In this edition of Moves and Moods, we continue tracking the progress of inflation, and the risks this poses for higher interest rates.

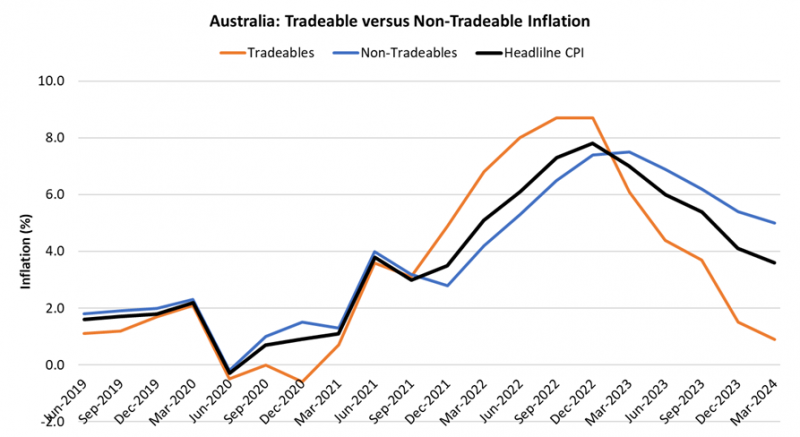

The financial press has been awash with commentary on the recent Australian inflation numbers. The year-on-year headline number was 3.6%, which is down from 4.1% in the previous quarter, but the core trimmed mean measure remained sticky at 4%. This is what the Reserve Bank looks at when setting interest rates, and it is 1.5% above the middle of the 2-3% range that they target. The number I look at is the non-tradeables inflation, Figure 1.

Recall that the tradeables piece of inflation largely represents the stuff coming in by ship or air. This is not just China sourced product, but a good chunk is. That is well down, condition normal.

However, before allowing the RBA or the Government any victory lap, we should recognise that the fall in the tradeables component of inflation had very little to do with them. That was mostly Xi Jinping, the China price at work making our goods cheaper, along with a sluggish Chinese economy.

The non-tradeables piece is the one we should focus on to measure domestic policy progress.

This scorecard is not so great. It fell from 5.4% year-on-year in the December quarter to 5.0% in the March quarter. That is 2.5% above the centre of the RBA target range of 2-3%. This is the piece that remains stubbornly high, and relates to rental rises, service prices and wage costs.

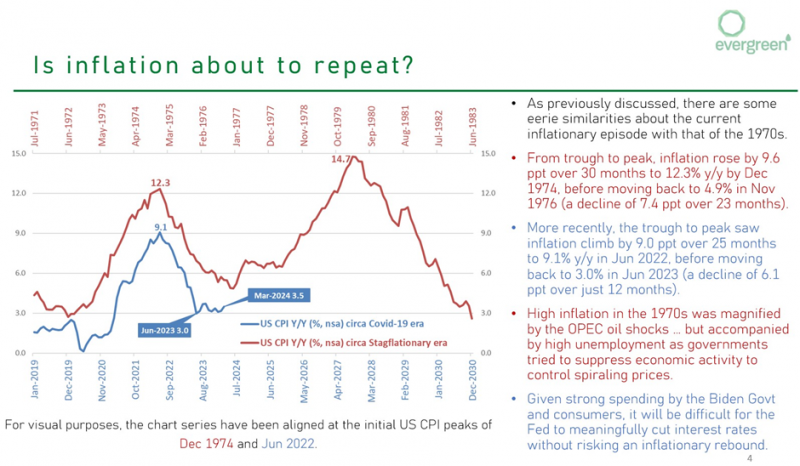

Our Back to the 70s script remains on track. Interest rates seem less likely to fall and may even rise.

Investment Opportunity

In a previous wire, we recalled the days of ABBA, the Honda Civic, and persistent inflation. The 1970s were a difficult time in geopolitics, the financial market and wider society. The policies of that time involved wars of different kinds: Cold wars between superpowers; hot wars between their proxies; the battle of the sexes; labour wars; trade wars; tariff wars; and, the anti-war backlash. Fashion follows folly.

There are perhaps two different ways to look at history. There is the glass half-full view, of a continuous struggle for progress, marked by an upward sloping line. There is also the glass half-empty view of a constant return to the starting point to complete one revolution of a perpetually repeating cycle.

The truth surely lies with a nuanced view that pits similarity versus difference.

“History doesn’t repeat itself, but it often rhymes” – Mark Twain

At a recent Evergreen Consultants investment committee meeting, economist Dr Peter Mavromatis presented a splendid chart recalling the tension between today and the 1970s, Figure 2.

Note that the 1970s inflation wave came in two halves, lasting over a decade, with two oil shocks. I purposefully included the text of Dr. Mavromatis’ commentary. ‘Eerie’ is the perfect word to describe this situation.

In my last column from just three weeks ago, I wrote:

“The investment opportunity is a reversal of the previous global disinflation shock. The geopolitical pressures of the time have famously elevated national security concerns over the economy. Policies to reshore manufacturing, or friend-shore into more expensive locations, will raise goods prices.”

More or less on cue and true to the 1970s vibe, Treasurer Jim Chalmers wrote an opinion piece on the Future Made in Australia policy initiative. Yes, there will be investment. It will be about encouraging investment in manufacturing and discouraging the wrong kind of foreign capital.

The stated aim is to align our national and economic security interests while delivering prosperity.

Move for this Mood

It is too early to judge what concrete measures the Future Made in Australia policy will entail. However, any policy which has a stated aim to screen qualifying capital for suitability at a government level, does not seem like a strong signal for foreigners to get on a plane, come visit some mine sites and invest.

Nobody would suggest that making something in Australia is a bad idea.

If you can and there is a market – and you are globally competitive – then knock yourself out.

Unlike in the 1970s, innovations in AI, automation and advanced manufacturing can lower labour cost. There will be Australian firms that grasp these. Government could create policy settings that accelerate this process, and that is clearly the intention of the Future Made in Australia package.

However, we must address the elephant in the room, which is Chinese manufacturing competitiveness.

The Chinese are not standing still

China is the factory of the world and it holds a leading position in electric vehicles, solar panels, lithium ion batteries and many other fast-growing segments of the global manufacturing economy.

The idea of automating factory activity to lower cost and offset labour shortages first became official policy in China way back around 2012. That nation now has the largest inventory of installed robots. Just as there was a China price that was driven by low labour cost, there is now a ‘much lower China price’ which is driven by extensive use of factory automation on a massive scale. The Chinese are not standing still.

The obvious strategy for Australia would be to leverage our highly-educated workforce in the design, marketing and delivery stages of manufacturing. This was the strategy of outsourced manufacturing.

In the new world, we must now ‘align our national and economic security interests’, according to Jim Chalmers. Presumably, that means an Australian firm should not partner with a Chinese firm, to make something innovative and at scale and export that into global markets. That is what I would do.

If you cannot pursue the first and best choice, you could do something similar in Japan, Taiwan, South Korea, or the USA. These are very good destinations for an Australian design or engineering team that wishes to achieve scale and cost advantages by partnering with a leading manufacturing enterprise.

The alternative – at smaller scale – is the niche strategy of high-value low-unit manufacturing. This might take you to Switzerland, Germany, the United Kingdom, the Netherlands, Ireland, Norway, Denmark, Sweden or Finland. If you really want to go wild, you might visit Poland or Turkey.

What do we make?

The one area of investment that I can think of that is made in Australia from go to whoa, is perhaps not the one our government imagines. That is gold mining, smelting and refining. All done here.

With the latest inflation data, yet more war likely for longer, and an Australian government that seems keen to splash cash, loans and subsidies on flagship projects, I am keen on gold.

Perth Mint gold certificates are ‘Made in Australia’ and backed by the only government guarantee of any gold depositary institution globally. That is the made in Australia Gold Corporation Act 1987.

The last time I purchased gold through them was September 2007.

That led to a good year for my portfolio return through the Global Financial Crisis of 2008.

History does not repeat, but my future portfolio may well rhyme with that one.

Disclosure: the author holds no gold as at the time of writing.

Disclaimers: This article contains information and educational content provided by Jevons Global Pty Ltd, a Corporate Authorised Representative (AR1250727) of BR Securities Australia Pty Ltd (ABN 92 168 734 530) which holds an Australian Financial Services License (AFSL 456663). The Market Online does not operate under a financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given.

The information is intended to be general in nature and is not personal financial advice. It does not take into account your personal financial situation or objectives and you should consider consulting a qualified financial professional before making any investment decision. All brands and trademarks included in this report remain the property of their owners.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.