- Cromwell Property Group (CMW) and real estate fund manager ARA Asset Management have both ramped up their campaign over a disputed nomination to Cromwell’s board

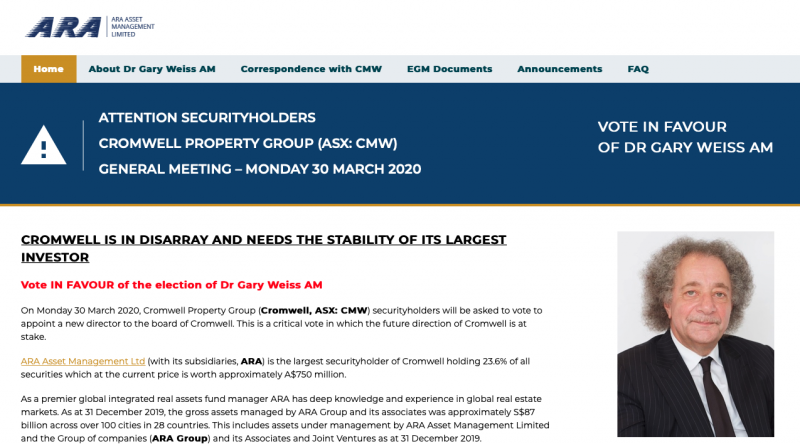

- ARA is Cromwell’s largest security holder and nominated Dr Gary Weiss for the role of Director after his nomination at last year’s AGM was unsuccessful

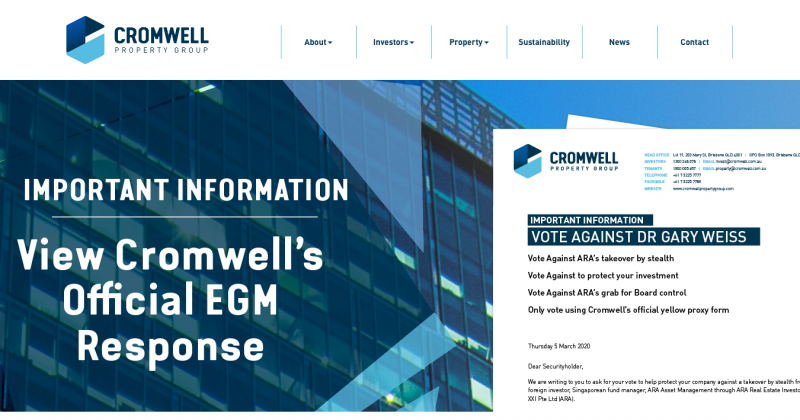

- However, Cromwell has taken a firm stance against the nomination claiming it would be open to other candidates but that Dr Weiss is overcommitted and not independent

- If elected, Dr Weiss would sit on a total of eight other boards, even after resigning from the Board of ARA’s largest shareholder, Straits Trading

- Cromwell maintains that Dr Weiss would not be considered independent for three years following his departure from that Board

- Ahead of the Extraordinary General Meeting on March 30, where Cromwell security holders will vote on ARA’s nomination, both parties have mounted a campaign urging security holders to take their respective sides

- Shares in Cromwell closed 4.5 per cent down today at 95 cents apiece

The dispute between Cromwell Property Group (CMW) and ARA Asset Management over the nomination of Dr Gary Weiss to Cromwell’s board has intensified with both parties taking out advertising on google.

Real estate fund manager ARA is Cromwell largest shareholder, holding 23.6 per cent of Cromwell securities, and on February 26 called an Extraordinary General Meeting (EGM). At the meeting on March 30, Cromwell security holders will vote on the nomination.

Cromwell however, has pushed back against the nomination claiming Dr Weiss is an unsuitable candidate and further, that his nomination is part of a greater scheme to infiltrate and take control of Cromwell’s board.

The disputed nomination

Prior to the current nomination, Dr Weiss stood for election at Cromwell’s AGM on November 28, 2019, after being put forward by ARA. However, he failed to gain a majority of votes with 51.3 per cent cast against the nomination.

In February, ARA once again nominated Dr Weiss and called the EGM. It claimed that it has been treated unfairly by Cromwell and should have been allowed greater input as its largest shareholder.

Specifically, ARA cited the following grievances:

- Cromwell strategic review would be conducted by investment banks without input from ARA

- They were excluded from Cromwell’s $375 million capital raising

- Cromwell decided to make a cash settlement, despite ARA electing to take up securities under Cromwell’s Distribution Reinvestment Plan

Further, ARA questioned the performance of Cromwell and claimed the addition of its nominee to Cromwell’s board would benefit investors.

“ARA strongly believes that there needs to be a refreshed strategy and direction from Cromwell and that the addition of Dr Gary Weiss will assist in delivering the best outcome for all security holders,” said the explanatory statement of notice of the EGM.

Despite attacking Cromwell’s performance amping up the need to change its strategic direction, in a presentation to Cromwell security holders ARA did not stipulate what any change precipitated by Dr Weiss may look like.

Cromwell responds

In response to ARA’s nomination, Cromwell has advised its security holders to vote against the election of Dr Weiss. Its justifications are twofold: firstly, that Dr Weiss is not a suitable candidate and, secondly, Cromwell claims that ARA’s nomination is part of a greater bid to take control of its Board.

Is Dr Weiss a suitable candidate?

In terms of the first reason, Cromwell has stated that Dr Weiss is not a suitable candidate. In a letter to security holders, Cromwell said Dr Weiss is “conflicted, overcommitted [and] not independent”.

Currently, Dr Weiss is an Independent and Non-Executive Director on the board of the Straits Trading Company, ARA’s largest shareholder. He has, however, flagged his conditional resignation from that board to remove conflicts of interest, if his nomination to Cromwell’s board is carried.

Nevertheless, Cromwell asserts that Dr Weiss would not be regarded as independent for three years after leaving the Straits Trading Board.

Subtracting the Straits Trading directorship and chairmanship of Ridley Corporation, which he has also said he will retire from, Dr Wiess sits on another eight boards, a degree of overcommitment which Cromwell attests would be in conflict with best practice corporate governance.

For these reasons, Cromwells maintains it believes Dr Weiss is overboarded and conflicted. In a statement to The Market Herald, the company said: “Cromwell is open to another nomination who is independent and not conflicted, but this offer has been continuously rejected by ARA.”

A takeover by stealth?

The second front of Cromwell’s rebuttal questions the motives for ARA’s nomination, claiming it is part of a great scheme to execute a takeover by stealth.

In a video on its website, Cromwell CEO Paul Weightman suggests ARA is aiming to create a perceived crisis, offer Dr Weiss as a “saviour” and secure his election.

He suggests, ARA along with other allegedly associated security holders, despite opposing finding from the takeovers panel, may then vote against the remuneration report. This could trigger a board spill, allowing it to be filled with directors friendly to a different agenda.

Both parties launch campaigns

Whatever their reasoning may be, both parties are now in full campaign mode, urging Cromwell shareholder to take sides. Ahead of the EGM on March 30, ARA has even launched a website lobbying for the election of its nominee.

On the other hand, Cromwell has dedicated the homepage of its website to its response and is urging shareholders not to support ARA’s nomination.

It appears likely campaigning by both parties will continue up until the EGM at the end of the month.

Shares in Cromwell today closed 4.5 per cent down at 95 cents apiece.