The ASX200 is set to trend upwards today, with futures expected to rise by 0.10 percent, influenced by bullish comments from the US Federal Reserve and stronger data from that country also.

The S&P and Nasdaq both reached record highs before close on Tuesday, rising 0.6 percent and 0.8 percent each, while the Dow Jones increased by 162 points, influenced by gains in megacaps.

The positive mood was mainly led by comments from Federal Reserve chair Jerome Powell, who told an ECB forum that the central bank was not ready to reduce interest rates despite progress on inflation. In terms of data, the JOLTs report showed that job openings had increased in May compared to the previous month.

Consumer discretionary and financials were the best performing sectors, while energy and health sectors showed weaker performances. Apple, Amazon and Tesla were among the top-performing megacaps, outperformed, with Tesla shares rising 10.2 percent after delivery numbers came in above expectations. At the same time, Nvidia dropped 1.3 percent, influenced by concerns around the sustainability of the AI-driven rally.

In Australian market news, Miramar Resources Ltd (ASX:M2R) says that an induced polarization (IP) survey has resulted in the potential extension to Northern Star Resources’ (ASX:NST) 313-thousand-ounce 8 Mile Dam gold deposit which lies adjacent to Miramar’s 8 Mile target, part of the wider Gidji joint venture project in the Eastern Goldfields.

The recently conducted survey has extended the chargeability anomaly offset from the deposit’s northern section, and which underlies multiple significant aircore end of hole (EOH) gold results.

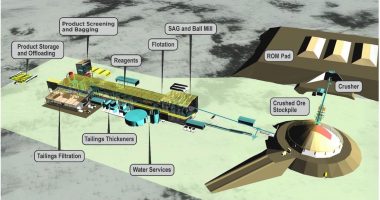

Chalice Mining Ltd (ASX:CHN) says it has signed a Strategic MOU with Japan’s Mitsubishi Corporation to support development of their Gonneville platinum group element-nickel-copper-cobalt project in Western Australia.

The two companies plan to work together during the ongoing prefeasibility study being conducted on Gonneville, with the intention of forming a strategic partnership to develop the project, which is located 70 kilometres northeast of Perth.

And Peppermint Innovation Ltd (ASX:PIL) have announced the securing of new contracts valued at more than AUD$315,000 based on their new Peppermint AI tool.

According to Peppermint, these clients include Informa plc (LSX:INF) and the Arms Trade Treaty Secretariat in Geneva.

Also in Australia, retail trade and building approvals data is due out from the Australian Bureau of Statistics later this morning.

In Forex, one Australian dollar is still buying 66.7 US cents.

Brent crude is down 0.10 percent to around US$86.51 a barrel, iron ore is up 1.40 percent to $108 per tonne.

Gold is down 0.08 percent to $2,330 an ounce and natural gas has fallen 1.02 percent to $2.45 a gigajoule.