With a bit of good grace, you could argue that the European stock market is the oldest exchange in the world.

It is widely considered that the Amsterdam Stock Exchange, with roots back to the ‘Dutch Golden Age’ of the 1600s, is the oldest modern stock trading venue.

But more importantly for investors, the European stock market provides investment opportunities that can be difficult to find elsewhere. While US indices are becoming increasingly tech-heavy, Europe offers a more diversified investment landscape.

The Euro STOXX 600 index offers a well-diversified group of companies covering all 11 Global Industry Classification Standard (GICS) sectors. Healthcare makes up the biggest proportion of the index, covering 15.4 per cent, with Industrials, Banks, Tech and Food/Beverage/Tobacco currently rounding out the top 5.

This diversification is worth noting, especially in light of the increasing tech sector concentration risk in the major US indices and the dominance of the ‘Magnificent Seven‘ – despite growing concerns that Tesla may soon fall out of that group.

The Euro STOXX 600 index has enjoyed the same recent positive performance as most indices across the globe, climbing around 40 per cent in the 5 years to December. While indices like the US S&P500 and Nasdaq have enjoyed higher returns over the same period, that is largely due to their aforementioned tech concentration, which comes with specific risks.

You can gain exposure to the Euro STOXX 600 index through Exchange-Traded Fund (ETF) products such as the iShares STOXX Europe 600 UCITS ETF, the Lyxor Core STOXX 600 ETF, and the BNP Paribas Easy Stoxx Europe 600 UCITS ETF.

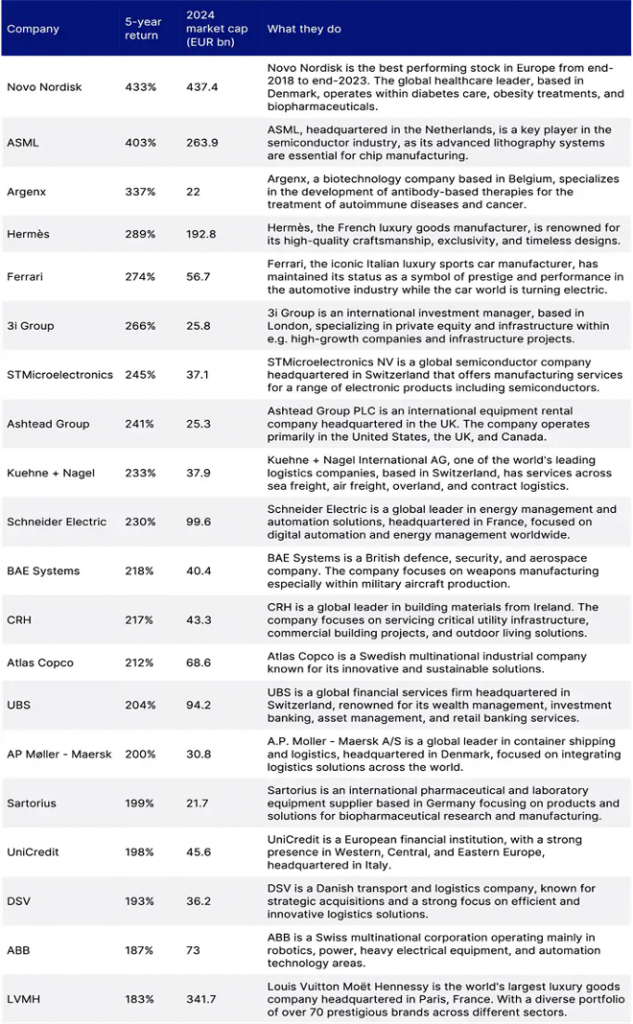

Since January 2019, the 20 best performing stocks of the Euro STOXX 600 have all returned more than 180 per cent, with healthcare giant Novo Nordisk (Denmark) the best performing, returning 433 per cent. This also means Novo Nordisk has become Europe’s most valuable company in terms of market capitalisation. The second most valuable company is the 20th best performing over the 5 years to January, LVMH (France). ASML (the Netherlands), which has the index’s second-best 5-year performance, squeezed in as the fourth most valuable company.

The index’s top 20 performers come from 10 different countries – 3 each from Denmark, France, Switzerland and the UK, two each from Italy and the Netherlands, and one each from Germany, Sweden, Ireland and Belgium. See the table below*.

* 5-year returns constitute price on January 1, 2019 – price on January 9, 2024.

Disclaimer: Saxo Capital Markets (Australia) Limited (Saxo) provides this information as general information only, without taking into account the circumstances, needs or objectives of any of its clients. Clients should consider the appropriateness of any recommendation or forecast or other information for their individual situation.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.