With crypto crown jewel Bitcoin back to fetching some US$75,660 per coin just after close on Monday (Sydney time), it’s fair to say we’re in another ‘crypto winder’ period, which tends to occur every 18 months or so.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

In fact, even after hitting all-time highs last October, the price has sunk some -40%, and BTC is at levels we haven’t last seen since October 2024. That October figure is important – it was the same month that critical minerals meetings drove the ASX to record levels; it was also when Xi and Trump met.

That meeting ended up killing fears of a trade war between China and the USA at its full-Hollywood-level conception, which calmed markets down at the same time ongoing fears about the USD saw gold and silver prices keep climbing.

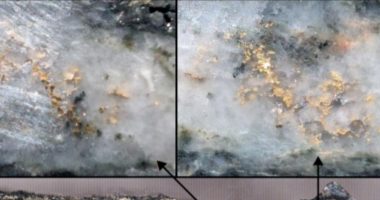

And it was when gold and silver prices began rising that the story for why crypto’s having another ‘winter’ period becomes obvious. Because, looking at crypto liquidity in the last few months, we’ve seen clear outflows from BTC-linked ETF products at home and abroad, and investors are rotating into precious metals.

And given that gold, and to some degree silver, are fundamentally less risky than the digital-based and ultimately still experimental asset class that is Bitcoin, it’s fairly obvious which way investor psychology went.

All in all, it really looks like the allure of Bitcoin has been stolen away from it. Traditional equities are going gangbusters; then there’s prediction markets, gold and silver and other precious metals; the AI trade; ‘meme stocks’, constant geopolitical distraction and chaos – with so much going on, it appears cryptocurrency has simply taken a back seat.

And what can that tell us? Well, perhaps, when there’s so much volatility in mainstream products like normal stocks and gold ETFs, there’s less appetite for cryptocurrency. After all, the 24/7-traded assets are known for steep intraday climbs and drops, and in that way, they are “exciting.”

But if ordinary shares in an ASX-listed silver miner are just as volatile intraday, then what’s the point of putting up with the trouble of a crypto wallet? Plus, with the outflows out of crypto and into gold and silver, well, precious metals are more exciting now, too.

Sorry, but Bitcoin’s boring right now.

How long will that last? That’s easy: Until it’s not anymore.

Join the discussion: See what’s trending right now on HotCopper, Australia’s largest stock forum, and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.