- Real estate business Rent.com.au (RENT) has battled negative earnings in the last four quarters despite achieving consistent growing revenue

- The company recorded a loss of $2,497,183 for the 2019 Financial Year, which is a slight improvement from 2018

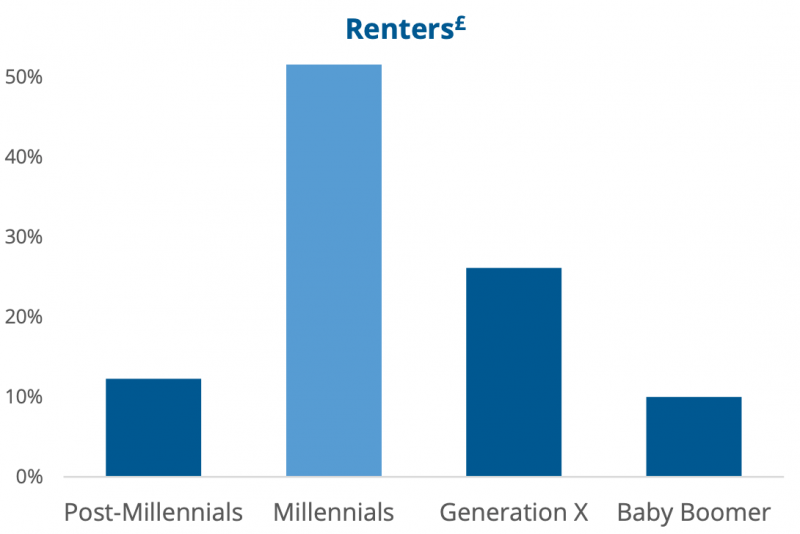

- RENT is now aiming to attract the millennials around the country who make up half of the market through a new scheme

- Similar to popular “buy now pay later” businesses like Zip Co and Afterpay, RENT will allow customers to “rent now pay later” with no surcharge

- Shares in the company are trading higher by 10 per cent today for pricing of 3.3 cents per share.

A Rent.com.au (RENT) with negative revenue has introduced a “move now, pay later” scheme to attract millennial renters across Australia.

The self-professed number one website in Australia for rental property has seen its negative earnings slowly even out over the past quarters but still sits in the red.

The figures

Image Sourced from Rent.com.au

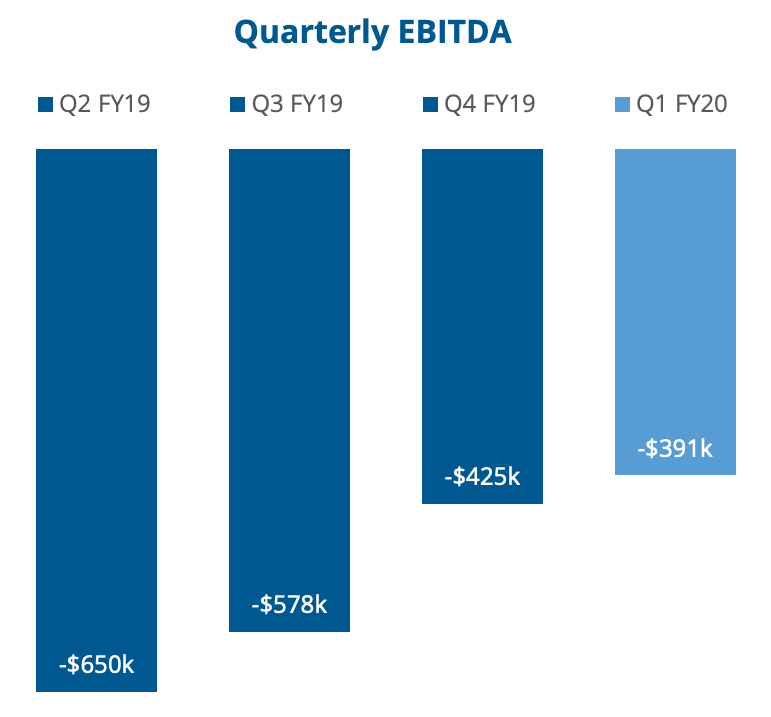

The company recorded a negative $650,000 earnings score for the second quarter of the 2019 financial year. Released yesterday, RENT has been able to reduce the loss to $391,000 by the end of 2020 financial year’s first quarter.

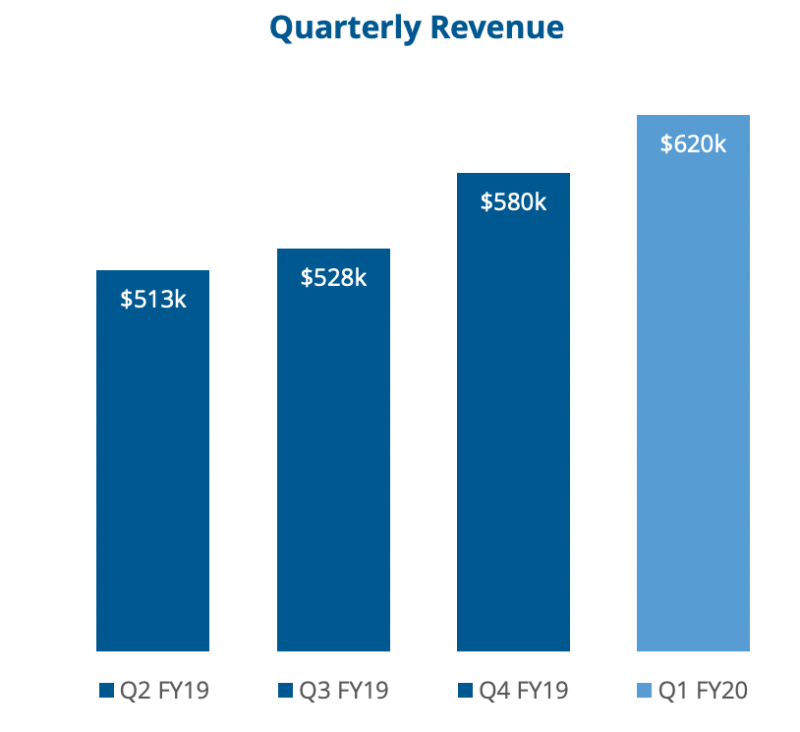

“Advertising product sales was a challenge over the past year, not only for our business but right across the industry, however the strategies and resources we put in place have borne fruit and we’ve achieved growth of 19% this quarter coming on top of the 18% we achieved in the previous quarter,” RENT CEO Greg Bader said.

However, this still marks a fourth consecutive quarterly loss for the company.

These figures also crash against what has only been growing quarterly revenue for the real estate business. The latest quarter represents a $107,000 premium in revenue. But earnings aren’t budging enough.

Image sourced from rent.com.au

The company’s net losses for the 2019 Financial Year were posted at $2,497,183 — although a slight improvement on 2018 Financial Year’s net loss of $2,822,540.

Chief Executive Greg Bader continued to focus on the positive opportunities in a media release by the company.

“Each quarter we get closer to our goal of profitability and I am encouraged by the dedication and hard work of the team who share that goal and keep innovating to achieve it in the near term,” he said.

“We are a small and diverse team with “making renting easier” as our mantra.”

“Move now, pay later”

In comes the company’s latest scheme to lift earnings.

Yesterday RENT announced its “Move now, pay later” feature to speak to the large millennial renters market.

“Moving is a stressful time for most people and trying to synchronise paying for your new bond with the return of your old one is near-impossible for many renters,” Greg explained.

“We know that more than half of renters are millennials, a generation characterised by challenging the norms particularly with regards to financial services.”

The scheme will allow renters to pay later on their rent through the business’ app. No surcharges are applied if the rent is paid within a 21 day period.

RENT management believes this speaks to the “buy now pay later” market that has plagued international business, including the likes of Zip Co and Afterpay.

Image sourced from rent.com.au

“This has the potential to change how people manage their money around the moving process,” Greg said.

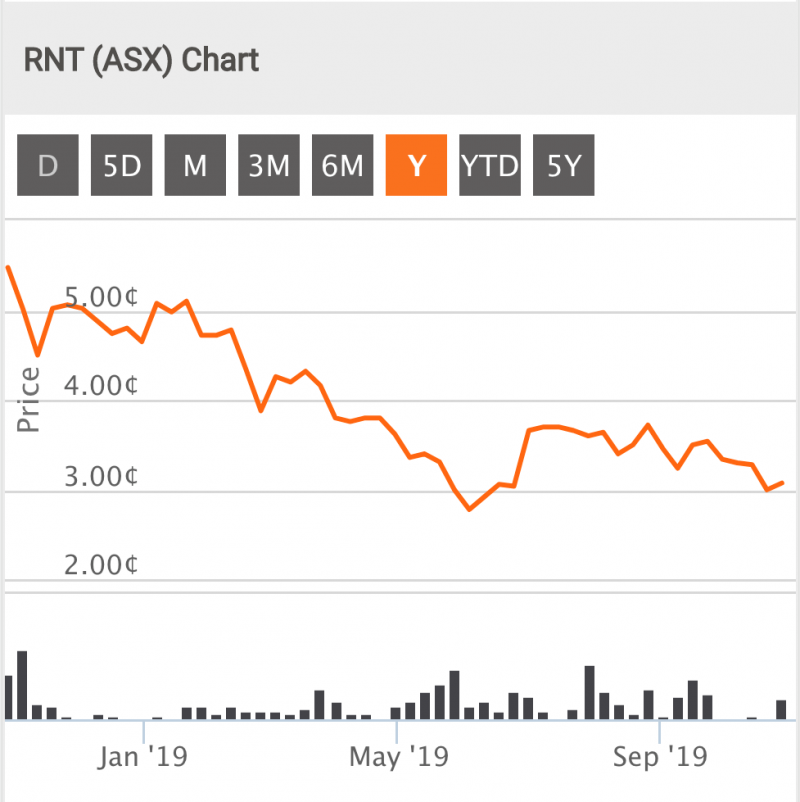

Shares in RENT have been on a downward trend since last year in a volatile fashion.

Today, however, they are trading higher by 10 per cent for pricing of 3.3 cents per share.