In this edition of Moves and Moods, we look at cost-effective exposures to uranium, as a commodity, alongside leading global uranium stocks.

The ASX-listed Betashares Exchange Traded Fund (ETF) offers diversified exposure in a single trade. The disclosed holdings can also offer self-directed investors with a simple research tool to help focus attention on single stock opportunities.

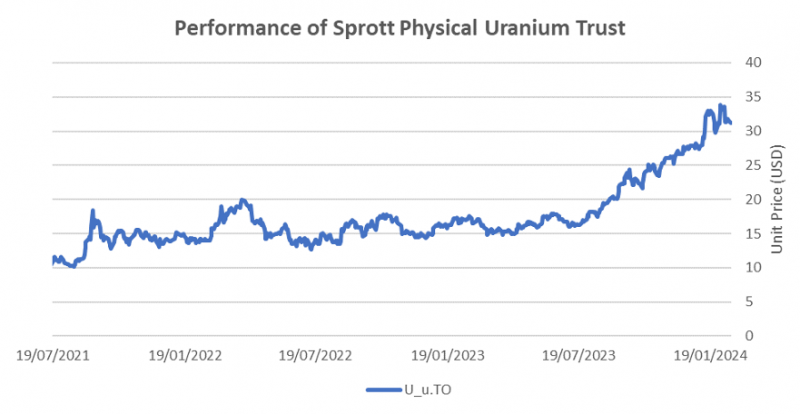

The world of commodity funds now offers direct exposure to the uranium market. The Canadian Sprott Physical Uranium Trust (TSE: U.U), offers physical uranium exposure in one trade, Figure 1.

Figure 1. Three years ago, the Canadian asset manager Sprott launched a physical uranium trust listed in Toronto.

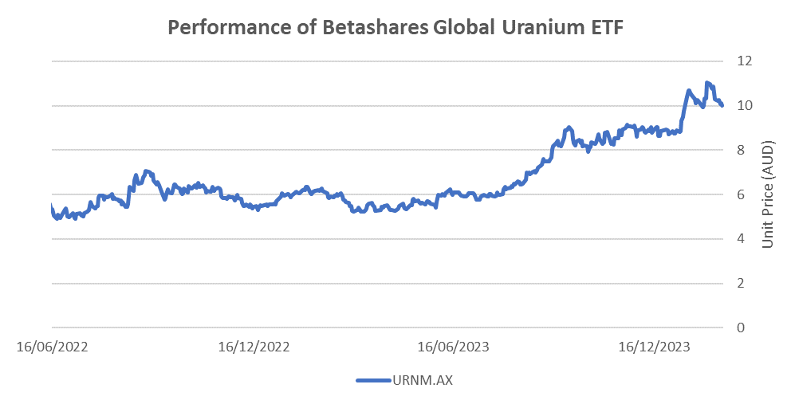

Thematic investment can be very challenging for self-directed investors. Global investment requires a brokerage account to trade foreign markets. These can involve hard-to-access exchanges and a range of foreign currencies. For this reason, many Australian investors stick to managed funds, or instruments that can be traded on the ASX. The advent of ETF products simplifies global thematic exposures on a cost-effective basis. One example is the Betashares Global Uranium ETF (ASX: URNM), Figure 2.

Figure 2 The Betashares Global Uranium ETF provides exposure to both uranium and uranium mining. Source: LSEG.

Investment Opportunity

There are at least three ways that self-directed investors can make use of exchange-traded product: They can simply buy the exchange-traded product to gain exposure to the target investment theme; they can use the easily obtained performance history of the product to analyse the theme; or, they can study the disclosed holdings of the product to surface single-stock ideas.

The complexity of the uranium market and the inaccessible nature of the commodity makes this a very different proposition to precious metals. I doubt that too many readers are keen to store drums of uranium oxide concentrate, known in the trade as “yellow cake” in their backyard!

For this reason, it pays to make effective use of listed investment products. As always, investors must be cautious about what they are buying. I will cover a few of these points before drilling into the composition of the Betashares (ASX:URNM) product to illustrate the three approaches to using exchange traded product as an investment, as a benchmark and to guide research.

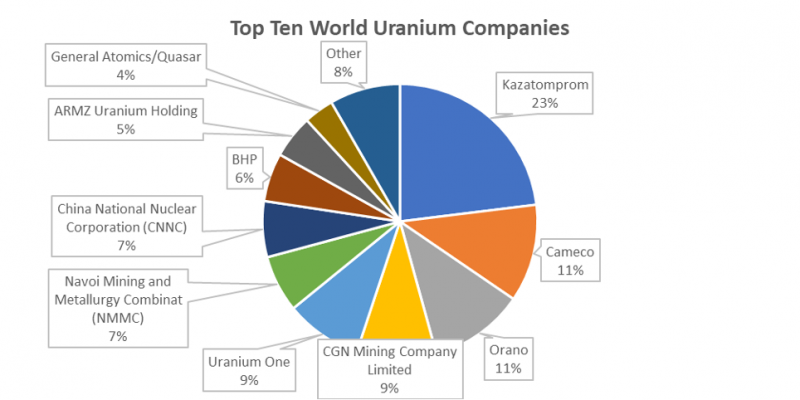

Of the top ten producing uranium companies only three are listed, Figure 3.

Figure 3 The global uranium market is very concentrated with only three listed majors. Source: World Nuclear Association.

The three listed majors are Kazatomprom (LSE:KAZq), Cameco (NYSE:CCJ) and BHP Group (ASX:BHP). The others in the top ten are either privately held, such as General Atomics, or state-owned such as the Russian group Uranium One, the Chinese players CNNC and the partially-listed CGN Mining Company.

Of these, we single out Cameco in Canada for being the largest Western producer. It has clear visibility onto the full global uranium supply chain, from mining to uranium fuel services. This is why uranium has a tight market structure. The Sprott Physical Uranium Trust, lists just three storage providers and locations for their physical uranium, Cameco (Canada), Orano and ConverDyn. Equally, the Betashares Global Uranium ETF disclosures, show that it’s dominated by Cameco, the Sprott Physical Uranium Trust and NAC Kazatomprom JSC, a Kazakhstan based producer listed in the London GDR market. The local trust has a management expense ratio (MER) of 0.69 per cent per annum whereas the US-listed Sprott Uranium Miners ETF (NYSE Arca:URNM) has near identical holdings for an MER of 0.19 per cent. There are advantages on cost and liquidity for shopping around in global markets, rather than to just stay at home in Australia.

Move for this Mood

Clearly, uranium is a concentrated market, and the leading players can be listed on two hands. There is simple exposure to be had by buying either the Sprott or the Betashares’ ETFs. The brokerage will likely be cheaper in the US, and the fee is half a per cent a year lower. This is not atypical for Australia and is one of the challenges for local investors who only have access to locally listed securities.

Of course, there are other factors to consider, such as the higher cost of tax advice to prepare tax returns in foreign currency. Online subscription tools, such as Sharesight, can help with managing portfolio valuation, dividends, and capital gains tax events.

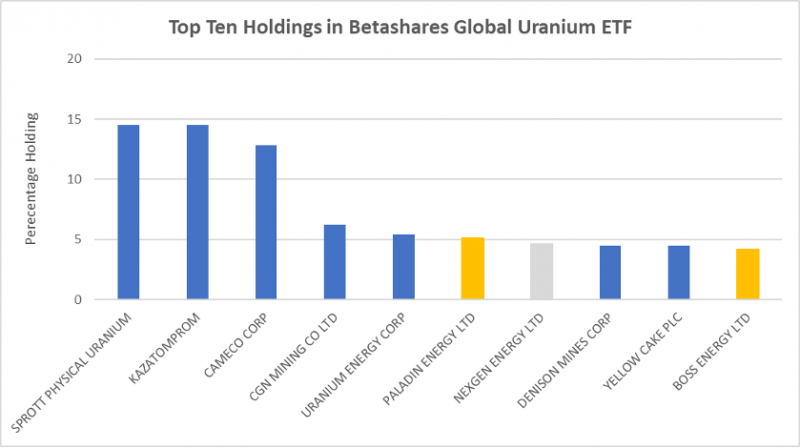

Earlier, I mentioned three main uses for an ETF: As an investment; a benchmark; or, for research. The first two have been covered, so let’s open the package for the ASX Global Uranium ETF, Figure 4.

Figure 4 Top ten holdings of Betashares Global Uranium ETF. Source: Betashares and LSEG.

In a prior note, I called out Paladin Energy (ASX: PDN) and Boss Energy (ASX: BOE), as my favoured local plays and mentioned the dual-listed Nexgen Energy (ASX:NXG) as an interesting Athabasca basin play in the most productive high-grade uranium mining district of Canada. The Betashares ETF offers exposure to all three, alongside the Sprott Physical Uranium Trust (TSE: U.U), the London-listed GDR for Kazatomprom (LSE: KAPq), the Canadian major Cameco (NYSE: CCJ), and the listed piece of CGN, which has a subsidiary involved in the trading of uranium in and out of China listed in Hong Kong 0 (HK:1164).

While some investors will benefit from buying just the ETF, others might choose to pick it apart, and only buy the pieces that interest them. You may not like holding a Kazakh company. That is fine, just buy the other pieces, or mix and match has you choose. This is how I use ETF products in my personal investments, and in the managed portfolio services that my firm provides to clients.

Disclosure: The author does not hold any current position in the stocks mentioned. Neither the author not the firm was paid by any of the companies or product providers mentioned.

Disclaimer: This article contains information and educational content provided by Jevons Global Pty Ltd, a Corporate Authorised Representative (AR1250727) of BR Securities Australia Pty Ltd (ABN 92 168 734 530) which holds an Australian Financial Services License (AFSL 456663). The Market Herald does not operate under a financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given.

The information is intended to be general in nature and is not personal financial advice. It does not take into account your personal financial situation or objectives and you should consider consulting a qualified financial professional before making any investment decision. All brands and trademarks included in this report remain the property of their owners.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.