- Buy now, pay later business Sezzle (SZL) is set to team up with the lending branch of America’s best online bank

- The ASX-lister has inked an agreement with Ally Lending, which forms part of leading digital services company, Ally Bank

- Essentially, the new deal will give Sezzle merchants and customers more ways to pay

- Under the agreement, customers can access long-term financing options, adding to the financials stock’s existing short-term, interest-free repayment plans

- Currently, Ally Lending hosts an online loan application and approval process, where a customer can apply to borrow up to US$40,000 (around A$55,780) to pay off over as many as 60 months

- Following the news, Sezzle shares are up 5.55 per cent, trading for $6.85

Buy now, pay later business Sezzle (SZL) is set to team up with the lending branch of America’s best online bank.

The ASX-lister has inked an agreement with Ally Lending, which forms part of leading digital services company, Ally Bank.

More broadly, Ally Bank is a subsidiary of Ally Financial, a New York Stock Exchange (NYSE) listed stock.

Essentially, the new deal will give Sezzle merchants and customers more ways to pay. Under the agreement, customers can access long-term financing options, adding to the financials stock’s existing short-term, interest-free repayment plans.

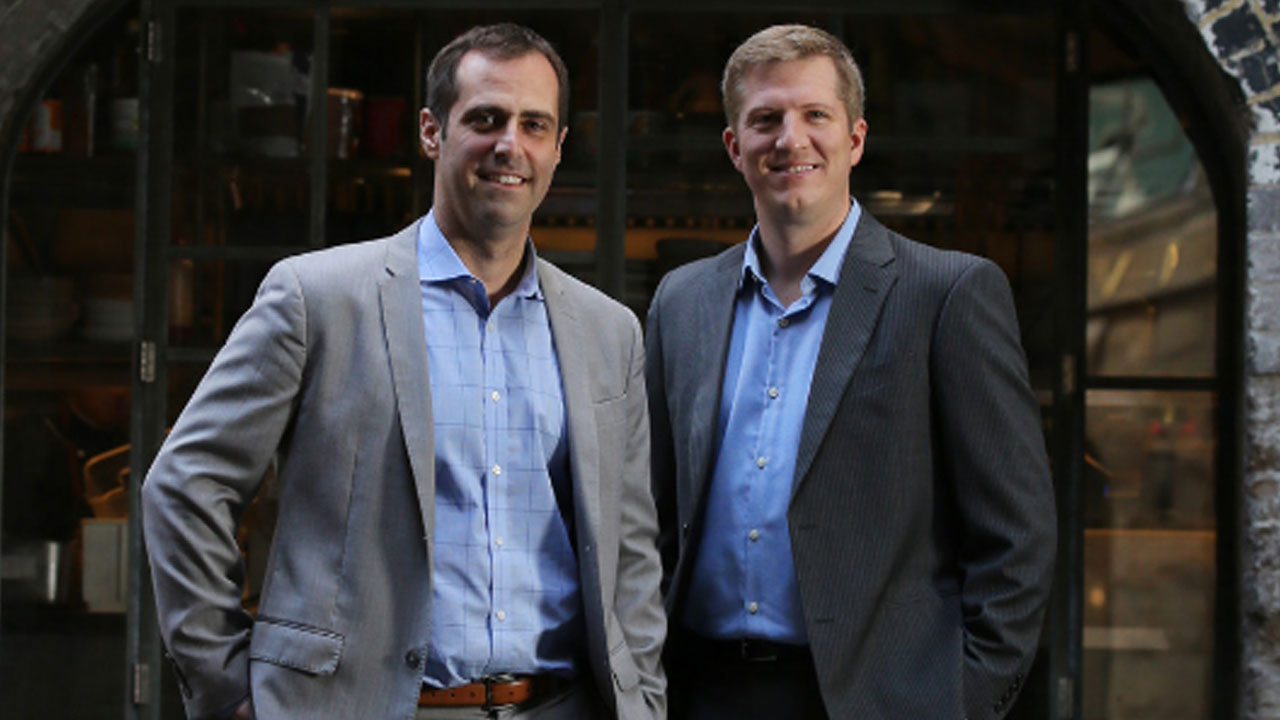

“Our collaboration with Ally Lending enhances our customer financing offerings, making it possible for consumers to better manage their finances,” Sezzle CEO and Executive Chairman Charlie Youakim commented.

“Ally’s dedication to its customers and commitment to innovation aligns with our own vision and culture – making this partnership a good fit for us,” he continued.

Currently, Ally Lending hosts an online loan application and approval process, where a customer can apply to borrow up to US$40,000 (around A$55,780) to pay off over as many as 60 months.

Significantly, its parent company is a U.S. financial services giant — at the end of FY20, Ally Financial was estimated to hold a staggering US$184.1 billion (about A$256.74 billion) in assets.

Speaking to the need for flexible payment plans in the current climate, Ally Lending President Hans Zandhuis said the company empathised with “the economic situation millions of Americans now face.”

“We’re proud to partner with Sezzle to offer budget-friendly, responsible financing options, so consumers can feel more secure when making the purchases they need,” he concluded.

Following the news, Sezzle shares are up 5.55 per cent, trading for $6.85 per share at 11:29 am AEST.