- A record number of Australians are taking advantage of historically low interest rates to refinance their homes, according to ABS data

- The data shows borrower refinancing of home loan commitments between lenders hit an all-time high of $17.2 billion, up six per cent in July 2021

- ABS head of finance and wealth Katherine Keenan says the value of refinancing between lenders was 60 per cent up in July 2021 compared to a year ago

- Over the same period, the number of dwellings approved fell 8.6 per cent (seasonally adjusted), declining for a fourth consecutive month

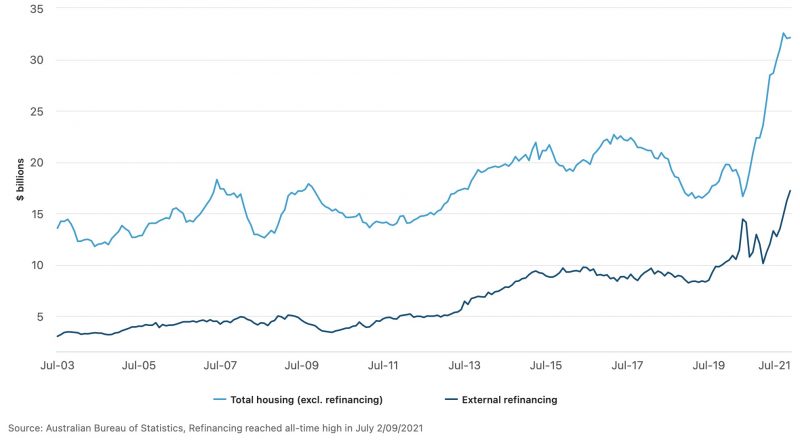

A record number of Australians are taking advantage of historically low interest rates to refinance their homes, according to the Australian Bureau of Statistics (ABS).

The ABS data shows borrower refinancing of home loan commitments between lenders hit an all-time high of $17.2 billion, up six per cent in July 2021 (seasonally adjusted).

ABS head of finance and wealth Katherine Keenan said the value of refinancing between lenders was 60 per cent higher in July 2021 compared to a year ago.

“This reflected borrowers seeking out lower interest rates, particularly for fixed rate loans, and cashback deals across a large number of major and non-major lenders,” he said.

In July 2021, the value of new home loan obligations, excluding refinancing, increased by 0.2 per cent (seasonally adjusted).

An increase in investor loan commitments (1.8 per cent) was largely offset by a decrease in owner-occupier loan commitments of 0.4 per cent. Since October 2020, investor loan commitments have been steadily increasing and have nearly doubled in value compared to a year earlier.

The number of loans for the construction of new dwellings continued to fall in July, but remained elevated compared to pre-COVID levels, HIA economist Angela Lillicrap said.

“The data reflects the progression of HomeBuilder projects as the majority have now finished the approvals process and will be commencing construction in the coming months,” she said.

“The value of loans for renovations reached its highest level on record in July. The value of loans for renovations was 115.9 per cent higher in the July quarter than the same time last year.”

Loan commitments for the construction of new dwellings have fallen 41.9 per cent from the all-time high seen in February 2021.

The value of these agreements has dropped from $4.2 billion to $2.5 billion since the peak in February 2021.

Since then, average loan amounts for owner-occupied houses (building, and acquisition of new and existing dwellings) have been increasing, hitting a new high in July, especially in New South Wales, Victoria and Queensland, ABS data shows.

Over the same period, the number of dwellings approved fell 8.6 per cent (seasonally adjusted), declining for a fourth consecutive month to be 24.9 per cent lower than the peak recorded in March.

ABS director of construction statistics Daniel Rossi said the decline was broad-based.

“Despite the fall, private house approvals remain at elevated levels and are 28.0 per cent higher than in July 2020 and 36.0 per cent higher than July 2019,” he said.