Almonty Industries Inc. (ASX:AII; NASDAQ:ALM) is building real assets, producing critical minerals, and slashing Western dependency on China. Meanwhile, MP Materials basks in inflated multiples, boosted by Washington headlines and investor complacency. This isn’t just a valuation gap, it’s a market failure.

Back with us today is Matthias Greiffenberger, our trusted capital markets analyst at GBC AG, who just dropped a report that calls this out in no uncertain terms. If you’re still pricing potential over performance, buckle up.

This article is disseminated in partnership with Apaton Finance GmbH. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Lyndsay: Matthias Almonty’s got production, they’ve got that geopolitical leverage and tungsten dominance. MP’s got branding and Beltway Buzz. So why is the market handing MP a billion dollar valuation while Monty gets priced still like a junior?

Matthias: Well, I think it basically boils down to perception where there’s fundamentals. MP Materials is playing the capital markets game very well. They have a high profile New York Stock Exchange listing for years. A polished PR machine, strong political visibility in Washington, and that gives them a great branding and that gives them also a valuation premium. And in contrast, Almonty has stayed laser focused on execution.

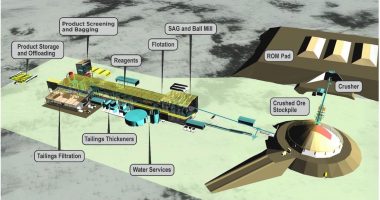

They’ve been building what will soon be one of the largest tungsten mines outside of China. And they’re fully permitted, government backed and already contracted with US defense. So I think it’s basically what I just said is it’s a big gap between perception fundamentals. They just listed on NASDAQ, but the market still hasn’t caught up to the story. The fundamentals are already there. It’s not a risky junior anymore but it’s been priced like one.

Lyndsay: Tungsten’s one of the hardest supply chains to break into. And Almonty broke in. As you said, Korea’s Sangdong mine isn’t just a story, it’s a strategic asset that they’re building. Now why aren’t investors treating it like one then?

Matthias: That’s the disconnect. The Sangdong isn’t just a project, it’s a geopolitical level fully permitted, financed by governments with a 15 year offtake agreement with a US defense contractor. And this tungsten is destined for critical defense uses like drones, missiles and high-tech electronics. It’s one of the few large scale tungsten sources outside of China and the US is well aware of it. But because Sangdong hasn’t hit first production yet, the market still treats it like a theoretical. So once that flips, it should be viewed for what it is, a Western cornerstone and asset in a weaponized global supply chain.

Lyndsay: Well, your report laid it bare, Almonty is executing, while MP is still mostly marketing. What specific financials or milestones prove Almonty is massively still mispriced?

Matthias: There’s a clear difference between hype and hard data and Almonty’s numbers are starting to speak louder and clearer. The constructed Sangdong mine is nearly complete. Long-term off-take contracts at floor pricing are already signed for Sangdong.

Financially they’re, in my opinion, on track to generate triple digit millions in EBITDA within the next few years. And meanwhile, MP trades as a massive multiple on much slower expected growth.

So, in my view, Almonty offers more upside and a stronger margin leverage yet its valued significantly lower.

Lyndsay: You’ve mentioned it a little bit. You’ve got Almonty trading at a fraction of MP despite operating margins, supply contracts and even that national level backing. Is this about ignorance or is Wall Street actually just being lazy when it comes to small caps?

Matthias: Honestly, it’s probably a bit of both. There are still blind spots when it comes to small caps especially when they were listed in Canada or Germany. So, institutions tend to stick with the brands they know even when the fundamentals say otherwise. But that dynamic is shifting fast. Almonty is now listed on NASDAQ and the strategic narrative is impossible to ignore. So once these institutions look past the name recognition, the discount should vanish.

Lyndsay: We all know that every mispricing does have that breaking point. Matthias, what’s going to force this rerate and when it happens, how violent do you think it could be that the snapback happens for anyone that’s not already in?

Matthias: I think that the trigger is pretty obvious. It’s the first production at Sangdong. So, that’s when the narrative flips. Almonty will, in my opinion, become a cash generating strategically critical western supplier and market stock for non-Chinese tungsten. And the fundamentals are real. The supply chain is secure and the contracts are signed. So now all that is left is that the market catches up and once they catch up, they will catch up quickly.

As always regarding the conflict of interest, please check out www.gbc-ag.de/

These conversations are packed full of sharp insights to guide your investment decisions, but remember, they’re our opinions. Our guests may have skin in the game, and so do we. Do your own due diligence, know your risk tolerance and speak with a licensed advisor.

For the full GBC report, head to their site: gbc-investmentresearch.de/

Join the discussion: See what’s trending right now on Australia’s largest stock forum and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.