- Renergen (RLT) raises $9.3 million through a share placement to private investors in Australia, New Zealand and South Africa

- The dual-listed company placed over 2.3 million CDIs at $2.14, as well as over two million ordinary shares at around $2.15 each, to raise the funds

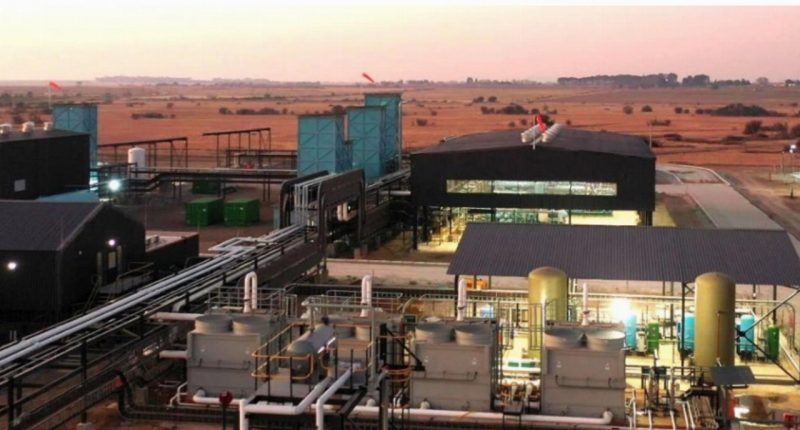

- Renergen says it will set the funds towards additional costs for studies required for further development of the company’s Virginia gas project in South Africa

- The placement come comes just two weeks after the company quashed rumours of a potential $20 million capital raise

- Shares in Renergen are down 9.24 per cent, trading at $2.16 just before market close

Renergen (RLT) has raised approximately R107.6 million (A$9.39 million) through a placement to private investors in Australia, New Zealand and South Africa.

The share placement comes two weeks after telling its shareholders it wouldn’t proceed with a proposed capital raise after it emerged from a trading halt on November 8.

The dual-listed natural gas and helium producer requested a trading halt earlier this month in response to an article published by the Australian Financial Review (AFR) on November 7, in relation to a $20 million capital raise.

Renergen stood firm that it wasn’t aware of how the AFR obtained the information and said the capital raise was incomplete before it became aware of the article.

The energy stock said on November 8 it had decided to no longer pursue the planned raise.

Today, however, Renergen announced it had completed a share placement under which it issued an aggregate of 4.37 million shares to investors.

This comprised 2.34 million CHESS depository interests at A$2.14 per security and approximately 2.03 million new shares at R24.64 per security, representing a 10 per cent discount to its 30-day volume-weighted average price.

Renergen plans to use the money for studies required to further develop phase two of the Virginia gas project in South Africa, and for working capital.

The funds will also support the delayed phase one liquid helium plant which the company said resulted in additional costs and lost revenue.

The placement will settle on November 28.

Shares in Renergen were down 9.24 per cent, trading at $2.16 just before market close.