The Australian Competition and Consumer Commission has alleged Webjet (ASX:WJL) misled its customers – and breached consumer law in the process – by billing its available airfares as cheap but failing to properly disclose compulsory service and booking fees that then had an impact on final prices.

The watchdog has now launched legal action in the Federal Court, with the action revolving around “false” flight prices between November 2018 and November 2023.

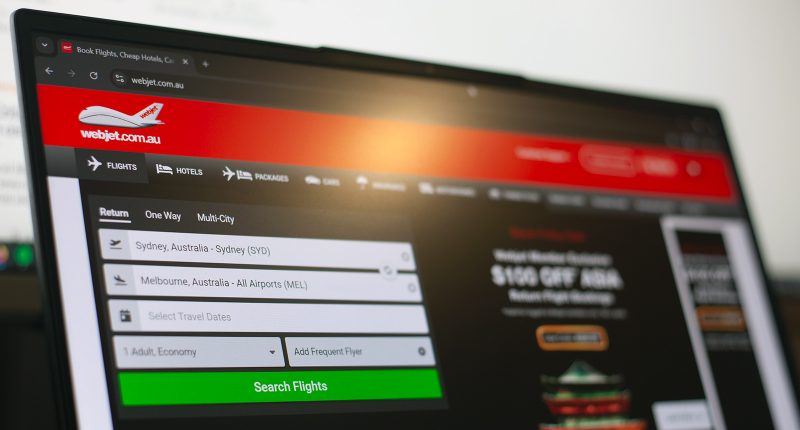

Of particular interest in the case will be statements billed on Webjet’s app as well as in marketing emails, social media campaigns, and on its website.

Phrases like “flights from $X” had appeared throughout these communication avenues, the watchdog flagged, but allegedly never included Webjet’s compulsory service and booking fees that sometime cost as much as $54.90 all up.

When fees were mentioned, they were often difficult to find, the ACCC claims.

Other alleged breaches include claims Webjet sent customers emails confirming flights that hadn’t actually been booked – then requesting further payments to lock them in.

ACCC chair Gina Cass-Gottlieb pointed out all this had happened as living costs mounted.

“We remind all businesses, whether they are online retailers or brick and mortar stores, that they need to comply with the Australian Consumer Law by not misleading consumers and displaying prices clearly, including hidden fees and surcharges,” Ms Cass-Gottlieb added upon sharing the ACCC’s planned legal action.

Webjet responded to the lawsuit nearly immediately with a statement on the ASX, where it suggested it had already taken steps to improve pricing and fee disclosures.

“Millions have chosen to book through Webjet Marketing during the period in question and we have very rarely been contacted by customers complaining about our disclosure of fees,” the company wrote on Thursday. “Webjet is confident there is no widespread customer dissatisfaction with our offering, disclosure, service, or pricing.”

This finance journalist actually got an email from Webjet’s marketing arm at 11.32am today billing its $100-cheaper Asia package. In that email, Webjet listed several service and booking fees, but expected “payment fees” were trimmed by the email format.

(This accidental trim in the Gmail view is likely to be just that, of course – accidental.)

Should the ACCC proved its claims in the Federal Court, it will be seeking fines against Webjet as well as compensation for any impacted customers –

This ACCC action will cause some whiplash among Webjet investors, many of whom would have just been celebrating a 14% spike in share prices yesterday.

Webjet – which demerged from Web Travel Group last year – had reported better than expected underlying profits to the tune of $9.2 million.

That success, and a $150M share buyback plan, had sent share prices rocketing.

Today though, Webjet is down 4.14% to 81cps.

Join the discussion. See what HotCopper users are saying about Webjet Group and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.