It can take a long time to bring a new drug to market, but companies that succeed reap mighty rewards.

Any time a company is working in drug manufacturing and clinical research, the compound needs to be tested on human subjects to ensure its product is safe, tolerable, and effective.

Given the risk this poses to those receiving the test drug, the safety standards required by regulators around the world to progress a new drug to human trial phases are detailed and complex.

It can often take upwards of a decade to bring a drug from inception to commercialisation, and this is provided the development phase goes smoothly and trials are successful.

For investors in the healthcare sector, however, this means the value proposition a drug developer provides is broken down into several different stages.

The Market Herald spoke to Recce Pharmaceuticals (RCE) Managing Director James Graham for an insider’s perspective of the drug development process and the value chain of a small-cap pharmaceutical company.

The trial process

Drug development is often spoken about in terms of clinical trials and their various phases.

Yet, it often takes years of conceptualisation and product development before a product even makes it to the clinical trial phase.

Developers first need to undertake target, lead, and pre-clinical work before a first-phase trial begins.

For Australian biotechs and pharmaceutical companies, the time to market is often up to 15 years, according to research published in the Journal of Commercial Biotechnology in 2020.

Once a drug developer has defined a target, it typically moves on to pre-clinical trial work. This work precedes any human trials and often tests the drug candidate in animals to determine its safety, how it reacts with living beings, and an appropriate dose concentration for human trials.

If pre-clinical work is successful, a drug developer can take the momentous step forward into clinical trials, in which it will test the drug in human subjects.

Provided all goes smoothly, phase I trials often take several months to a year to complete, testing the drug in a small number of patients to determine safety and tolerability.

From here, companies progress to phase II trials for efficacy, where the size of the study patient population increases and can typically take around two years.

Finally, a company can then begin phase III trials to test the efficacy of a drug in much larger groups of trial participants, which can typically take three to four years for all data to be assessed — as long as everything goes smoothly.

Only then can a drug be eligible for commercialisation, at which point it would enter into phase IV, where these studies are designed to monitor the effectiveness of the approved drug in the general population and to collect information about any adverse effects associated with widespread use over longer periods of time.

It’s a long process. It’s an expensive process. And it requires a great deal of patience from investors who believe in the product.

Yet, while companies can often appear to be treading water as trials progress, they are working tirelessly to maximise the potential value of each stage of the clinical development progression.

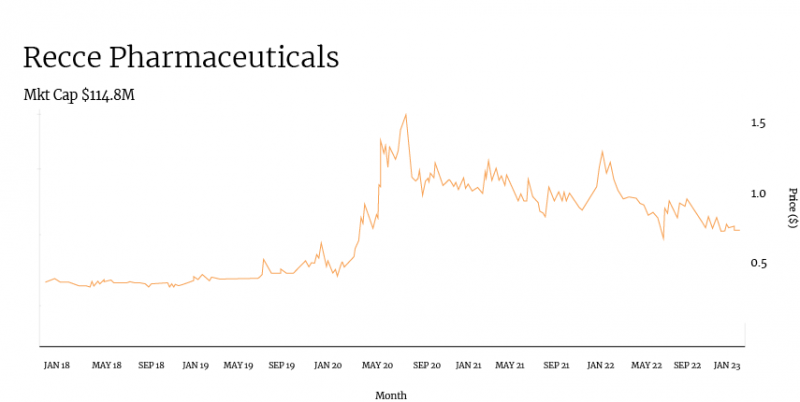

Recce Pharmaceuticals (RCE), for example, has tripled in value over the past three years as it progressed its key compounds through the various clinical trial phases.

Recce’s key points of value

Recce’s lead candidate, RECCE-327 (R327), is in second-phase trials for the treatment of wound infections including burns and in first-phase trials for the treatment of sepsis, which is currently one of the world’s most expensive conditions to treat. The company also has two other compounds in pre-clinical development.

Taking a look at Recce’s share price over the past several years, there is a clear correlation between the company’s progression of clinical and pre-clinical trials and its share price.

Positive pre-clinical data for R327 in January saw the company’s share price begin to climb from around 35 cents to over 50 cents in just one month.

While Recce could not escape the COVID-19-induced market crash, it quickly rebounded in April when it announced a phase I/II clinical trial for R327. Weeks later, Recce released more positive pre-clinical data for the compound, and shares soared to around 80 cents.

From here, it’s easy to track the share price journey through the lens of Recce ASX announcements: a spike in July 2020 when R327 was chosen as a candidate for the potential treatment of COVID-19. A peak in September following the selection of a research facility for R327’s phase I trial. A dip following a capital raise shortly thereafter.

It’s worth noting that while Recce has undergone typical share price fluctuations, its trading volume has remained consistent, averaging around 80,000 shares per day in the four weeks to November 15. Consistent volume means consistent interest in the company from investors.

Recce has maintained this interest thanks to the expansion and acceleration of its clinical development work.

In August 2022, the company completed its dosing of the seventh cohort of its phase I clinical trial with 6000 milligrams of its R327 drug. Over the course of the study, seven cohorts of up to ten healthy male subjects were dosed over one hour, and no serious adverse effects were reported.

This phase I success has allowed the company to progress to Phase Ib/IIa sepsis efficacy study.

Meanwhile, new data from the phase I clinical study of R327 has provided optimism for the potential of the drug to treat urinary tract infections (UTIs), supporting additional findings from pre-clinical in-vivo kidney and UTI bacterial infection studies.

Furthermore, Recce is set to undertake a new phase II study for R327 treating diabetic foot ulcer infections, with the first patient to be dosed in the fourth quarter of this year.

Finally, Recce said it had also progressed multiple pre-clinical programs to an advanced stage while demonstrating activity against multiple World Health Organisation (WHO) Priority Pathogens.

Recce’s ongoing trial work means its share price remains leagues above where it sat prior to the pre-clinical results and the commencement of new clinical trials.

It also stands to reason, then, that RCE shares could continue to increase as it moves forward through each stage of the clinical trial process.

“When you’ve got a stable price, and you come through — hopefully — with a positive news result, you give yourself a launch platform to go from,” Mr Graham said.

“So, positioned across our programs, with upside opportunity and mitigated downside risk, we give ourselves every chance for success.”

Of course, Recce is not unique in this regard. Several other biotech companies have gone through similar share price journeys while developing key drug compounds.

Recce in good company

ANP — clinical trials for rare diseases

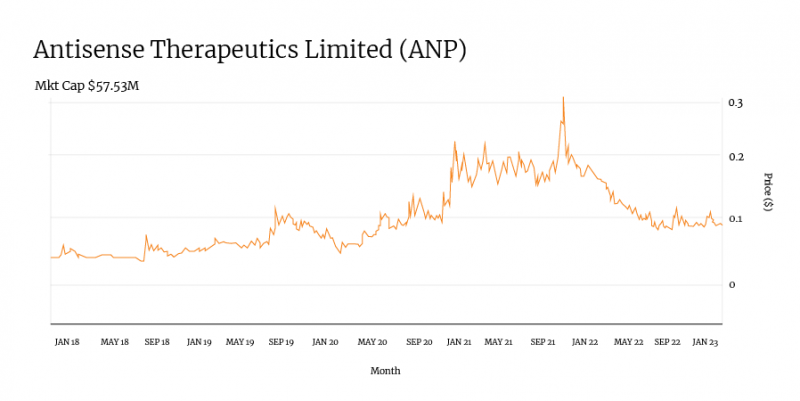

Antisense Therapeutics (ANP) is working on several treatments for rare diseases — the most advanced of which is its ATL1102 drug for the treatment of Duchenne muscular dystrophy (DMD).

Looking at its recent share price graph, the company’s large price spike in September 2019 relates directly to the release of positive Phase II data for ATL1102.

The subsequent steady rise in December 2019 came on the back of the commencement of dosing under a Phase II DMD trial and plans to progress to a Phase IIb trial.

In late 2020, Antisense’s share spike followed the receipt of orphan drug designations for ATL1102 in Europe and the United States.

The company reached its all-time high in October 2021 ahead of launching Phase III trials in Europe for its lead drug.

More recently, ANP has begun dosing mice in a DMD combination study and made plans to conduct a monkey toxicology study for the drug.

IMU — Anti-cancer drug development

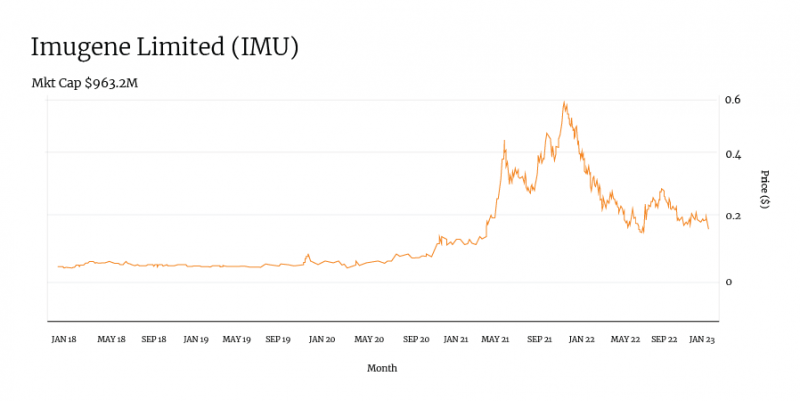

Immuno-oncology specialist Imugene is developing platform technology to promote the body’s own immune system against cancerous tumours. The company’s product pipeline includes oncolytic virus and B-Cell immunotherapies designed to treat a variety of cancers.

The company’s share price started to move in October 2019 following positive Phase Ib trial results of its lead HER-Vaxx immunotherapy product, and it climbed steadily — despite dilution — as trial work progressed.

IMU’s initial 2020 peak came after it dosed its first patient in a Phase I trial for its PD1-Vaxx product.

When the company published fresh HER-Vaxx Phase Ib trial data in June 2021, this came with a share price spike.

Just five months later, Imugene hit an all-time high following the announcement of three new trials and the dosing of its first patient in a Phase I trial of its CheckVacc product, alongside a supply deal with Pfizer for a Phase II trial.

While the company has retreated from this all-time high as investors naturally take profits and market sentiment changes, it still sits some 2000 per cent higher than it did just five years ago.

What does the data mean?

While no two stocks are the same, the share price journey of other ASX-listed small-cap drug developers shows how influential the trial process can be on the value of a company.

The companies examined are still several steps away from commercialising their core compounds, but investors who got on board early enough are already enjoying tenfold increases on share prices.

Recce Pharmaceuticals (RCE) has followed a similar journey so far, suggesting the business could be a significant growth opportunity for investors.