In the year’s biggest trading debut to date, Royalty Pharma shares have soared nearly 60 per cent.

The biopharma funder’s initial public offering (IPO) hinged on hopes of a U.S. economic rebound, encouraging weary investors to give a fresh healthcare player a punt.

Shareholders got in on the big pharma buy at US$28 (around A$40.73) a pop, netting the giant US$2.2 billion (roughly A$3.2 billion) following the sale of a staggering 77.7 million shares.

As a result, the IPO clinched Warner Music Group’s US$1.925 (approximately A$2.80 billion) debut, which was launched just over a fortnight ago.

That Nasdaq listing saw the ‘big three’ recording player enter the market on a US$25 (about A$36.37) IPO price. But by the bell on June 3, Warner had risen 20.5 per cent into the green to trade for US$30.12 (roughly A$43.82) a share.

Royalty Pharma is transforming the funding of life sciences.

— Nasdaq (@Nasdaq) June 16, 2020

We welcome them to the home of the world’s most innovative companies. https://t.co/lRYpSSm9fN pic.twitter.com/1nm1XBAxza

While Royalty Pharma’s debut is 2020’s biggest and brightest to date, initial listing expert Renaissance Capital says it’s also one of the largest billion-dollar IPOs since 2015.

“Since 2010, only two other billion-dollar IPOs have had a higher first-day pop; Twitter and Chewy,” the researcher stated of the biopharma’s debut.

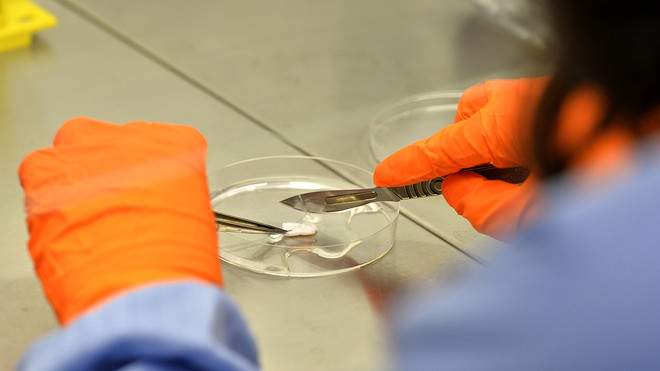

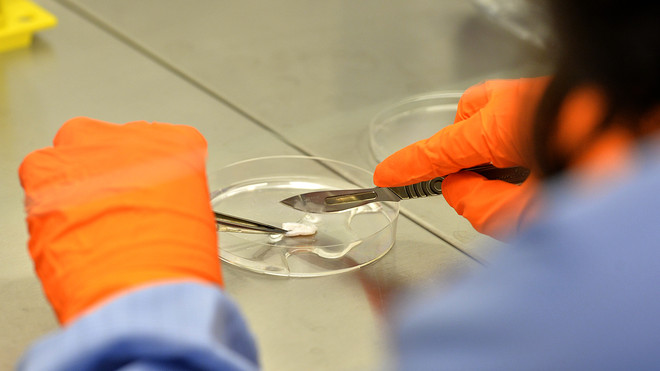

Founded 24 years ago, Royalty Pharma has made a business out of buying biopharmaceutical royalties. The new Nasdaq-lister injects capital into a wide range of healthcare plays, funding innovation across not-for-profits and global biotechs.

As a result, Royalty has funded a suite of royalties, meaning it’s entitled to payments based on the sales performance of many leading therapies. These include prescription drugs such as Imbruvica, an oral, daily-dose medication for treating a range of leukaemias.

On Australian shores, the healthcare hype is real. Pandemic fears have plagued many listed stocks, but have also fueled the debut of companies like medicinal cannabis play Little Green Pharma.

And next month, Advent Health is set to debut on the ASX. With 21 million shares set to go on offer at $1.00 each, the Allied Health group has an implied market cap of $44.5 million.

As hopes for a COVID cure continue, the exchange world is still on the lookout for healthcare hopefuls ready to list.