A profitable Venture-listed mining stock responsible for 6.5% of the world’s tin recently gifted investors with news it beat its own production records for Q4 and the year.

Alphamin Resources (TSXV:AFM) reported a solid performance for fiscal year 2024 via a January media update, with significant increases in tin production and financial metrics. The company achieved a 38% increase in tin production, reaching 17,324 tonnes for FY2024.

Building on its success from Q3 2024, this growth is attributed to the successful expansion of the Mpama South project, which was completed in Q2 2024. For Q4 2024, Alphamin produced 5,237 tonnes of tin; a 7% increase from the previous quarter.

The processing facilities also performed well, with plant recoveries averaging 75%, surpassing the target of 73%. Despite high rainfall impacting outbound road conditions and transit times, the company managed to maintain robust production levels. However, tin sales volumes for Q4 decreased by 11% to 4,942 tonnes due to the clearing of a sales backlog in the previous quarter.

Financially, Alphamin’s EBITDA for FY2024 is estimated to increase by 102% to US$274 million, driven by higher tin production and sales volumes, as well as a 17% increase in the average tin price to US$30,345/t. The Q4 earnings before interest, taxes, depreciation, and amortization (EBITDA) guidance of US$76 million is 17% below the previous quarter due to lower sales volumes and a 4% decrease in tin prices.

Production guidance for FY2025

Looking ahead, Alphamin has set production guidance of approximately 20,000 tonnes of contained tin for FY2025, benefiting from the full-year impact of the Mpama South expansion. This ambitious target reflects the company’s confidence in its operational capabilities and market conditions.

Exploration update

Alphamin’s exploration strategy is focused on three key objectives:

- Increasing the Mpama North and Mpama South resource base and life of mine.

- Discovering the next tin deposit close to the Bisie mine.

- Ongoing grassroots exploration for remote tin deposits on the large prospective land package.

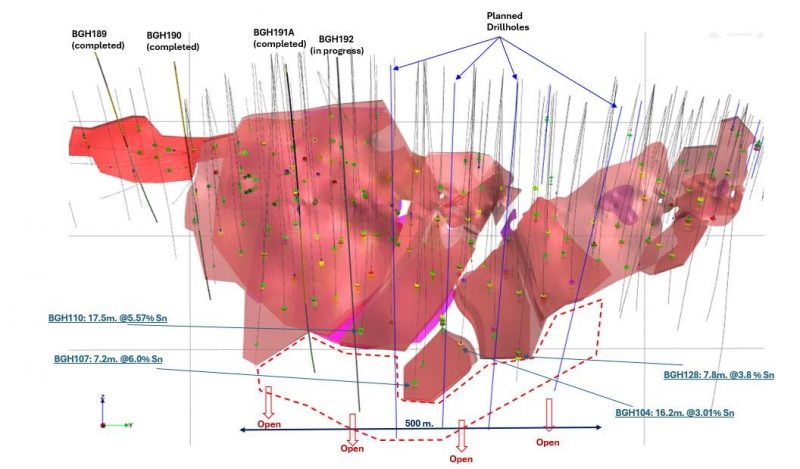

Exploration drilling at Mpama North and Mpama South recommenced in Q4 2024.

At Mpama South, a surface drilling campaign targeting down-dip, up-dip, and strike extensions is underway. Initial results have shown potential extensions of the mineralized system.

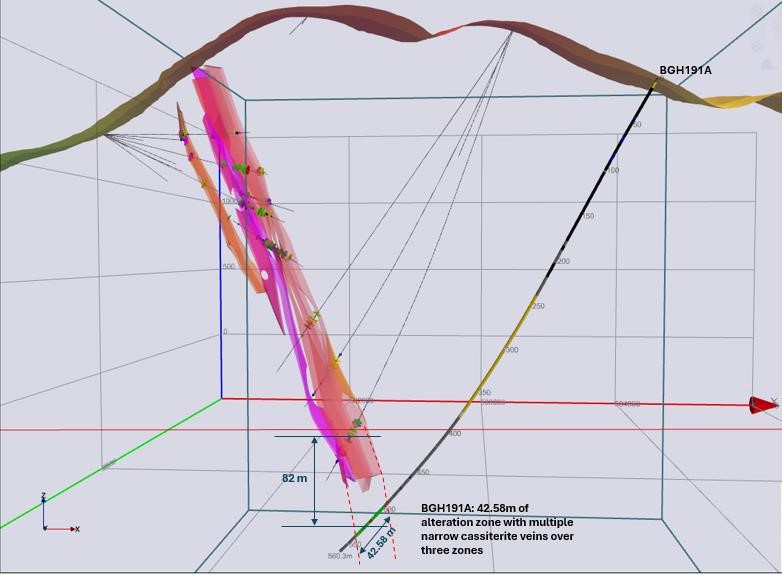

At Mpama North, geological fan drilling from underground has intersected zones of chlorite alteration and minor cassiterite veins and drillhole MNUD008A intersected a thick chlorite altered zone of visual tin cassiterite approximately 20m north of the previously most northerly Resource drillhole and some 200m below the bottom of the current mining echelon.

State of the tin concentrate market

The tin concentrate market, particularly in Africa and the Democratic Republic of the Congo (DRC), remains a critical area of focus.

Alphamin is one of the world’s largest producers of high-grade tin concentrate which positions it strategically to capitalize on market dynamics.

The global demand for tin, driven by its applications in electronics and technology, continues to rise, providing a favorable backdrop for Alphamin’s growth.

Investment corner

Alphamin Resources Corp presents a compelling investment opportunity. The company’s significant increase in tin production, robust financial performance, and strategic exploration initiatives point to its potential for sustained growth.

The successful expansion of the Mpama South project and the promising exploration results at Mpama North and South further enhance its value proposition. With a strong foothold in the DRC, Alphamin is well-positioned to benefit from the rising global demand for tin.

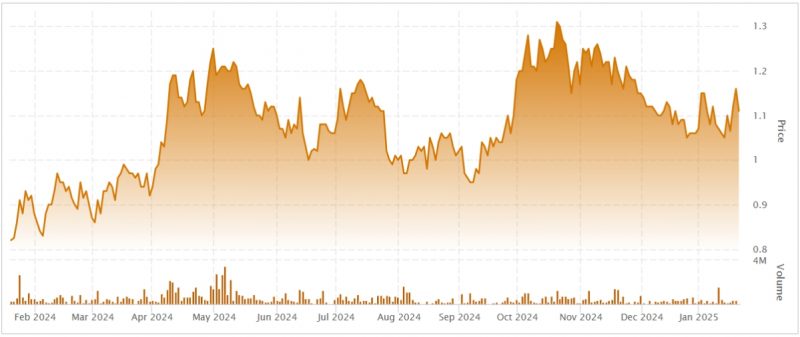

The company’s stock has grown an impressive 35% compared to this time, last year.

Investors seeking exposure to the tin market should consider Alphamin as a key player with substantial upside potential.

This is sponsored content issued on behalf of Alphamin Resources Corp.

Join the discussion: Find out what everybody’s saying about this stock on the Alphamin Resources Bullboard, and check out the rest of Stockhouse’s stock forums.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.