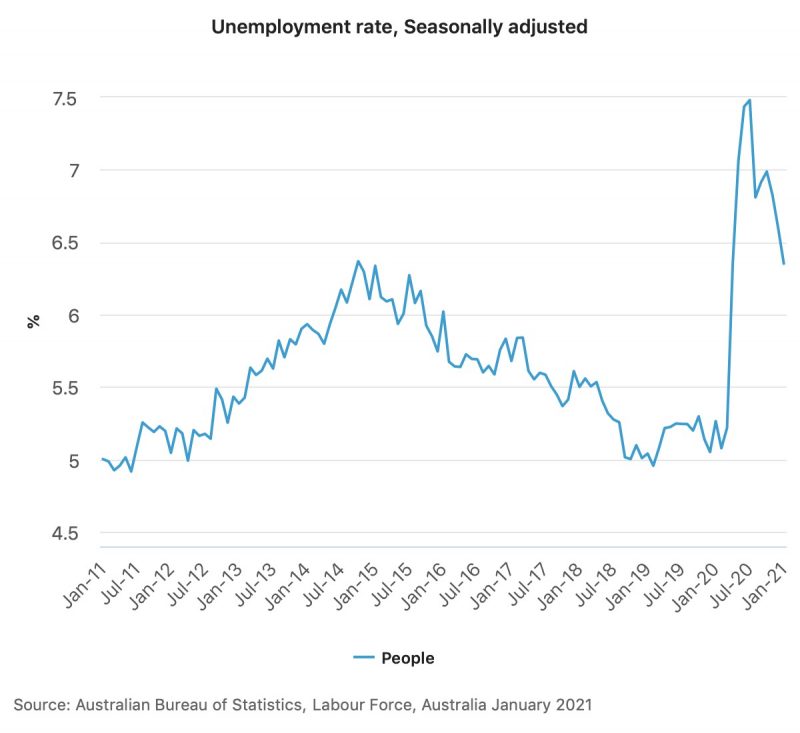

- Both unemployment and underemployment have continued their downward trends in another positive sign for Australia’s recovery from the COVID-driven recession

- While unemployment fell from 6.6 per cent to 6.4 per cent, it remains 1.1 per cent higher compared to this time last year

- Underemployment fell from 8.5 per cent to 8.1 per cent, thanks largely to an increase in full-time work

- However, these improvements did not transfer to hours worked, which fell 4.9 per cent but was attributed to people taking annual leave

- Prevailing lockdown measures in Sydney and Melbourne also had an impact on statistics

Both unemployment and underemployment have continued their downward trends in another positive sign for Australia’s recovery from the COVID-driven recession.

“January 2021 was the fourth consecutive monthly rise in employment, as employment in Victoria continued to recover,” said Bjorn Jarvis, head of labour statistics at the ABS.

Unemployment dropped from 6.6 per cent in December to 6.4 per cent in January — 1.1 per cent higher than the same time last year — with the Australian Bureau of Statistics (ABS) estimating gainful employment for another 29,100 people last month.

Despite a fall in part-time work, there was also a 59,000-person increase in full-time employment, causing the underemployment rate to fall from 8.5 per cent to 8.1 per cent.

That said, the improvements did not transfer to hours worked, which fell 4.9 per cent on a seasonally adjusted basis.

But this was largely attributed to an unusually large proportion of Australian workers taking annual leave with the relaxation of many travel restrictions.

“After a tough 2020, more Australians than usual took leave in the first two weeks of January, particularly full-time workers,” Jarvis continued.

“However, the number of employed people who worked zero hours in early January in the capital cities also reflects some ongoing effects of recent lockdowns in Sydney and Melbourne.”