You know how it is: you’re standing at the self-serve checkout wondering how your grocery shop can be so expensive. You turn a red capsicum over in your hand, while in your mind: what’s stopping you from scanning this through as a brown onion? Is anybody even watching?

Well, at the stores of one un-named UK multinational retailer – one which the company, perhaps strangely, didn’t name due to “privacy laws” and because its name wouldn’t affect the share price – Rocketboots (ASX:ROC) has been watching.

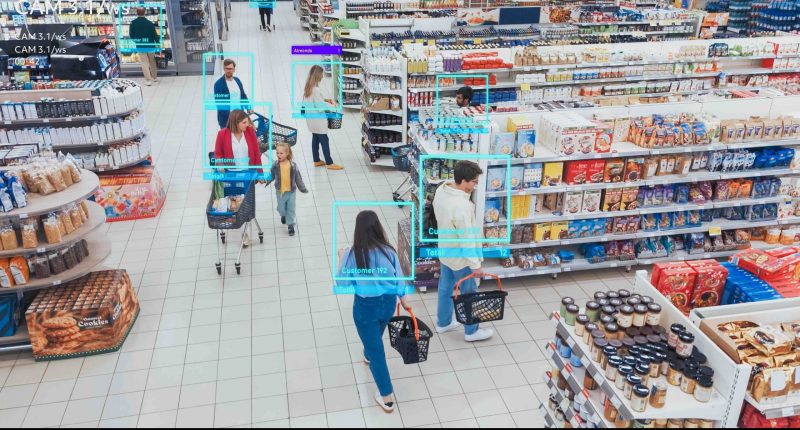

Or at least, its AI-powered theft detection software system has been watching, a filter applied to CCTV cameras overhead to stores in both the US and the UK.

The highly illiquid and undeniable nanocap is one of the more niche offerings on the ASX tech index, if you can call it that, alongside companies like Shekel Brainweigh (in that the latter also work in theft prevention.)

Its big claim to fame on Wednesday seemed to be both that it had struck a deal with a “multinational retailer” (undisclosed) in the first place, yes, but also that the client hit positive Return on Investment (ROI).

In other words? Rocketboot’s tech, at least in this early-stage proof of concept type exercise, was cheap enough to take on that the cost of using it was below the cost of goods presumably saved from being shoplifted by nefarious customers.

(Worth considering is that if the name of a multinational retailer isn’t materially significant to the company’s share price, nor was the value of the contract.)

But this could change, if they can keep the client locked into a SaaS style arrangement, which Rocketboots hinted at on Wednesday.

“Whilst the trial value was not material at the commencement of the trial, it is now material due to ongoing extensions and variations with the customer having paid fees equal to approximately 8% RocketBoots’ FY2024 revenue,” the company wrote.

The company also stated contract discussions are “in progress” and another three UK retailers are trialling its software at “advanced” levels.

ROC last traded at 9.3cps.

Join the discussion: See what HotCopper users are saying about ROC and be part of the conversations that move the markets.

DISCLAIMER: This article is not and should not be interpreted as financial advice.