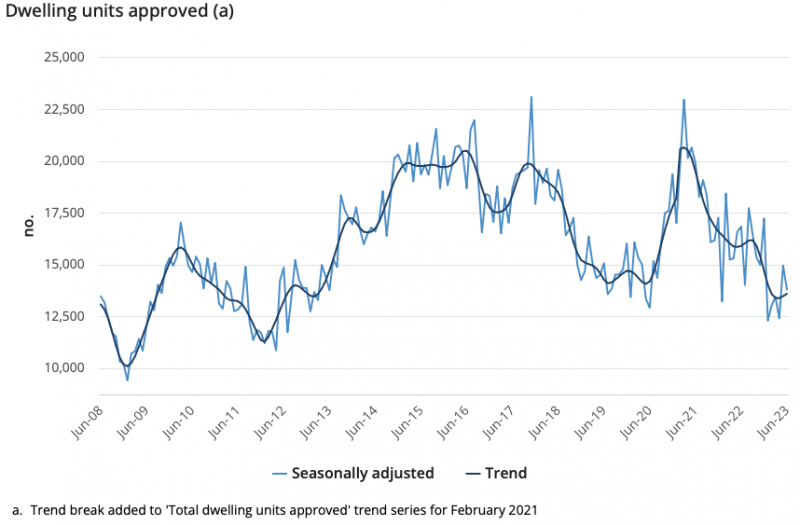

The latest ABS building approvals data shows a sharp decline in approvals throughout June of 7.7 per cent – after a strong increase in May of 20.5 per cent.

ABS Head of Construction Statistics Daniel Rossi said the plunge was driven by the volatile private dwellings excluding houses series, which fell 21 per cent.

Prices, however, have remained elevated.

“In June 2022, the average approval value for a new house was $409,900. Over the past 12 months, this has risen by 12.5 per cent to an average of $461,200 in June 2023,” Mr Rossi said.

Across Australia, total dwelling approvals were mixed, with New South Wales down 44.9 per cent, almost matching Tasmania at a decrease of 35.6 per cent.

Queensland saw a 28.3 per cent jump, while Victoria also saw positive strides with an increase of 26.4 per cent, followed by Western Australia with an 8.7 per cent jump, and a smaller 0.8 per cent rise for South Australia.

The value of total building approvals only rose 1.2 per cent following May’s increase of 11.4 per cent, and the value of total residential buildings fell 4.6 per cent, comprised of a 4.6 per cent fall in new residential buildings and a 4.7 per cent decrease in alterations and additions.

The value of non-residential buildings approved rose to a record high, increasing 7.6 per cent in June following a 7.2 per cent increase in May, which is the third month in ten years in which the non-residential sector value exceeded the total residential value.

ABS Head of Finance Statistics Mish Tan also announced that refinancing activity still remained at record highs.

“Refinancing activity has remained at record highs in recent months, as borrowers continued to switch lenders amid interest rate rises,” she said.

“The value of total refinancing between lenders was 12.6 per cent higher in June compared to a year ago.”

Morgan Stanley sees a glimmer of hope

Morgan Stanley analysts offered a glimpse of hope for the residential building sector in a recent research note.

Analysts highlighted a rebound in new home sales, with the new home sales index rising by approximately four per cent in the June quarter compared to the previous one.

Analysts anticipate stable to mildly positive results for the sector in the 4Q of FY23 once heavyweight listed companies unveil their statistics through the reporting season, with the potential for up to 1100 new sales indicating possible overall growth in apartment sales for FY24.

The ongoing turmoil in the construction sector

Builders Australia released figures at the end of July showing building materials inflation had hit three-year lows with the help of plunging steel prices.

But despite some prices levelling out, the body says other materials have further inflated, adding to separate pressures borne from labour shortages that are driving up the overall cost to build homes.

According to Master Builders Australia Chief Economist Shane Garrett, the latest data from the June 2023 quarter indicates that the cost of building materials has increased by a modest 0.6 per cent.

While this marks the smallest quarterly increase since the end of 2020, there are still challenges ahead for the industry.

“While the slowdown in the overall cost of home building materials is welcome, there has still been a sizeable increase of 7.4 per cent over the past 12 months,” Mr Garrett said.

“The past year has seen sizeable drops in the cost of several crucial building materials. The 10 per cent drop in steel product prices over the past year was the most significant change, with a welcome reduction of 4.4 per cent in the cost of structural timber also occurring.”