- Australia’s banking regulator issued final recommendations to help banks, insurers, and superannuation trustees in managing climate-relates risks, but did not impose new rules

- Australian Prudential Regulation Authority (APRA) says while the guide provided no new rules, it will assist entities to manage climate-related risks and opportunities

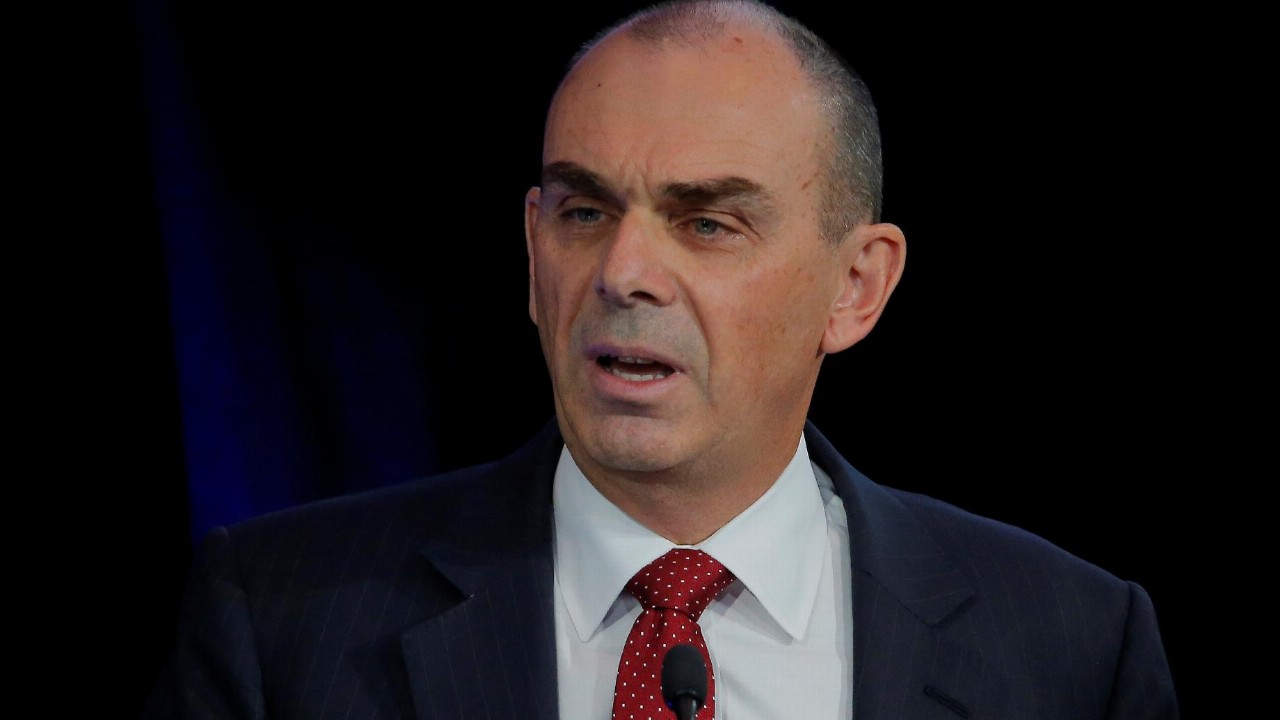

- APRA Chair Wayne Byres says the move to a lower-emissions economy creates financial risks that firms must plan for

- Mr Byres said as a result of the diversity of APRA-regulated entities, the guide does not “prescribe any particular way of doing things”

Australia’s banking regulator issued final recommendations to help banks, insurers, and superannuation trustees in managing financial risks related to climate change, but did not impose new rules.

The Australian Prudential Regulation Authority (APRA) said while the guide provided no new regulatory requirements, it will assist APRA-regulated entities to manage climate-related risks and opportunities.

The guidance contains APRA’s perspective on best practices in governance, risk management, scenario analysis, and the disclosure of climate-related financial concerns. It is intended to be adaptable, allowing each institution to use the method that is best suited to its size, client base, and business plan.

APRA Chair Wayne Byres said the move to a lower-emissions economy creates financial risks that firms must plan for.

“Most APRA-regulated entities recognise the potential challenges of climate change, such as future changes in consumer and investor demand, emerging technologies, new laws or adjustments in asset values, but they don’t always have a good understanding of how to respond,” he said.

“CPG 229 is a direct response to their request for more clarity about regulatory expectations and examples of better industry practice.”

Mr Byres said as a result of the diversity of APRA-regulated entities, the guide does not “prescribe any particular way of doing things”.

“Nor does it force companies to making any particular investment, lending or underwriting decision — those are matters for the entities themselves to decide,” he said.

“But we do want to make sure that those decisions are well-informed, and don’t undermine the interests of bank depositors, insurance policyholders or superannuation members.”

The proposed guidelines was largely welcomed in response to the consultation, according to APRA. Some stakeholders, on the other hand, desired a higher degree of prescription in response to worries that they would lack the necessary competencies or resources to manage the financial risks posed by climate change.

APRA-regulated firms are advised to use the revised guidelines immediately to improve their management of climate change financial risks in a way that is suitable to their company and its specific circumstances.