Earnings roll on in Week 7, with a whole bucket load of reports coming in from ASX-listed companies today. But, it’s not FY26 earnings that’s caught attention on the HotCopper forums – it’s acquisitions and expansions.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

With more than seven million users on the HotCopper forums, every discussion and speculation can move markets – which is why getting in front of those trends is so important for any trader worth their salt.

In this daily HotCopper Trends column, we break down the top three Aussie stocks each trading day, and why they’ve drawn a daily focus intraday.

First up, Aeris Resources (ASX:AIS) has beaten all the good (and bad) earnings reports to claim the most chatter on the forums after acquiring Peel Mining (ASX:PEX) and all its workings and projects for $214 million.

The deal jewel is Peel’s South Cobar works. Aeris will take control there, while Peel will spin out its other holdings into a proposed “NewCo” listing.

AIS has actually dropped -8.9% today, though; PEX is up +17%.

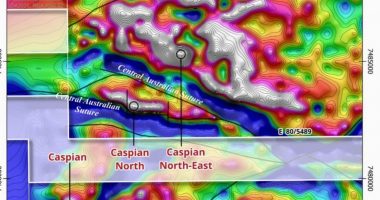

Elsewhere, popular explorer Dateline Resources (ASX:DTR) has near-topped the HotCopper discussions again on February 12 after new gold intercepts.

Dateline has been working on extending the North Pipe at Colosseum through early CY26 and has been rewarded with its focus, with returns up to 149.65 metres at 1.39 grams per tonne gold, including 55.2m @ 2.83g/t gold.

The hit helped DTR‘s share price up +3.2%, to 32cps.

AMP Ltd (ASX:AMP) and its earnings drew into third place. The financial company delivered strong profit growth and higher AUM; a +20.8% lift in underlying NPAT, to $285 million, supported by North cashflows.

Maybe some users were happiest because AMP coughed up a 2cps dividend for FY25, and a total FY25 dividend at 4c (20% franked).

Today, AMP has been -27%, down to $1.26/ea.

And then looking wider, the ASX 200 has been up +0.6%.

That’s Thursday’s HotCopper Market Trends, I’m Isaac McIntyre – see you for close.

Join the discussion. See what’s trending right now on Australia’s largest stock forum and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.