Clever Culture Systems (ASX:CC5) received an order for four of its ‘APAS‘ systems from pharma giant AstraZeneca. However, the company’s only going to get $3M for its troubles. Further, that payment covers a seven year period. (It also assumes “annual maintenance and support services.”)

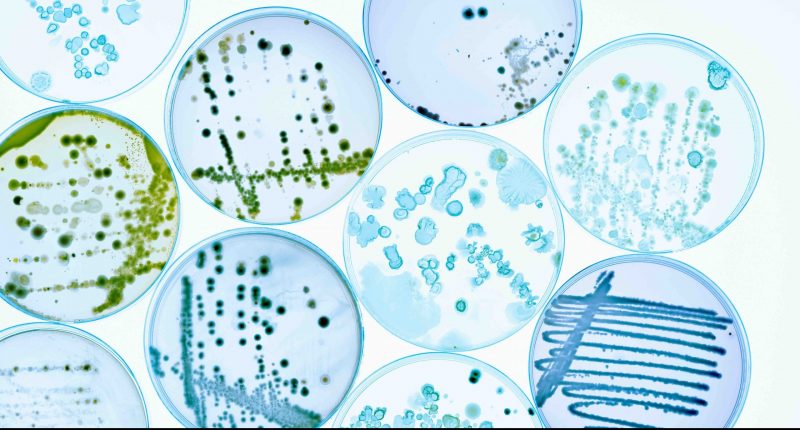

The APAS system automates the process of imaging and analysing microbiological cultures contained on plates in laboratory settings.

This request for four more machines expands upon an existing order from the pharma giant, further cementing the relationship between David and Goliath (consider, CC5 has a share price of 1.7cps).

The total value of all machines sent to Astra comes in around $7M for Clever Culture. Notably, the APAS system was only offered to market in March – and already, Astra has ordered more. In total, the company has shipped 12 APAS units.

“It is expected that AstraZeneca will finalise their internal validation of APAS for environmental monitoring and start progressively integrating APAS Independence into routine operation for drug manufacturing over the coming months,” the company wrote on Thursday.

The company recently set up its machines to handle smaller 55mm plates, which was a key decision for Astra in ordering more APAS systems and moving to rollout the tech across its global operations.

One can’t help but wonder if Clever Culture could probably be charging more.

“The addition of contact plates to the APAS platform was a key factor for this additional commitment of roll out, enabling AstraZeneca extended functionality to automate another test performed during route environmental monitoring,” CC5 CEO Brent Barnes said after the sale was announced.

CC5 last traded at 1.7cps through Thursday morning.

Join the discussion: See what HotCopper users are saying about Clever Culture Systems and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.