- Despite reporting record revenues of $810,000 for the quarter, Rent.com.au (RNT) shares dropped as much as eight per cent today

- RentPay, a service that aims to make the process of paying rent easier, was launched last month and now has 700 customers

- Advertising revenue also hit a new quarterly record of $384,000, up 72 per cent from the same quarter last year

- Optimising RentPay remains the focus of the company in the September quarter

- Shares in Rent.com.au are down 4.17 per cent and trading at 11.5 cents each at 3:47 pm AEST

Despite recording record revenues of $810,000 for the quarter, shares in Rent.com.au (RNT) fell by as much as eight per cent on the market today.

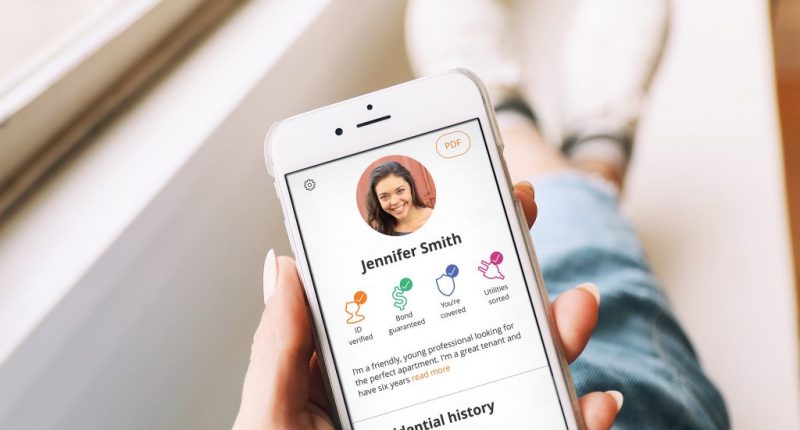

RentPay, which is designed to streamline the rent-paying process, launched last month and currently has 700 users, which Rent.com.au CEO Greg Bader said having within 90 days of launching was a great result.

“This equates to over $1 million in rental payments per month, with 94 per cent of that paid instantly into agents accounts via the New Payments Platform (NPP),” he said.

Mr Bader said another record revenue result was another good result.

“It’s particularly pleasing to improve over the traditionally strong March quarter and compared to the same period last year we achieved a strong 31 per cent improvement,” he said.

“With RentPay only just launched and yet to materially contribute to our earnings, the core rent.com.au platform continues to go from strength to strength with strong contributions from both its main revenue streams.”

Mr Bader said renter products were up 15 per cent on the same quarter last year with its RentBond finance product racking up almost $3 million in successful loans in the June quarter.

Advertising revenue also hit a new quarterly record of $384,000, up 72 per cent from the same quarter last year.

“Our record revenue result has driven an increase in the profitability of our core rent.com.au business, with EBITDA increasing to $59k, marking four successive quarters of positive EBITDA,” Mr Bader said.

Mr Bader admitted that the launch of RentPay had hit a few hurdles.

“We are yet to find the ideal balance between the required level of security and a simple, intuitive process flow for onboarding customers.

“We’re still making improvements to the platform, for example, our optimisations so far have seen a doubling of our conversion rate (from app download to paying customer) in June compared with May.

“We are also implementing additional credit card security protocols that simplify the verification process and improve security.”

RentPay software development expenses of $698,000 were capitalised in the June 2021 quarter, while a net $273,000 was spent on launching and optimising RentPay.

Optimising RentPay remains the focus of the company in the September quarter.

“We are adding new security functionality and verifications on the front end while also optimising the user experience and features based on customer insights,” Mr Bader said.

“In parallel we are finalising marketing campaigns to both our existing customer base as well as the broader renter market.”

“Now that the peak of the RentPay development has passed, some of our capacity can return to enabling the growth opportunities within the rent.com.au platform.”

Shares in Rent.com.au were down 4.17 per cent and trading at 11.5 cents each at 3:47 pm AEST.