- Australian natural skincare company Skin Elements (SKN) has secured a $20 million funding facility with LDA Capital

- Under the agreement, Skin Elements will issue shares to LDA Capital over the next three years at a floor price determined by Skin Elements

- Funds from the agreement will give the company ready access to additional equity to support both its growth into new markets and existing channels

- On the market, Skin Elements last traded at 10 cents per share

Skin Elements (SKN) has secured a $20 million funding facility with LDA Capital.

The parties have signed a put option agreement, which will see LDA provide Skin Elements up to $20 million in committed equity capital over the next 36 months.

Under the agreement, Skin Elements will issue shares to LDA Capital over the next three years at a floor price determined by Skin Elements and will receive funds for the issue of those shares.

Funds from the agreement will give the company ready access to additional equity to support both its growth into new markets and existing channels.

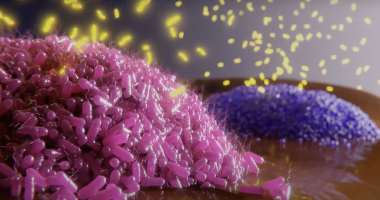

Last year, the natural skincare company applied for a Therapeutic Goods Administration (TGA) registration for its sanitising disinfectant, Invisi Shield — a hospital-grade disinfectant.

“Successful registration with the TGA will allow the company to make more

detailed and specific product and label claims in respect to Invisi Shield which has the potential to open up significant new commercial-scale sales and distribution opportunities,” the company explained to the market.

“We are excited to have secured this $20 million equity funding facility from LDA Capital,” Chairman Peter Malone said.

“LDA Capital has a track record of providing funding to help emerging growth

companies achieve their business goals, and we are delighted to see that LDA Capital shares the same positive view on the global growth potential of our Invisi Shield sanitising disinfectant and our range of natural skincare products as we do,” he added.

On the market, Skin Elements is suspended and last traded at 10 cents per share.