For those not regular watchers of the ASX biotech sector, it’s worth noting Recce Pharmaceuticals (ASX:RCE) has been on a tear this year.

Recce is developing its flagship patented next-gen anti-infective, R327, with clinical results so far across Diabetic Foot Infection (DFI) and Acute Bacterial Skin and Skin Structure Infection (ABSSI); and, Urosepsis/Urinary Tract Infection (UTI) trials, pointing towards a potential commercial value proposition.

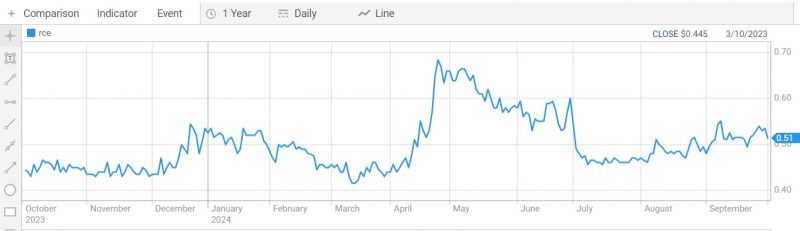

At the time of writing – 1.30PM in afternoon trades on Tuesday 1 October 2024 – Recce’s one-year returns are up over +16%.

We’ve seen a number of other biotech companies hit the bourse in recent history with investor interest in the sector.

Some stocks in particular – demonstrate solid performance YTD.

LTR Pharma (ASX:LTP), developing a nasal spray Viagra competitor, has posted gains of +444% YTD; while Cleo Diagnostics (ASX:COV), developing a blood test for early detection of ovarian cancer, is up +128% YTD.

Recce Pharma, for its part, has been on the bourse for closer to a decade now, after a 20c IPO raise and opening at about 40cps back in January 2016.

It’s been trading at 51cps and hit an all-time high of $1.45 back in late August of 2020 – the first year of COVID.

Biotech and markets: Star-crossed lovers?

Outside of that anomalous period, however – let’s just define that as January 1 this year onwards – Recce shares hit a record high of 69cps back in April. That was around the same time the company received safety committee approval for fast-transfusion dosages in UTI patients of 4,000mg of R327 via intravenous (IV) administration.

Such volatility isn’t unusual for biotech companies and its history of price action reflects a textbook case for the sector. There’s exposure to unexpected market trends and consequent sentiment, and, a market forever somewhat risk-off if clinical results don’t meet expectations.

Biotech companies are also notoriously long-term value propositions, especially if they’re in the early days of getting through regulatory approvals – and perhaps by being publicly listed they’re forever star-crossed.

Shareholder and investment communities are typically defined by some level of impatience when progress is perceived to be tracking slowly for any company, but this is especially true for biotech – where a well-liked stock can easily become a pariah overnight.

Enter Etana: Recce welcomed to Indonesia

But Recce Pharmaceuticals has pivoted, now, towards one market where it may see a good deal of momentum pick up – and it’s been gearing up for a busy end to 2024.

A large part of that hinges on a relatively freshly minted relationship which Recce has, which is underlined by a Memorandum of Understanding (MOU) with regional healthcare entity Etana Biotechnologies Indonesia.

Etana and Recce’s relationship doesn’t exist in a vacuum: It has the attention of Indonesia’s government.

In February of 2024, the Chairman of Indonesia’s National Research and Innovation – in an acronym, BRIN – Mr Laksana Tri Handoko, highlighted the Indonesian Government’s growing interest in innovation when it comes to biomedicine, which aligns with its larger overhead goal to tackle the health challenge of antimicrobial resistance (AMR).

“We need to build a national capability, especially after the lesson of the recent pandemic,” he said.

“This collaboration is a continuation of the close relationship we have with Australia, which I see will grow moving forward. We want to build our expertise together and I look forward to the work to start with us.”

Source: Recce Pharmaceuticals (ASX:RCE)

It wasn’t just BRIN – Indonesia’s Health Minister, Mr Budi Sadikin, also pointed to greater cohesion between Indonesia’s and Australia’s biomed private sectors and public agencies.

“The global health challenge of antimicrobial resistance is a pressing issue on the world stage,” he said, also in February.

“Indonesia welcomes collaborative initiatives and supports efforts to combat antimicrobial resistance, including the development of innovative therapeutics for infectious diseases.”

Diabetic Foot Infections in Indonesia

Alongside Etana, Recce ultimately wants to launch a Phase III diabetic foot infection clinical trial of R327 in Indonesia.

If successful, this would be Recce’s first Phase III clinical trial marking a significant company milestone.

Indonesia is a country boasting a massive population centre in South East Asia and part of the Valeriepieris circle. Otherwise known as the Yuxi Circle, it’s a relatively small area of Earth’s surface that contains half the human population.

Indonesia, for its part, has a population of some 275.5 million – making it the fourth most populous country in the world.

When it comes to sepsis and diabetes:

- The Lancet notes that in the South East Asia region, 4 million people died due to sepsis in 2019 alone. Of these, 62% of deaths were caused by bacterial infections.

- It’s predicted that there’ll be 14.1 million diabetic patients in Indonesia by 2035.

- The prevalence of diabetic foot ulcer in Indonesia is high (12% in hospitals & 24% in community settings) when compared with US and worldwide, which ranges between 1.4% and 5.9%.

“This bilateral collaboration between Recce and Etana, signifies the Australian and Indonesian Governments’ shared commitment to advancing public health, fostering innovation and addressing the global challenge of AMR in the Asia Pacific region,” Recce Pharma CEO James Graham said in February.

“By combining our expertise and resources, we can make significant strides towards a healthier and more resilient future for both our nations and the global community.”

RCE last traded at 51cps.

Join the discussion: See what’s trending right now on HotCopper, Australia’s largest stock forum, and be part of the conversations that move the markets.

Disclaimer: The Market Online & HotCopper had a commercial relationship with Recce at the time this was written.

-1200x645-380x200.jpg)

-1200x645-380x200.jpg)