Ora Banda Mining (ASX:OBM) has revealed its FY26 gold production forecast has increased to 150Koz following a board approval of the company’s FID.

The company, all things in order, shouldn’t need to raise – $32M of the $39M CapEx projection is covered by a drawdown loan and the company expects flows from its Riverina Underground to support the other $7M.

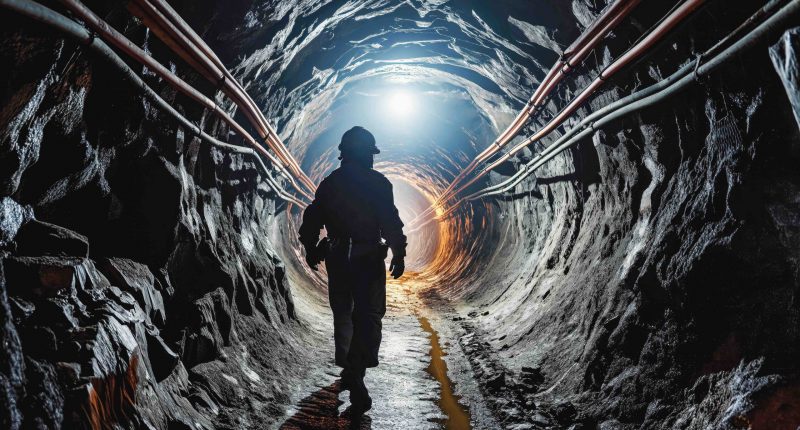

Construction commences this calendar quarter with the first development ore expected for Q4 – not long after works on the mineface portal commence.

Steady state production of “~60Kozpa” will be hit in the June quarter of 2025 around the same time digging and hauling gets properly underway.

The Sand King resource stands at 3.4Mt of ore at 2.8g/t gold for 306Koz of gold – a 176% increase struck in recently history; former calculations underpinned an earlier 110Koz guidance. The higher-confidence underground ore reserve is for 537K tonnes of ore at 3.2g/t for 55Koz ounces of gold.

“Our DRIVE to 150 plan to target 150,000 ounces in FY26 firmly places us on the pathway to becoming a mid-tier gold producer, and the most exciting part is that we are only just getting started on unlocking this highly prospective and under-explored tenement package,” Ora Banda MD Luke Creagh said.

““The Riverina Underground continues to ramp up well and with the support of Sand King Underground, is expected to deliver 40% year-on year growth and ~34% reduction in AISC/oz over the same period.”

OBM last traded at 37.5cps.