- COVID-19 has created a huge demand for new and used cars, as people spend more time travelling domestically and shy away from using public transport

- Alongside the increased demand for cars, prices have also jumped up due to the limited number of new vehicles entering Australia

- The whole situation has created a huge opportunity for lenders, with roughly 90 per cent of cars being bought on finance

- Additionally, over 60 per cent of all buyers will shop around for a loan, creating competition for fast easy loans

- Enter MoneyMe (MME), an ASX-listed business that has perfected its AI technology to allow fast, automated loans to be approved within an hour

- The business already offers loans of up to $50,000 and boasts a strong base of repeat customers, making it primed to capitalise on the growing car demand

- Shares in the MME are trading for $1.52 per share on Thursday, April 22

The COVID-19 pandemic has dominated headlines for over a year now and has led to monumental changes in everyday Australian’s way of life.

Unfortunately, many of those changes have been negative in their impact, with travel restricted and tens of thousands of jobs shed when the pandemic first hit Australia.

However, amongst all of the hardship has been signs of opportunity, such as the growing demand across the nation for used and new car sales.

Stuck at home and with more cash to spend, more and more Australians have decided to upgrade their vehicles over the last year.

Of those buyers, many have turned to personal loans to fund their purchase giving lenders a strong opportunity to shine.

Among the ASX-listed business which are set to benefit from this increasing demand is MoneyMe (MME), a fintech company which already offers loans of up to $50,000.

With a low-cost business model, a strong base of loyal customers and newly expanded loan offerings, MoneyMe is well positioned to continue to capitalise on this car sale boom.

Accelerating demand

According to the Federal Chamber of Automotive Industries, Australia’s peak car body, new car sales actually fell over in 2020 — dragged down by COVID-19.

However, this was partially offset by double digit growth in new car sales in both December and November last year as the pandemic-related restrictions eased.

Additionally, the used car market experienced strong growth across 2020 with Gumtree reporting a 13 per cent increase in people looking for vehicles.

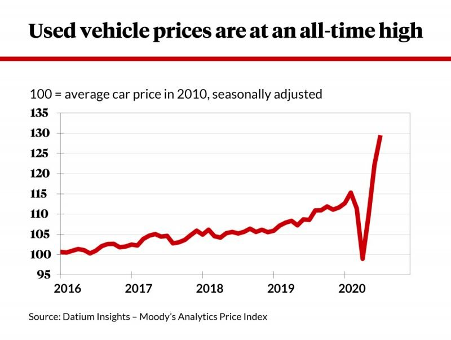

The price of used cars also shot up because supply couldn’t keep up with the demand, according to leading analyst firm Moody’s Analytics.

Anecdotally, car dealers and others within the industry said demand for new cars was strong throughout the second half of last year and into 2021.

Australian Automotive Dealer Association Chief Executive James Voortman told ABC there had been an uptick in sales during the recent first quarter.

James explained that changes in spending habits, brought on by COVID-19, had stimulated demand

“There isn’t much overseas travel happening. People are looking to holiday at home in a car, people are also shying away from public transport and looking for a car.”

Australian Automotive Dealer Association Chief Executive James Voortman

Coupled with disruptions in the global supply chain of new cars, with most vehicles sold in Australia produced overseas, there was demand for what stock was still available.

“I think the chief determining factor was where was that car manufactured and if it was manufactured in a country or in a region that has been affected by COVID-19 to the extent that a factory has had to close or had supply disrupted,” he said.

Expanding payment options

With demand on the rise, how are buyers paying for their new vehicles and how do ASX-listers factor into the equations?

Put simply, most people who buy a new car use finance. ASIC recently stated a whopping 90 per cent of all vehicle sales rely on financing.

Of those loans, only 39 per cent are actually financed through the actual car dealership where the vehicle is being purchased.

Additionally, the average loan being taken out by most buyers in Australia totals just under $32,000, with older Australians likely to spend more.

Given the reliance on loans and the clear trend of shopping around for financing when buying a vehicle — how do lenders ensure they’re getting picked?

For MoneyMe, the answer is to provide fast, simple access to loans which all boast low interest rates.

The ASX-listed business uses its artificial-intelligence technology to assess customers in as little as an hour, with the whole process able to be done online remotely.

The ease of access is just one of several selling points for the company, which historically has been able to offer a low interest rate of 6.25 per cent.

MoneyMe said its loans have already proved a hit with customers, helping it to a net promoter score of 75 plus and a 4.8-out-of-five star google review average.

Additionally, around 35 per cent of MME’s loan originations come from existing customers who’re already using its products.

What’s next?

The fintech business recently released its Vehicle Finance option Autopay, having already moved into the credit card space with MoneyMe Freestyle and the Shop Now, Pay Later space with MoneyMe plus.

Commenting on MME’s expansion into the vehicle finance sector, CEO Clayton Howes said the new product offers a fast and flexible solution for both dealers and customers.

“We believe dealers who have access to finance that is settled in minutes and is a same-day drive away product will have a distinct sales advantage,” he said.

“In the same way that people look to Afterpay for where they shop, we expect consumers will look to Autopay when they purchase their vehicles,” he added.

MoneyMe’s Autopay solution is already available for direct use in dealerships, with more than five dealerships already set up in its system.

With a strong base of repeat customers, easy-to-use technology in place and a willingness to diversify further to meet consumer’s ever-changing loan needs, MoneyMe argues it’s well primed to capitalise on the ongoing car sales boom.

Shares in MoneyMe are trading for $1.52 per share on Thursday, April 22.