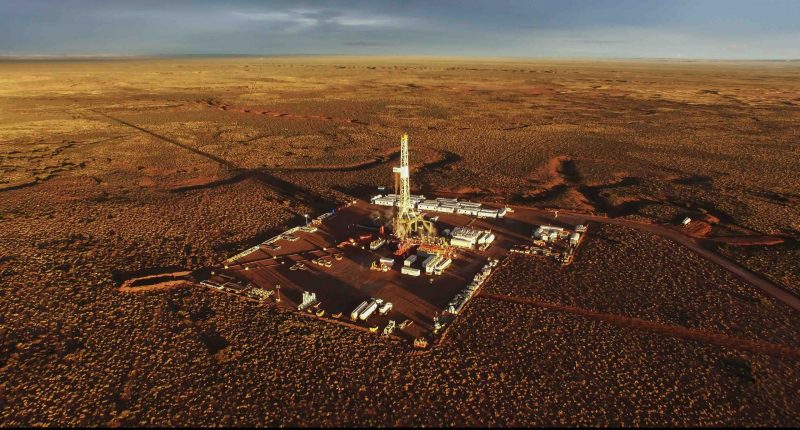

Under the new management of former Strike Energy chief Stuart Nicholls, formerly Neil Young-led Elixir Energy (ASX:EXR) has unveiled its new strategic plan: a heightened focus on QLD’s Taroom Trough.

Elixir, to remind, has been active in QLD for around two years when it moved back into Australia, taking a partial step away from its Nomgon project in the Mongolian Gobi Desert.

The company has had most success, if you measure it in terms of shareholder response, at the Daydream-2 well in QLD where gas has been flowed before.

Then again, gas flow expectations were missed in a crucial update in October last year, which caused shares to halve. But that’s beside the point.

With new management at the helm, investors are likely now keen to see what direction Elixir will head in. And the wording of the company’s plans for 2025, in a summary created by itself, may cause more cynical shareholders to pause for reflection.

Here’s what the company wrote on Monday of its own strategy: “Elixir’s strategic plan is built around a fast-follower approach in Queensland’s Taroom Trough, strategically positioning itself to leverage surrounding development activity and investment to drive rapid advancement.”

If that sounds delightfully vague, you aren’t alone. This finance journalist joins you. Still, a clear three point list was provided. In short, Elixir will secure long-term land rights in the Taroom; “[prove] the presence of commercially viable reserves” in Permian sands, and, collaborate on early production opportunities.

While stage three sounds a lot like a farm-in, it will be stage two that investors watch most closely: proving commercially viable quantities of gas exist underfoot at Taroom.

But the timeline of this plan was made complicated by a comment on capital expenditure from the company.

“Each phase is supported by a specific work program and associated capital requirements. Given the significant investment in neighbouring areas, Elixir’s assets may increase in value without immediate activity on its part,” Elixir wrote.

“As such, the company will progress through each phase only when the appropriate cost of capital is available.”

EXR last traded at 2.5cps.

Join the discussion: See what HotCopper users are saying about EXR and be part of the conversations that move the markets.