Adisyn (ASX:AI1), a little heard of microchip stock, has pointed to excitement around another microchip competitor – Nanoveu (ASX:NVU) – in explaining recent price action in a speeding ticket.

And on Wednesday, A1I shares at one point jumped 25% again, to 7cps.

In short, Adisyn believes there’s just a general amount of excitement in the small end of the ASX, and the even smaller component that relates to microchip stocks.

When the ASX asked the company if it was aware of any information it hadn’t declared explaining a recent spike, it answered “yes.”

“The company is aware that ASX listed Nanoveu Limited has on 15 October 2024 announced that it has reached an agreement to acquire Embedded A.I. Systems Pte Ltd, which holds a proprietary, semiconductor system on a chip business,” Adisyn elaborated on Wednesday.

“There are few micro-cap companies on the ASX with exposure to semi-conductor technology. Accordingly, the Company believes that the market’s enthusiasm for Nanoveu’s announced transaction has positively impacted the price and volume of the Company’s shares.”

In other words: Contagion excitement.

And to be sure, ASX traders and investors alike have been hungry all year for exposure to the AI thematic with no shortage of investment idea think pieces available for the discerning Australian share market punter.

Adisyn’s rise on Wednesday also points towards market enthusiasm for news it has itself moved to acquire a business, much like Nanoveu’s recent news – and along with that, AI1 is also throwing a $3M capital raise for funds to buy it.

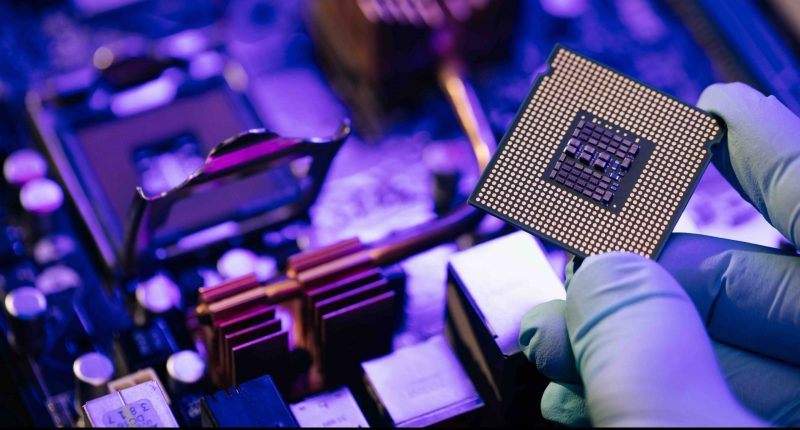

Adisyn’s proposing to purchase a company called 2D Generation, which Adisyn wants for its “innovative semiconductor solution to generate opportunities.” It named defence, data centres, and cybersecurity as possible end-markets broadly.

Broadly, 2D Generation own the rights to a patent that would allow graphene to be applied to microchip which could lead to chips getting even more powerful, and even smaller – meaning more and more CPU can be packed into a phone, smartwatch, and so on.

Whether that happens remains to be seen, but in a world where AI’s the name of the game, it’s not surprising small players wouldn’t be keen to expand.

Negotiations, however, remain ongoing.

AI1 last traded at 6.6cps.

Join the discussion: See what HotCopper users are saying about Adisyn and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.

-1200x645-380x200.jpg)