- The Federal Government has revealed its 2020-21 budget, placing job creation and tax cuts at the forefront of its plans to mitigate the economic impact of COVID-19

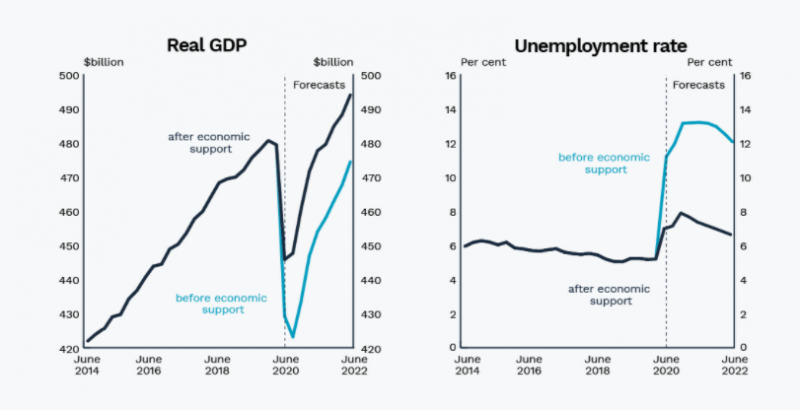

- However, NAB Chief Economic Alan Oster said the government’s prediction of a 4.7 per cent increase in GDP by 2022 is 20 per cent higher than the big bank’s bravest prediction

- The biggest discrepancy, Alan said, comes from the impact of the $100 billion worth of stimulus set to be withdrawn in 2022

- Notably, the Government is implementing a further $17.8 billion in personal tax relief, which is expected to impact around 11 million Australians

- In an effort to prop up the nation’s job market, the Government unveiled a JobMaker Hiring Credit to incentivise employers, which will eventually replace the current JobKeeper Wage Subsidy

- Under the Government’s plans for the private sector, all businesses that generate less than $5 billion in turnover can deduct the full cost of any capital assets acquired between now and June 30, 2022

- When combined with the $299 billion in economic relief already provided this year, the new budget brings the Government’s overall support during the pandemic to more than half a trillion dollars

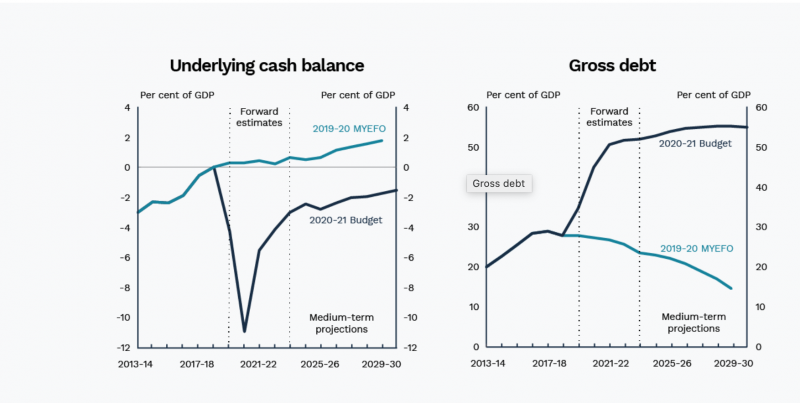

- As a result of the increased spending, the annual deficit is expected to hit a staggering $213.7 billion, or 11 per cent of GDP, and net debt is forecast to reach just under $1 trillion by 2024

The Federal Government has revealed that job creation and tax cuts will be integral in its battle against the nation’s worst economic downturn since the Great Depression.

Treasurer Josh Frydenberg unveiled the 2020-2021 budget late on Tuesday night, outlining the Government’s plans to carry Australia through the ongoing COVID-19 pandemic.

However, while the Federal Government is predicting a 4.7 per cent increase in Australia’s GDP by 2022, NAB Chief Economist Alan Oster said the big bank’s estimations fell 20 per cent shorter.

“They’ve got a GDP increase of 4.7 per cent, we’re saying by 3.8 per cent,” Alan said.

He said even the bank’s bravest estimations couldn’t predict a GDP rise of more than 3.8 per cent because of the $100 billion in stimulus set to be withdrawn in 2022.

Notably, the Government is implementing a further $17.8 billion in personal tax relief, which is expected to impact around 11 million Australians. Through the scheme, average income earners will receive a one-off tax cut of around $21 per week, with high income earners pocketing a permanent tax cut of around $47 per week.

Meanwhile, in an effort to prop up the nation’s job market, the Government unveiled the JobMaker Hiring Credit as an employer-centred replacement for the JobKeeper Wage Subsidy, which is due to expire on March 28, 2021.

The new scheme will subsidise eligible employers $200 a week for each newly hired employee between the age of 19 and 29, with a further $100 for new hires between the age of 30 and 35.

In a bolstered attempt to stimulate the private sector, all businesses that generate less than $5 billion in turnover, which includes all but the top one per cent, can deduct the full cost of any capital assets acquired from now until June 30, 2022.

The private sector and tax stimuli are part of a broader direct economic support package worth $257 billion, which the Government hopes will thaw out an economy struggling under the pandemic’s unpredictable lockdowns and border closures.

When combined with the $299 billion in economic relief already provided this year, the new budget brings the Government’s overall support during the pandemic to more than half a trillion dollars.

The traditionally spend-thrift Coalition was quick to point out that a “once-in-a-century” pandemic has required an unprecedented amount of investment into economic growth and job creation over the short term, which it plans to follow up with more stable debt reduction once the country is back on its feet.

That said, all this spending has come at the cost of the annual deficit, which is expected to hit a staggering $213.7 billion (11 per cent of GDP) before the Government’s proposed debt management plans come into effect.

Meanwhile, net debt is expected to spin out to just under $1 trillion over the next three years.

To put that into perspective, before the onset of COVID-19 and its resulting economic fallout the Government forecast a $5 billion surplus for the 2019-2020 financial year.

Adding further concerns to the budget, all these shortfall estimates are based on the assumption that a vaccine for the virus will be available before the end of next year, suggesting even more dire figures if the pandemic extends past then.

Whether or not a vaccine materialises in time, the Federal Government will be hoping the high cost of this year’s budget will be enough to salvage the nation’s struggling businesses, spiralling unemployment and uncertain future.