- BPM Minerals (BPM) has seen a 176 per cent rise in its shares after announcing it will acquire all shares in Recharge Resources from Borg Geoscience

- Through this purchase, BPM will also acquire five projects located on the boundary of the Earaheedy Basin in WA

- BPM Minerals will pay 1.875 million ordinary shares, the same amount of options, two million performance shares, and a net smelter royalty for the acquisition

- To support the development of the acquired assets, the company will raise $1.5 million in a private placement

- BPM Minerals is up 176 per cent and trading at 58 cents per share

BPM Minerals (BPM) has entered into a binding heads of agreement, to acquire all shares in Recharge Resources from Borg Geoscience.

Recharge Resources owns the Table Hill, Ivan Well, Hawkins, Rhodes, and Oldfield projects and applications, which BPM Minerals will acquire through the purchase of Recharge Resources.

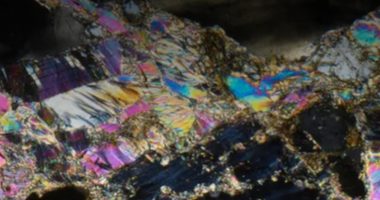

The projects are located on the boundary of the Earaheedy Basin in Western Australia, which is now a lead and zinc exploration hotspot since a recent discovery there by Rumble Resources (RTR).

As consideration for the acquisition, BPM Minerals will issue 1,875,000 fully paid, ordinary company shares to Borg Geoscience, at 20 cents. The company will also issue the same number of options, which can be exercised for 25 cents by September 1, 2025.

Additionally, BPM will issue two million performance shares, which are subject to various conditional vesting conditions. Finally, the company will give Borg Geoscience, a one per cent net smelter royalty on all minerals, mineral products, and concentrates that are produced and sold from the acquired tenements.

In related news, BPM Minerals has received commitments to raise up to $1.5 million (before costs), in a private placement to sophisticated investors. Through the placement, the company will issue a total of 7.5 million fully paid, ordinary shares at 20 cents, across two tranches.

The first tranche will see 5.4 million shares issued, with the issue of the remaining 2.1 million to be approved by shareholders at a later date. All shares issued through the placement will be accompanied by one free-attaching option, which can be exercised at 25 cents by September 11, 2025.

Participants in the placement are likely to include the project vendor Borg Geoscience, Inyati Capital, and other various high net worth investors.

The proceeds of the placement will support the acquisition of Recharge Resources and its five projects. The funds will also help expand and accelerate exploration programs at BPM’s Earaheedy, Nepean, and Santy projects.

The company plans to convene a general meeting in July, where it will seek shareholder approval for issuing the balance of placement securities in tranche two, for issuing the acquisition consideration, and issuing $375,000 in investor awareness shares to StocksDigital.

BPM Minerals is up 176 per cent, trading at 58 cents per share at 2:12 pm AEST.

-1200x645-380x200.jpg)