- Whether it be the emergence of a millennial workforce or a collective concern for our environment, the question of ethics seems to be a growing factor in our investment decisions

- A report from the Responsible Investment Association Australiasia shows four out of five of us would consider switching superannuation or investments if it didn’t align with our ethics

- With interest in the movement ever-increasing, it begs the question as to whether investors should have to compromise on returns to meet their ethical imperatives

- So what is ethical investing? And what do investors stand to gain from it?

What is ethical investing?

Socially conscious, sustainable, and socially responsible are likely a few of the terms investors may have heard thrown around in recent years when describing the umbrella ethical investment strategy.

While not entirely interchangeable, in essence, these terms generally reflect an investment strategy that seeks to invest based on moral or ethical principles, be it through minimising harm to the environment, people or animals as a priority.

For some investors, this means reducing exposure to companies engaged in the likes of fossil fuel production, tobacco or firearms activities, to others, it means investing in companies that maintain diverse workplace policies, good labour standards and consumer privacy.

Source: Morningstar

Whether it’s the developed millennial demographic cementing itself in the working world, a general shift in consciousness towards the impact of our actions on our planet, or simply fund managers ensuring they’re across the next big thing, the sentiment towards ethically responsible investments is becoming more apparent.

According to information released by the Responsible Investment Association Australiasia (RIAA), four out of five Australians says they would consider switching their superannuation or investments if it did not align with their ethics.

Its 2020 Responsible Investment Benchmark Report also revealed funds managed under responsible investment approaches grew for the 19th consecutive year in 2019.

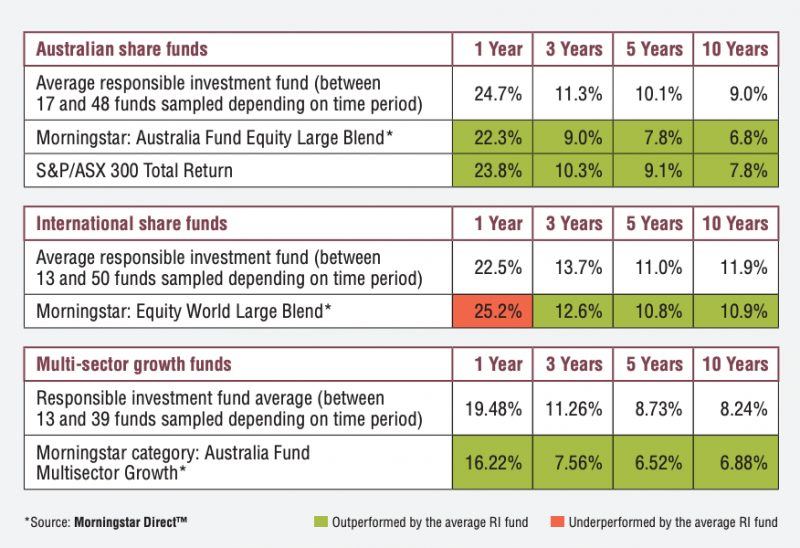

And perhaps most intriguingly, it found international responsible investment share funds outperformed the Morningstar average mainstream international share fund for almost every time period except for one year.

Source: Morning Star

The screening process

The screening process acts as the filter for what stocks or assets make its way into a potential ethical portfolio and typically comes in the form of a positive or negative screen.

According to RIAA, a positive screen seeks out investments or assets that target a particular solution or perform well in relation to other environmental, social and governance (ESG) benchmarks.

Negative screening, on the other hand, looks to exclude particular investments, based on an investor’s ethical imperatives.

In the RIAA 2020 benchmark report, it was observed that the ESG integration responsible investment approach that has the most influence on the construction of responsible investor portfolios.

The prominence of climate change also seems to be moving to the forefront, with the report revealing 19 per cent of responsible investment were screened for fossil fuels, representing a 14 per cent increase from the year before.

Responsibility or returns?

An investor may have a number of dealbreakers when choosing where to put their money — be it long-term growth, dividends or low risk, — but generally speaking, most are seeking the highest return in accordance with their risk tolerance.

The issue of ethicality, being so broad in principle, varies greatly from person to person, meaning what one investment someone might deem ethical, another may see as an avoidable consequence of a particular asset.

So what happens when you want to add screening for ethical requirements into that list? Are you inevitably left with fewer options on the menu?

In 2021, as ethical investments creep further and further to the forefront, it begs the question as to whether the two factors — ethical responsibility and the hunt for returns — have to remain at odds with each other.

An ethical shift?

From ASX-listers to global fund managers, investors now face a myriad of potential suitors when it comes to upping their exposure to the ethical sector.

Some major fund managers have even flagged that sustainability — a recognition of today’s investment impacts on the future — should be a new standard for investing.

Prominent investment managers of all scopes have some skin in the ethical investing game. They’re launching their own takes on the ethically conscious index, or honing in on the movement entirely as sustainability becomes all the more eminent in investor’s minds.

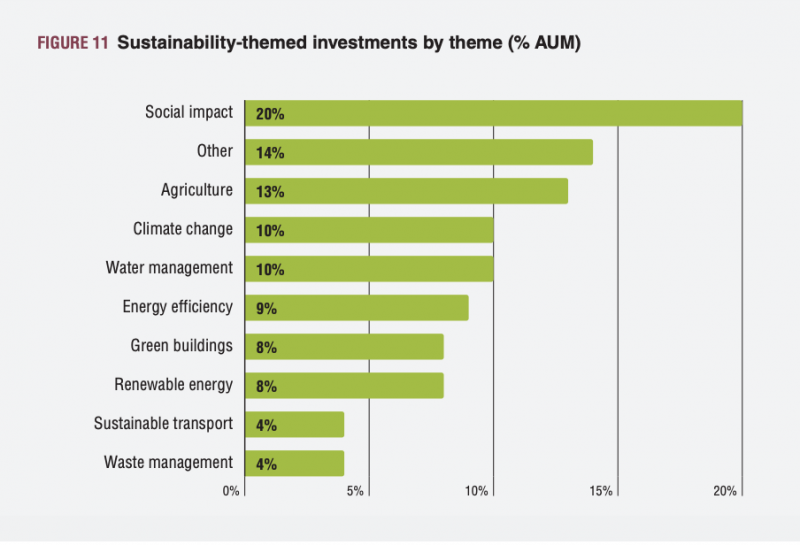

Responsible investment assets under management in Australia (AUM) under this sustainability theme also grew from 4 per cent in 2018 to 6 per cent in 2019, with social impact, agriculture and climate change coming up as most popular themed investments.

Source: RIAA

Whatever an investor’s reasons for taking up ethical investing, it shows that as long the world around us continues to change, the way we approach our investment decisions can continue to change too.

Past performance is not an indicator of future performance.