The switch to remote working in light of COVID-19 has put an emphasis on the need for cloud applications, high-speed and reliable internet, and IT services.

The repercussions of not being adequately prepared to support a remote workforce run much deeper than the frustrations of having a laggy or unstable connection.

Businesses need fast, secure Internet that can protect the privacy of their staff and their intellectual property, as well as their back-up mechanisms. Going into COVID-19, many businesses were underprepared.

This has turned all attention to the providers of these IT services. On the ASX, while some companies have struggled to survive the pandemic, internet and IT service providers have faced unique challenges in having to adapt to the huge acceleration in the digital economy.

Of course, the market for these stocks was huge before the pandemic hit; a May 2020 Grandview report valued the telecom services market at a whopping US$1.7 trillion (roughly A$2.36 trillion) in 2019 with a predicted compound annual growth rate (CAGR) of five per cent from 2020 to 2027.

“As people worldwide struggle with the realities of the COVID-19 pandemic, digital entertainment platforms, as well as the global telecom service providers, have benefitted from the current scenario due to their industry type and business model,” the Grandview report said.

The struggle for these companies, the report said, is meeting the sudden increased demand for higher bandwidths and high-speed connectivity.

So, what does this look like for ASX-listed telco companies?

Internet on the ASX

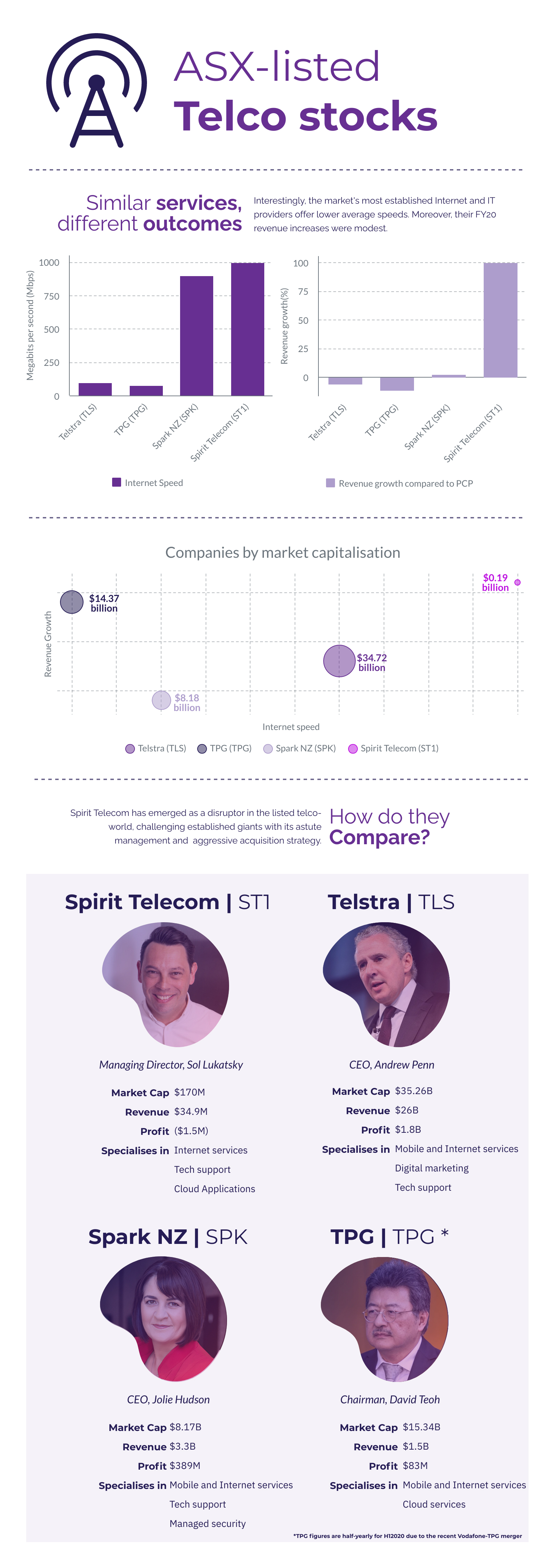

Of the country’s top listed telco stocks, Spirit Telecom performs the best in terms of internet speed.

While your standard Telstra NBN speed might see you downloading at between 30 and 50 megabits per second (Mbps) with a peak of 100Mbps, Spirit touts the ability to provide speeds of one gigabit per second (Gpbs). This is equal to 1000 Mbps.

Moreover, while the companies perform similar services, Spirit’s business model is slightly different.

Spirit bundles IT services such as cloud applications, infrastructure, cybersecurity, and IT support with its high-speed links — making it a one-stop-shop for all tech needs, with just one bill and one account manager to speak with.

Why Spirit?

Of course, this begs the question: why has Spirit Telecom, with its $200 million market cap, been grouped with these multi-billion-dollar peers?

The company has seen impressive growth in the face of COVID-19. While the listed big-caps have staged moderate recoveries from the brutal mid-March market crash, Spirit has almost tripled in value since the slump. In fact, the company’s share price has nearly doubled since the start of the year from before COVID-19 hit.

The growth has been driven by the company’s range of services and its aggressive acquisition strategy — from April 2019 through to July 2020, the company made eight major acquisition. In August, Spirit raised $23.2 million for another three buys.

The string of purchases underpins Spirit’s next phase in its growth plan to expand its geographic reach and become a truly national brand, as well as significantly grow its network of wholesale partners.

While Spirit was built on the premise of offering the country’s fastest internet, it is the company’s transformation to a modern telco that can meet all of the product and service needs for Australian business with one service point and one monthly bill that has driven its meteoric growth.

Spirit’s small-to-medium business (SMB) client base includes many businesses in essential areas like education facilities, aged care, and hospitals, which has underpinned its resilience in recent months.

Long before COVID-19 hit, Spirit was setting itself up for major growth through a string of strategic company purchases. These acquisitions have enabled it to build out the comprehensive product and service suite spanning across managed IT support, cloud storage, and cybersecurity, alongside voice and high-speed internet.

Moreover, the company’s Spirit X sales platform is the country’s largest aggregator of business-to-business (B2B) internet products in one online sales portal and has proven to be an effective lead generator — now able to service over 80 per cent of Australian businesses.

This focus on B2B service has created a sticky customer base and a growing stream of recurring revenue for Spirit.

Spirit’s currently forecast revenue run rate is $80 million. The company’s revenue doubled over the 2020 financial year alone.

Spirit Telecom makes the list of top ASX telco companies because it is young and nimble; it’s ready to disrupt the looming giants of the telco industry and change the game.