- Tiger Resources has secured a funding facility with QMetco, which allows for the drawdown of up to US$30 million over three tranches

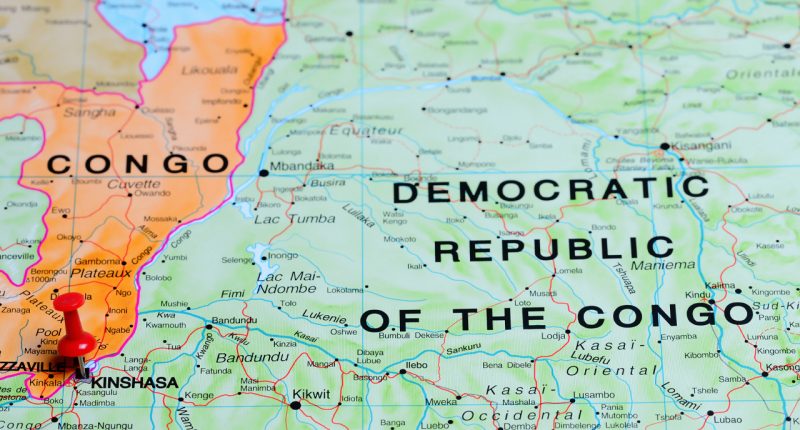

- The funding will be used to advance its Kipoi Copper Project in the Democratic Republic of Congo

- Kipoi hosts the Kipoi Central, Kipoi North, Kileba, Judeira and Kaminafitwe deposits

- QMetco will provide marketing services for 12 months for copper products

- Tiger undergoes management changes

Tiger Resources has secured a funding facility with QMetco, which allows for the drawdown of up to US$30 million over three tranches.

The funding will be used to advance its Kipoi Copper Project in the Democratic Republic of Congo, as well as provide ongoing working capital.

The facility will also allow Tiger to continue progressing discussions with its senior lender group regarding potential options to achieve a more holistic restructure of its current debt position. This will hopefully provide Tiger with a more stable and sustainable future capital structure.

Tiger has been exploring funding options for a while. It confirmed that QMetco was ultimately the only party who was able to provide funding on acceptable terms within the required timeframe.

Tranche 1 will include the payment of US$5 million, Tranche 2 will be US$7 million and the remaining $18 million will be available under Tranche 3, subject to the satisfaction of various conditions.

The Kipoi Copper Project is operated by SEK (Société d’Exploitation de Kipoi), a 95 per cent-owned subsidiary of Tiger. It is located 75 kilometres northwest of Lubumbashi, the capital of Katanga Province, in the central part of the Katanga Copper Belt.

The project hosts five known copper deposits which include: Kipoi Central, Kipoi North, Kileba, Judeira and Kaminafitwe.

As of December 2014, mineral resources for the Kipoi Copper Project were 938,000 tonnes of copper.

Tiger has also signed an engagement letter which will see QMetco providing exclusive marketing services for copper and cobalt products produced at Kipoi, for a 12-month term.

Under the facility, QMetco appointed non-executive Chairman, Michael Anderson.

“Mr Anderson has a wealth of experience in the mining industry, bringing over 25 years’ experience of senior leadership and technical expertise to the company,” Tiger Managing Director Caroline Keats said.

Tiger has also advised Chief Financial Officer David Wrigley has resigned and is looking for a replacement.