- Deathcare service provider, Propel Funeral Partners (PFP), has painted a lively updated guidance picture for the 2020 financial year

- The company reported today that it saw an eight per cent increase in the company’s revenue per funeral for the month of May compared to April, as well as a healthy boost to its total funeral volume

- Propel expects its total funeral volume to exceed 13,000 this financial year, an increase of 1700 services since FY19

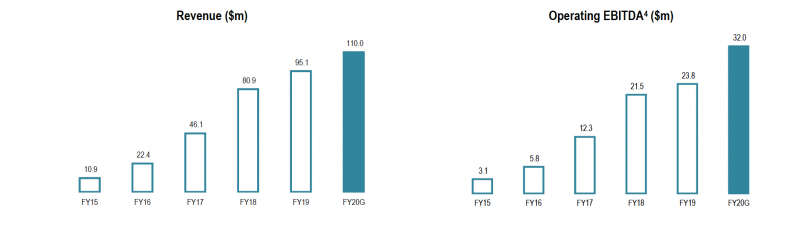

- The company is preparing for a larger-than-life balance sheet for this financial year, as its new revenue guidance stands at approximately $110 million, with an operating earnings before interest, tax, depreciation and amortisation (EBITDA) of around $32 million

- Propel’s finished the day 1.38 per cent higher today, and is selling shares for $2.92

The second-largest death care service provider in Australia and New Zealand, Propel Funeral Partners (PFP), has provided updated guidance for the 2020 financial year.

With restrictions on funerals implemented in March and April due to the COVID-19 pandemic, the company’s ability to offer a full range of services to its client families was affected.

The company’s comparable average revenue per funeral in the month of April declined by approximately 10 per cent on the personal contract purchase (PCP).

However, the easing of funeral attendee limits in both countries contributed to a circa eight per cent increase in the company’s average revenue per funeral in May 2020, compared to April 2020.

Propel expects the recent government-imposed social distancing measures and an increased focus on personal hygiene could result in a benign flu season in 2020 and a deferral of death volumes into future periods.

However, the company remains confident that death volumes are forecast to increase in Australia and New Zealand, due to the growing and ageing populations in both countries.

Propel also reported in its updated guidance that its total funeral volume is set to exceed 13,000 this financial year, an increase of 1700 services since FY19.

The company is preparing for a larger-than-life balance sheet for this financial year, as its new revenue guidance stands at approximately $110 million, with an operating earnings before interest, tax, depreciation and amortisation (EBITDA) of around $32 million.

Propel said it would release its full FY20 results in late August.

The company finished the day 1.38 per cent higher today, and is selling shares for $2.92.