- 3D Oil’s (TDO) Otway Basin joint venture has contracted a Shearwater GeoServices seismic vessel to acquire a large 3D seismic dataset from offshore of southeast Australia

- The move is part of the ConocoPhillips farm-out agreement, through which ConocoPhillips must acquire a minimum of 1580 square kilometres of 3D seismic

- The vessel will cover 2700 square kilometres, and is expected to take around 60 days

- Once completed, along with the processing and interpretation of the 3D seismic survey, ConocoPhillips may then decide to drill an exploration well

- On market close, 3D Oil is up 3.92 per cent and is trading at 5.3 cents per share

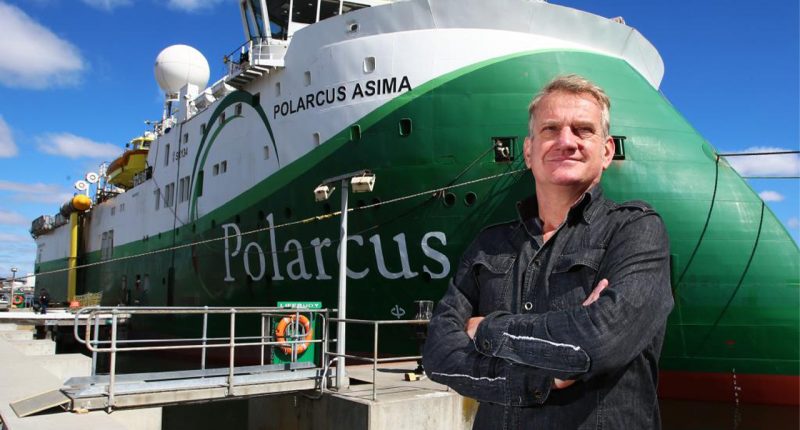

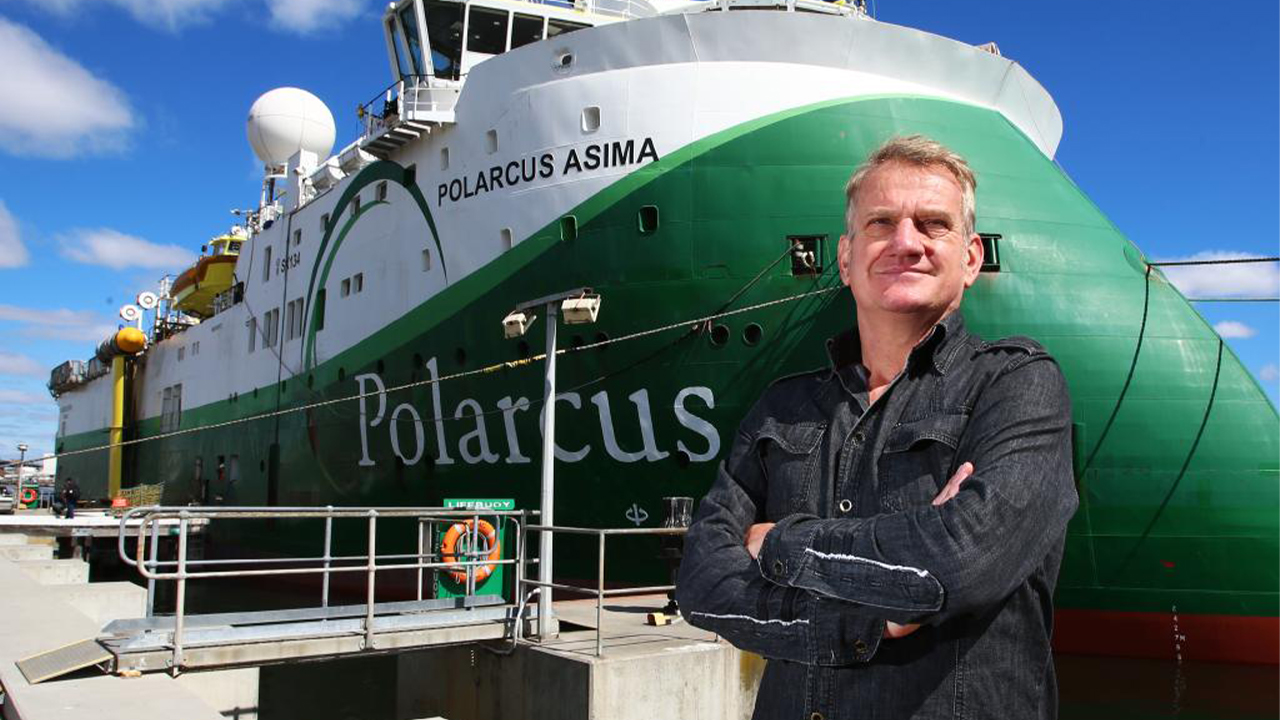

3D Oil’s (TDO) Otway Basin joint venture has contracted a Shearwater GeoServices seismic vessel to acquire a large 3D seismic dataset from offshore of southeast Australia.

Last year, ConocoPhillips Australia signed an agreement to earn up to 80 per cent of 3D Oil’s subsidiary, 3D Oil T49P, T49P exploration permit.

Under the terms of the farmout agreement, ConocoPhillips is to purchase a minimum of 1580 square kilometres of 3D seismic data at no expense to TDO.

ConocoPhillips has now called on Shearwater’s Geo Coral Vessel to purchase the seismic survey.

The survey will cover an area of 2700 square kilometres and is expected to take around 60 days to complete, between the beginning of August and end of October 2021.

The increase in size of the area will provide coverage of all leads within the permit and tie with the previously purchased Flanagan 3D seismic survey.

Once completed, along with the processing and interpretation of the 3D seismic survey, ConocoPhillips may then decide to drill an exploration well, which will fulfill the current year six work program obligation.

If it decides to drill such exploration well, 3D Oil will need to spend up to US$30 million (A$38 million) in drilling costs, after which it will contribute 20 per cent of drilling costs, which is in line with its interest in the permit.

“3D Oil strategically acquired this permit with the view that this area is arguably the last on the east coast with significant remaining gas reserves,” Executive Chairman Noel Newell said.

“This a key milestone for the company in the realisation of the significant gas potential identified in T/49P,” he added.

On market close, 3D Oil is up 3.92 per cent and is trading at 5.3 cents per share.