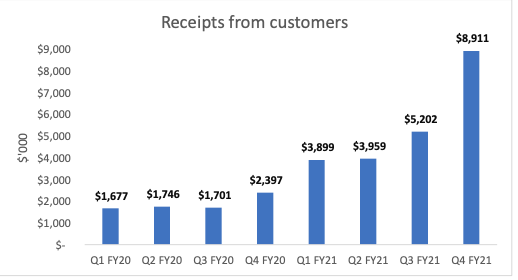

- BetMakers (BET) records its strongest quarter to date following $8.9 million in cash receipts for the fourth quarter of FY21

- This marks a just over 71 per cent increase on the previous quarter and a 272 per cent increase on this time last year

- The revenue growth is from a significant increase in activity in the Australian market and from BetMakers implementing its international expansion plans

- The company finished the period with more than $120 million in cash and no debt

- BetMakers was down 1.08 per cent to trade at 91.5 cents per share

BetMakers (BET) has recorded its strongest quarter to date following $8.9 million in cash receipts for the fourth quarter of FY21.

This over 71 per cent increase on the previous quarter and a 272 per cent increase on this time last year.

The revenue growth can be attributed to a significant increase in activity in the Australian market and from BetMakers implementing its international expansion plans.

In June, the company completed the acquisition of Sportech’s racing, tote and digital assets to expand its global customer base. As a result, today’s reported numbers include two weeks worth of cashflows from the Sportech business.

BetMakers finished the period with more than $120 million in cash without any debt.

CEO Todd Buckingham said the past quarter was a very “pleasing result for the company.”

“We have seen an impressive uplift on our strong base of domestic operations

while also capturing growth in global markets that we have identified as having the potential to be opportunities for us to expand our B2B wagering technology products and services globally as they continue to develop,” he said.

“BetMakers has a very clear strategy for growth in Australia and internationally. This includes in the United States where our Fixed Odds plans, starting in New Jersey, progressed during Q4 FY21 after being passed unanimously by the Senate and General Assembly.”

BetMakers was down 1.08 per cent to trade at 91.5 cents per share at 11:42 am AEST.