- Irongate Group (IAP) pays $36 million on a fund-through basis for an office building at 34 Southgate Avenue in Cannon Hill, Queensland

- The acquisitions offer a five per cent initial yield, with construction expected to be completed in July 2022

- IAP has entered a contract with Anthony John Group and Cannon Hill Developments, the seller, who will develop the property on behalf of IAP

- Once completed, the building will, the building will comprise 3520sqm of lettable area and will be occupied on a 10-year lease by ASX-listed Michael Hill

- Shares in Irongate have dipped 0.34 per cent to $1.48 as of 11:44 am AEST

Irongate Group (IAP) has purchased an office building at 34 Southgate Avenue, Cannon Hill, Queensland on a fund-through basis for $36 million.

IAP has entered a contract with Anthony John Group and Cannon Hill Developments, the seller, for commercial land and buildings and a development agreement with Cannon Hill under which it would develop the property on behalf of IAP.

The sale was negotiated by CBRE’s Jack Morrison and Adelaide O’Brien, with the $36 million price tag offering a five per cent initial yield.

The acquisition price is made up of an initial payment of $3,897,000 to Cannon Hill under the contract for commercial land and buildings, with the remainder paid to the seller over time under the development agreement.

Construction is expected to be completed in July 2022, and IAP will get a five per cent coupon at that time. IAP will use its existing loan capacity to pay the purchase price and related transaction fees.

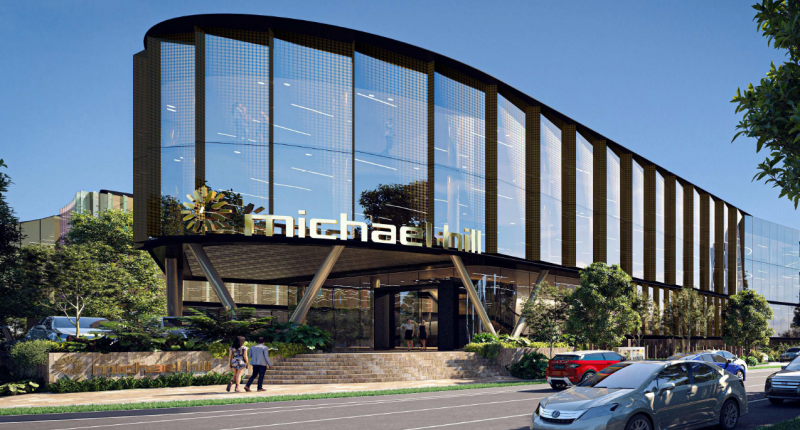

IAP CEO Graeme Katz said once completed, the building will comprise 3520sqm of lettable area with two levels of underground car parking and will be occupied on a 10-year lease by ASX-listed Michael Hill (MHJ).

“The building will be used by Michael Hill as its global head office and will also provide the tenant with manufacturing and distribution capabilities,” he said.

“The acquisition aligns with IAP’s strategy of investing in well-located, high quality assets that provide a sustainable income stream for investors and will deliver IAP with a brand-new building with 10 years of income growing at 3 per cent per annum.

“The acquisition continues our recent theme of acquiring assets in Brisbane, a market we believe currently offers relative value to both Sydney and Melbourne.

“Together with the industrial acquisitions in Brendale, Pinkenba, Kingston and Morningside, IAP has deployed close to $100 million over the past 6 months in Brisbane at an average yield of 5.5 per cent with a weighted average lease term of more than 8 years.”

Shares in Irongate have dipped 0.34 per cent to $1.48 as of 11:44 am AEST.