- The Agency (AU1) hasn’t been able to turn a profit despite the real estate boom, although losses have narrowed to $1.8 million

- The net cash loss after tax was primarily due to the amortisation of the rent roll as well as non-cash financing and interest and finance costs, AU1 says

- Despite the loss the company saw growth in key areas, including revenue, EBIDTA and gross commission income

- The total number of transactions for FY21 was 4964, up 57.7 per cent from the previous year

- Shares in The Agency are down 8.62 per cent to 5.3 cents at 2:02 pm AEST

A real estate boom hasn’t managed to bring The Agency (AU1) into profitability but losses have tightened to $1.8 million after a $9 million loss in FY20.

The company said the net cash loss after tax was primarily due to the amortisation of the rent roll as well as non-cash financing and interest and finance costs, with the company claiming it has achieved a profitable scale.

Despite the loss, the company’s preliminary FY21 report noted growth, including revenue (up 39 per cent), earnings before interest, taxes, depreciation and amortization (up 544 per cent) and gross commission income (up 69 per cent).

Home loan approvals for FY2021 increased by 24 per cent year on year, from $137.4 million to $170.6 million, according to the company’s Mortgage Solutions Australia division.

Due to the disposal of the WA rent roll in September 2020, property management had 3517 properties under administration as of June 30 2021, a 27 per cent decrease from the previous year. This rent roll brings about $7 million in revenue each year.

The total number of transactions for FY21 was 4964, up 57.7 per cent from the previous year. The company said the growth is higher than the 40.7 per cent growth in the national real estate market from July 2021 to July 2022.

Listings were also up to 5137, a 30 per cent increase on FY20 while the gross value of sales was up 65.5 per cent year on year.

In FY21, operating expenditures accounted for 32 per cent of revenue, down from 42 percent of revenue in FY20 and 65 per cent of revenue in FY19.

The Agency said it was now concentrating on utilising a scalable platform to attract high-performing agents with low capital expenditures and corporate overheads.

The Agency has 325 agents across Western Australia, New South Wales, Victoria and Queensland, with company looking to boost agent numbers in the coming quarters.

In appreciation of considerable improvements to the balance sheet, according to the company, primary lender Macquarie Bank has cut its interest rate from 4.75 per cent to 3.75 per cent. Peters Investments, a supportive stakeholder, converted $3 million in convertible notes to become a 30.2 per cent shareholder.

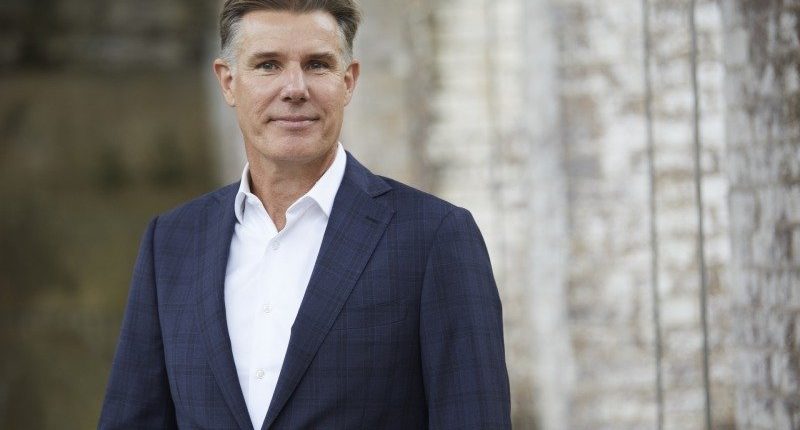

In management news, ex-McGrath boss Geoff Lucas joined as group CEO in March.

Shares in The Agency were down 8.62 per cent to 5.3 cents at 2:02 pm AEST.