- Melbourne’s CBD was lagging even prior to the recent lockdown, with occupancy levels a cause of concern, according to an industry body

- The Melbourne CBD stayed around 45 per cent of pre-COVID occupancy levels, considerably behind the other capitals

- A Property Council survey found that 81 per cent of office building owners and managers are not expecting to see a material increase in occupancy levels soon

- Prior to the current Melbourne lockdown, over half of survey respondents cited a lack of worker flexibility as the biggest impediment to full occupancy

- Herron Todd White Melbourne director Jason Stevens expects to see a sharp decline in demand for B, C and D grade office space

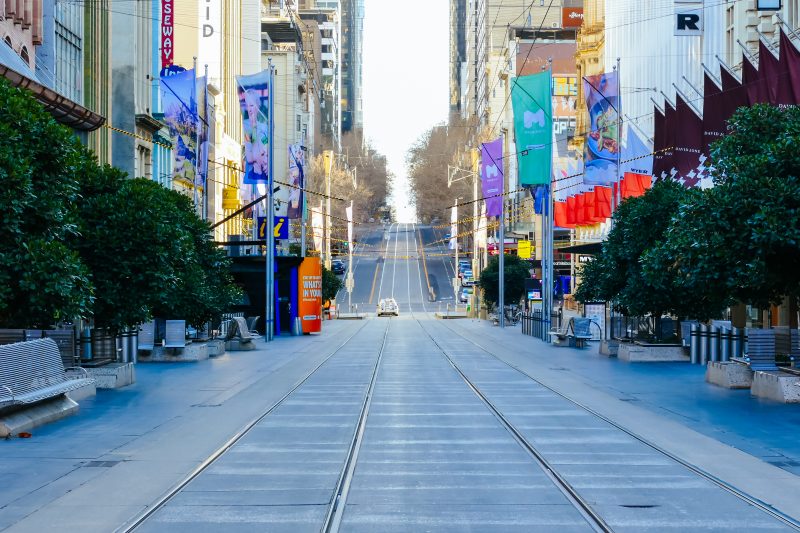

Melbourne’s CBD was lagging even prior to the recent lockdown, with occupancy levels a cause of concern, according to an industry body.

The latest office occupancy report from the Property Council of Australia has underscored the challenge that Melbourne has in rebuilding the city’s economic core.

The Melbourne CBD stayed around 45 per cent of pre-COVID occupancy levels, considerably behind the other capitals, according to a monthly poll of property owners and managers conducted before the current lockdown.

Property Council chief executive Ken Morrison said Melbourne remains a cause for concern.

“Even before the current lockdown, it was clear that Melbourne was well behind the pack in terms of CBD recovery,” he said.

“Once the current lockdown has concluded, there will need to be a redoubling of efforts to return the Melbourne CBD into the vibrant city centre that it was prior to the pandemic.

“Melbourne’s occupancy levels now sit 23 per cent behind Sydney, which has maintained encouraging momentum since the Northern Beaches lockdown disruption earlier this year.”

During May, Sydney’s CBD experienced a rise in occupancy to 68 per cent of pre-COVID levels while all other CBDs recorded a relatively consistent number of workers returning to their offices.

Prior to the current Melbourne lockdown, over half of survey respondents cited a lack of worker flexibility as the biggest impediment to full occupancy.

“Flexibility will continue to be a strong feature of working in the post-pandemic world, but the current levels of occupancy are not sufficient to support Australia’s broader economic recovery,” Mr Morrison said.

“Our CBDs support millions of jobs and generate hundreds of billions of dollars in economic activity. We need them firing on all cylinders.”

The survey found that 81 per cent of office building owners and managers are not expecting to see a material increase in occupancy levels within the next three months.

Herron Todd White Melbourne director Jason Stevens aid the Melbourne CBD office leasing market was hit hard by the prolonged lockdown in 2020 as the trend of working from home permeated.

“This was most acutely felt in the secondary grade office sector as the strong take up in new prime and A grade space was fuelled by the flight to quality,” he said.

“We expect this trend to continue throughout 2021 and onwards which will result in a sharp decline in demand for B, C and D grade office space.”

Mr Stevens said despite the repercussions of COVID-19, there is a significant weight of capital in the market seeking limited investment opportunities.

“This is best illustrated by limited stock being presented within the CBD office market due to owners refusing to sell under market value for what may be perceived as short-term leasing pain,” he said.

Continued substantial vaccines in B, C and D grade office spaces might see many of these types of buildings being repositioned for alternative uses such as residential, according to Mr Stevens.

Office occupancy as a percentage of pre-COVID levels by CBD

| Jan-21 | Feb-21 | Mar-21 | Apr-21 | May-21 | |

| Melbourne | 34% | 27% | 39% | 45% | 45%* |

| Sydney | 50% | 54% | 56% | 65% | 68% |

| Brisbane | 70% | 72% | 69% | 70% | 71% |

| Canberra | 76% | 72% | 72% | 70% | 71% |

| Perth | 74% | 72% | 79% | 78% | 77% |

| Adelaide | 77% | 77% | 79% | 78% | 78% |

| Hobart | 89% | 84% | 89% | 91% | 93% |

| Darwin | 89% | 89% | 93% | 93% | 93% |