If you’ve been following critical minerals, here’s why tungsten, and Almonty Industries (NASDAQ: ALM, TSX: AII, ASX:AII), should be on your watchlist.

This article is being disseminated on behalf of Almonty Industries, a third-party issuer and is intended for informational purposes only.

1. A Critical national security metal

Tungsten is officially classified as a critical mineral by the U.S. government. With the highest melting point of any metal and unmatched hardness, it’s essential for everything from armor-piercing munitions to ultra-hard cutting tools in heavy industry. It is a crucial component for several defense applications such as penetrators, fragments, hypersonic weapons, bulletproof armours, and can hardly be substituted

2. A broken global supply chain

China controls over 80% of the world’s tungsten supply, and in February 2025, it imposed new export controls. For the West, this creates a dangerous dependency. For investors, it signals a potential supply shock. With Russia and North Korea, the world’s tungsten supply grows to almost 90%

3. America’s dependency dilemma

The U.S. hasn’t produced tungsten since 2015. And by January 2027, the U.S. military will be banned from buying Chinese, Russian & North Korean critical minerals. With the clock ticking, Western buyers urgently need new supply to offset the supply gap.

4. Demand set to soar

The tungsten market is forecast to nearly double by 2032, from $5.5 billion to over $10 billion. From semiconductors to EV components and even smartphones, demand is surging, and prices have already climbed from $200 to nearly $520 Rotterdam ATP price per mtu unit since 2020. Simultaneously, most Western Countries increased their military budgets while Nato has called for Allied nations to invest 5% of their GDP in defense.

5. A pure-play Western solution

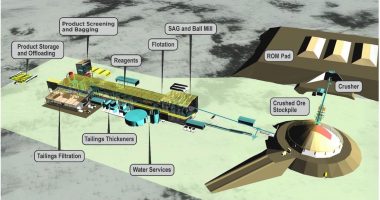

That solution is Almonty Industries (NASDAQ: ALM, TSX: AII, ASX:AII). Fresh off a $90 million NASDAQ IPO, Almonty is on track to become the largest conflict-free tungsten supplier in the world, with assets in Portugal and South Korea. Its flagship Sangdong Mine, one of the largest deposits outside China, is scheduled to restart in late 2025 with a 45-year mine life at an expanded production capacity. Analysts, including Oppenheimer, have already set price targets as high as $7 per share.

A critical metal, a broken supply chain, surging demand, and a Western producer ready to deliver. Click below to learn more about Almonty Industries.

Join the discussion: See what’s trending right now on Australia’s largest stock forum and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.