- Nanosonics’ (NAN) share price has gone from strength to strength in 2020, however, that doesn’t mean it’s immune to effects of the COVID-19 pandemic

- The company’s share price dropped significantly during the month of March, as the pandemic wreaked havoc on the wider market

- However, it has since rebounded to sit at over $6 per share, as COVID-19 proves prosperous for healthcare products

- Q3 results showed the company had performed better than expected and recorded some sales growth

- Despite this, it did forewarn there may be more COVID-19 related setbacks to come

Nanosonics’ (NAN) share price has gone from strength to strength in 2020, however, that doesn’t mean it is immune to effects of the COVID-19 pandemic.

The company, which specialises in infection prevention, creates and sells ultrasound probes and compatible disinfection units.

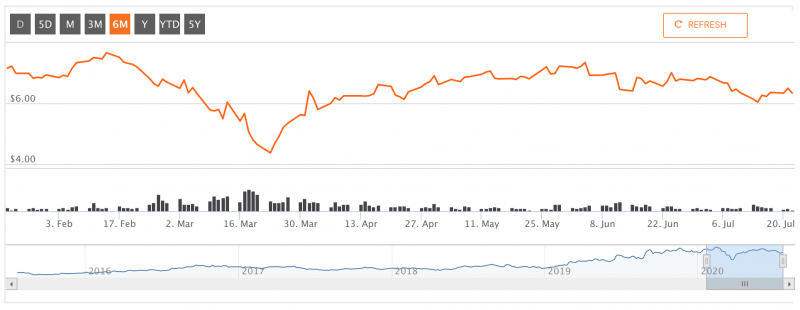

It’s share price hit a high of $7.67 in February this year, after steadily trending upwards for years.

Source: Hot Copper

But that all came crumbling down in March as COVID-19 reached Australia’s shores and wreaked havoc on the wider market.

A bumpy share price ride

The entire economy ground to a halt as businesses shut their doors, leaving hundreds of thousands of people out of work.

The ASX, and its healthcare sector in particular, eventually bottomed out on March 23, and Nanosonics followed that wider trend.

Source: ASX

Its share price almost halved in the month of March, falling to a low of $4.37 per share on March 23.

Since then, the wider healthcare sector has begun to rebound, with Nanosonics following suit and hitting a high of $7.35 per share in early June.

In a business update released in April, Nanosonics revealed it had recorded higher-than-expected sales growth during the third quarter.

It also reported consumable sales were in line with its pre-COVID-19 expectations in a win for shareholders.

The recovery can be credited to the pandemic initially increasing demand for health products, as health and wellbeing were at the forefront of most people’s minds.

“Now more than ever the importance of infection prevention has gained prominence not only within the healthcare company but across the broader community,” said Nanosonics CEO Michael Kavanagh.

What’s to come?

However, the company did warn the impacts of COVID-19 could still be felt in the fourth quarter and full-year results.

In particular, the company was concerned about the impact of COVID-19 on sales staff, who were for a time unable to directly access hospitals.

The company is yet to release a business update for the June quarter, but at the end of 2019, the company had $82 million in cash reserves.

Nanosonics share price has since dropped under the $7 mark and is now hovering at just over $6 per share as investors await the new financial results on June 25.

Shares in the company were trading down 3.38 per cent today, July 22, at $6.28 per share.