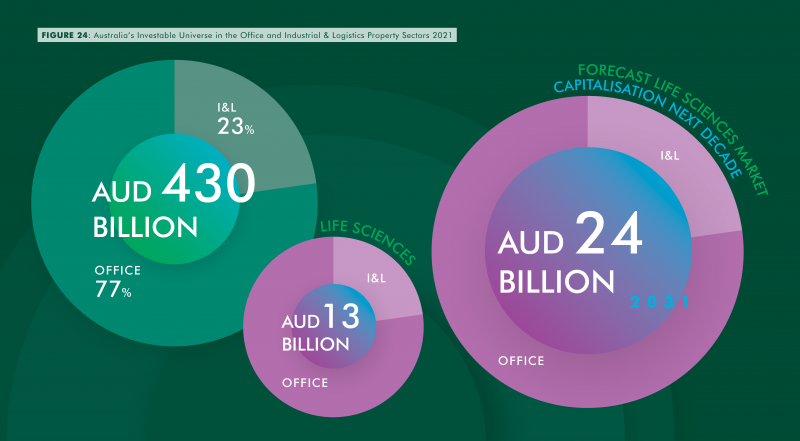

- Australia’s life sciences real estate industry is expected to nearly double in value to $24 billion over the next decade, according to CBRE

- Report author Sass J Baleh noted that a predicted one per cent uplift in the sector would equate to a lift from $13 billion to $24 billion by 2031

- The report says investors may maximise opportunities through sale and leaseback transactions, conversions, and collaborations

- According to CBRE’s analysis, life science investment sales have constituted an average of two per cent of overall industrial and logistics sale volumes

Australia’s life sciences real estate industry is expected to nearly double in value to $24 billion over the next decade, signalling a significant shift in profile for the potential asset class, according to a recent CBRE research analysis.

The life science industry encompasses the pharmaceutical, biotechnology, medical equipment, food science and healthcare sectors.

The report examines Australia’s potential in the life sciences market and predicts the country’s strong — albeit ageing —population growth, government expenditure and incentive schemes, ease of doing business and research institutions will put Australia on the map for life sciences property shift.

According to report author Sass J Baleh, a predicted one per cent increase in the sector’s contribution to Australia’s office and industrial and logistics investible universe, from three per cent to four per cent, would boost the sector’s value from $13 billion to $24 billion by 2031, owing to strong occupier and investor demand.

“The Government’s focus on sovereign capability and resilience on all things relating to pharmaceutical life sciences will propel this sector’s growth in R&D, manufacturing, logistics and distribution,” Ms Baleh said.

“Comparing Australia’s health systems to similar OECD countries, such as Germany and Canada, provides a good indicator of Australia’s direction of growth in this sector.”

Corporate offices, logistical facilities, R&D laboratories, and production facilities are the four primary components of a life sciences company’s property portfolio.

According to CBRE executive director capital markets – industrial & logistics Chris O’Brien, investors could maximise opportunities through a variety of methods, including sale and leaseback transactions, conversions and collaborations.

“Investors seeking income-producing assets can target strategic sale-and-leasebacks or disposals by life science companies looking to improve their balance sheets or offload non-essential assets following key M&As,” Mr O’Brien said.

“We expect that assets will come onto the market as pharmaceutical companies start to recycle capital for critical R&D.

“However, investors should note that as some of these assets are multi-use sites and include industrial, laboratories and offices, they may have to purchase properties in their entirety. Many life science precincts are set upon very sought after precincts, with high underlying land value.”

Mr O’Brien also mentioned that value-added investors could be interested in buying older light industrial facilities to convert into laboratories or cold storage.

However, he cautioned that these conversions would not be as technologically advanced as purpose-built facilities, thus this method would be better suited to markets with a limited amount of land dedicated to the life sciences sector.

According to CBRE’s analysis, life science investment sales have constituted an average of two per cent of overall industrial and logistics sale volumes and six per cent of office sale volumes from 2017 to 2021 year to date.

However, despite a considerable drop in total office volumes, life science-related office and industrial sale transactions hit a new high in 2020.

Australia currently has around 20 established and active life science-related precincts and an estimate of 15 that are emerging or planned.