Memphasys (ASX:MEM) has executed a long-term European commercial supply agreement with Centro Fertilita Assistita (CFA) Italia, marking the Australian company’s first commercial contract in mainland Europe and establishing a five-year supply pathway for its Felix automated sperm isolation system.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

Disclaimer: This content has been prepared as part of a partnership with Memphasys Ltd and is intended for informational purposes only.

The agreement carries a minimum value of €525,000, equivalent to around A$925,000, based on contracted cartridge volumes and pricing.

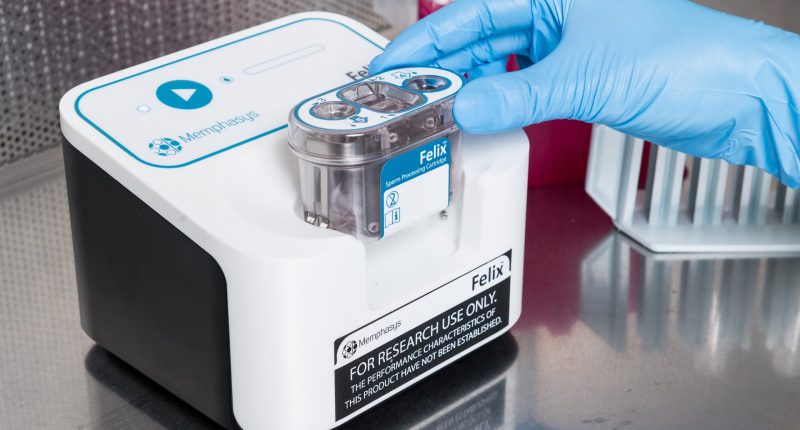

Under the terms, CFA Italia has committed to minimum purchases of 3,000 Felix cartridges over the first 24 months, followed by 1,500 cartridges per year in years three to five. This equates to a minimum contracted volume of 7.5K cartridges over the agreement, priced at €70 a cartridge. CFA Italia is one of Italy’s largest private IVF groups and is based in Naples, with an established network of IVF clinics across the country.

Ahead of any contractual obligation and before CE Mark approval, CFA Italia has placed an initial purchase order for 500 Felix cartridges, valued at approximately $62.5K. Memphasys expects to recognise revenue from this order in the current quarter, with cash receipt anticipated in the following quarter.

These early orders followed on-site clinical engagement, training, and onboarding, and reflect clinical interest generated through its direct commercialisation.

The agreement provides for CFA Italia to deploy the Felix system within its own IVF clinics and to engage its broader commercial network to promote and sell the technology across Italy. CFA’s existing relationships with numerous IVF clinics are expected to support wider market penetration beyond the minimum contracted volumes, with Memphasys noting early demand that could exceed the baseline commitments.

Memphasys described the agreement as a strategic milestone in its expansion, adding to existing arrangements in Japan, India, and the Middle East. The company indicated Europe represents a core pillar of its global commercialisation strategy for Felix, with CE Mark approval expected in early 2026.

MEM shares have been +20% higher on the news.

Join the discussion. See what HotCopper users are saying about Memphasys Ltd and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.