of gas).

AGL has now remitted all of its pre-payments, totalling a gross of $15 million. These funds will be used to partly fund the development of the infrastructure required to deliver the gas, including pipelines that will be linked to existing lines further south in the Cooper Basin.

The pipeline will commence in the Vali field and pass close to the Odin field so that the gas provided by both fields will flow through the same pipelines.

The processing and pipeline tie-in agreements with the South Australian Cooper Basin Joint Venture (SACB) were inked in March and May 2022 respectively, completing the finalisation of all commercial agreements required for gas produced from the Vali gas field to flow to Moomba, be processed and supplied for sale to AGL.

The pathway to production is virtually complete, and the first gas will enter the market at a time when the security of supply and cost are becoming ever more urgent issues.

A diversified future

In addition to its rapidly progressing gas resources, Metgasco is also developing a diversified future in its staged purchase of Patriot Hydrogen Limited.

Patriot utilises a 100 per cent renewable process to convert waste to energy, producing five high-value revenue streams, including syngas (dense hydrogen) for fuel, turbine-generated electricity, biochar, carbon credits, and wood vinegar for industrial and agricultural applications.

Patriot’s first modular unit, for Kimberley Clean Energy (KCE), will be deployed on a Kimberly cattle farm in Q4 2022.

The key objective is to replace the farm-owners considerable cost of diesel usage by generating electricity via the production of syngas(dense hydrogen) which Patriot shares the costs of the diesel savings.

On success the business upside potential is huge as under the terms of their agreement KCE has an option for up to 75 of the modular units, to be installed across Western Australia’s north.

Several other potential clients have been identified for the Patriot process, and design and manufacturing plans for these interested parties will commence once the first KCE plant is successfully

Is Metgasco undervalued?

Metgasco is an energy company that is currently nearing delivery of first gas from Vali – a field that has a life expectancy of up to 30 years, with a guaranteed income stream from energy giant AGL until at least 2026.

Some 84 per cent of the gross 2P 100PJ reserve is as yet uncontracted for sales, requiring more wells to come online in the future – foreshadowing further infrastructure investment.

The company is also on the cusp of expanding its Cooper Basin gas production hub via fast-tracking the Odin-1 well (tested at 6mmscf/d) gas, which can feed its gas straight into the Vali pipeline that terminates at the processing plant in Moomba.

This scenario is occurring in a market where gas shortages and energy insecurity are grave issues that need to be dealt with quickly, as they are having a serious effect on business confidence.

A number of gas customers have already expressed interest in the uncontracted Odin gas.

In addition to these highly encouraging aspects of its operations, Metgasco has signed an agreement for a staged purchase of an exciting waste-to-energy hydrogen development outfit, which has the potential to revolutionise the processing of waste in remote communities and deliver a range of high-value revenue streams at the same time.

And yet Metgasco shares were trading at a mere $0.024 as of 22 August 2022.

Some analysts suggest that this makes the company a potentially excellent investment – a nimble and experienced partner of choice in the gas and energy fields, with several irons in the fire and an income stream imminent.

The question is, who will capitalise on the opportunity that Metgasco appears to present?