- Asian markets have opened stronger than expected on Wednesday, despite rising fears about fresh outbreaks and a dreaded ‘second wave’ of infections

- Analysts had been predicting a negative response in the wake of confusion over the status of the U.S.–China trade deal and resurgent virus numbers in the world’s two biggest economies

- But despite analyst fears and slightly negative futures markets, the indexes haven’t seen the falls predicted

- While they’re not exactly forging ahead either, there seems to be a surprising resilience in the face of bad news

- Whether it’s because our 21st-century attention spans are now jaded by the virus crisis or because things are genuinely rebounding remains to be seen

Asian markets have opened stronger than expected on Wednesday, despite rising fears of fresh outbreaks and a dreaded ‘second wave’ of infections.

Analysts had been predicting a negative response in the wake of confusion over the status of the U.S.–China trade deal and resurgent virus numbers in the world’s two biggest economies.

But despite marginal losses in Asian futures ahead of market opens — Japan’s Nikkei 225 futures falling 0.02 per cent and Hong Kong’s Hang Seng index futures losing 0.01 per cent — both markets opened green.

As the day continues, the Nikkei, Hang Seng and FTSE Straits Times Index have all meandered from green to red and back again, but don’t seem to be too spooked by the new uncertainties.

Surprising resilience

Global markets have been rattled rather than shattered through the pandemic.

While underlying economic indicators are showing the current situation to be a 100-year storm, worldwide indexes have been remarkably resilient.

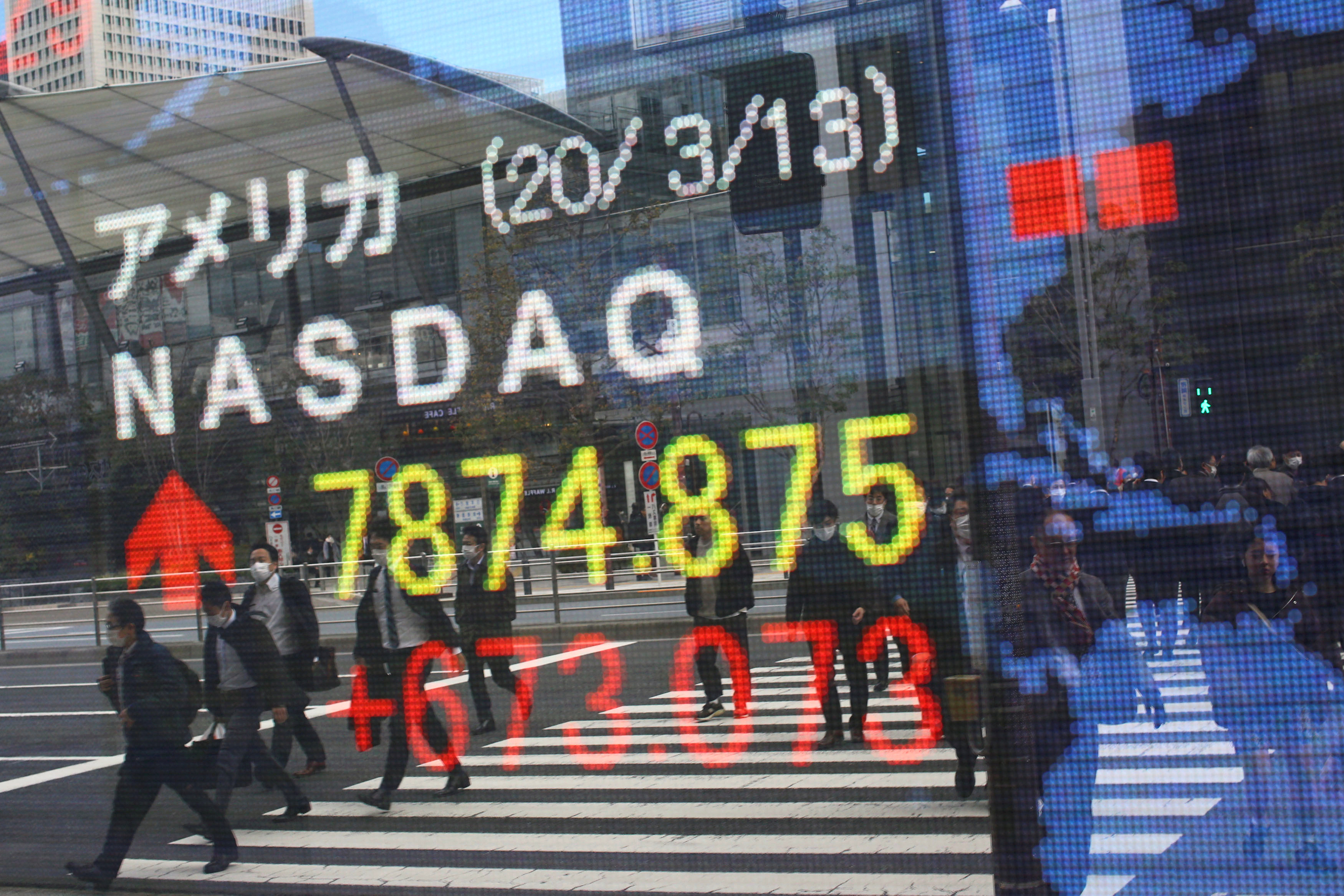

The Nasdaq continues to hit new highs, and many other markets are generally on the rebound after bottoming out in March.

It appears the Asian markets are gaining confidence from their overseas counterparts, which seem to be weathering the storm despite ructions in their own economies.

Ongoing civil unrest and spiking virus numbers in the U.S. have done little to scare off investors — the Dow Jones (0.5 per cent), S&P 500 (0.43 per cent) and Nasdaq (0.74 per cent) all closed higher on Tuesday.

It might be that the surprisingly strong opens across Asia are attributable to the strong U.S. showing, and reassurances that the U.S.–China trade deal is still on firm ground.

As investors, politicians and the general populace continue to adjust to the ‘new normal’ ushered in by the pandemic, the failure to be shaken by the bad news could either be a case of virus fatigue, or a new confidence that maybe things aren’t that bad after all.

Leap of faith

There seems to be a growing global resolve to reopen, despite the obvious health risks.

The U.S. is holding steady on its path to reopening despite spiking numbers in a number of states.

The global airline industry is also encouraging open borders and a return to relatively full capacity to help save its own hide.

And while China has returned to heavier lockdown restrictions around the epicentre of the recent Beijing outbreak, the measures are less restrictive than the nationwide shutdown after the original Wuhan explosion.

As testing, contact tracing and isolation measures become more normalised, people and governments seem better prepared to roll with the punches and carry on relatively unabated.

It seems Asian investors are on the ‘keep calm and carry on’ bandwagon too.

While the markets aren’t quite surging ahead, they’re performing far better than might have been predicted, given the unsettling trade and virus news this week.

Conventional wisdom says markets will generally move with the big news of the day, but recent activity seems to fly in the face of that notion.

Whether it’s because our 21st-century attention spans are jaded by months of the virus crisis or because things are genuinely rebounding remains to be seen.

Either way, it seems cautious optimism is winning the day.