- US-based Brookside Energy (ASX:BRK) is set to boost production of oil from its Oklahoma acreage to 2500 BOEPD

- A four-well drill run is set to go live in Q1 2024

- Brookside also reported it has decided to self-fund its four-well program

- The company is surging ahead with an on-market share buyback in two tranches

- Brookside produced its one-millionth barrel of oil back in July of this year

- BRK last traded at 1.1 cents

US-based Brookside Energy (ASX:BRK) is set to boost production of oil from its Oklahoma acreage to 2500 barrels of oil equivalent per day (BOEPD).

Underpinning this increase is a four-well drill run set to go live in Q1 2024.

The program will occupy Brookside for much of the year – all four wells will be brought online together in unison in H2 2024, tipped as “late Q3 [or[] early Q4” by Brookside on Wednesday.

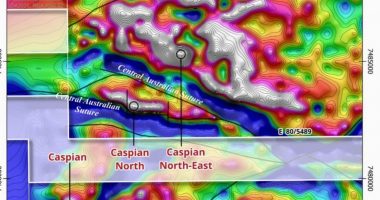

All four wells will be within Brookside’s “SWISH Area of Interest IAOI)” – Brookside’s terminology for its landholding; the microcap oil producer describing these plans as “transformational”.

If it can meet the 2500 BOEPD quota it’s set for itself, Brookside will stand to be one of the most established ASX smallcap oil and gas producers by output volume. Rigs and permits are in place.

Self-funded program

Brookside also reported today shareholders are set to get the best bang for their buck as the company has decided to self-fund its four-well program.

Brookside reported that energy services costs have “normalised” and that from a neurology perspective, a recent oil and gas hit on neighbouring acreage has emboldened the company to skip shaking the tin for a raise.

Instead, Brookside is surging ahead with an on-market share buyback in two tranches, with a second beyond the 10 per cent in 12 months limit to be tested for shareholder approval in early 2024.

Management comment

“Since the announcement of our inaugural 2P Reserve of 11.9MMBOE at the SWISH AOI in April 2023 the company has continued to field industry investor enquiries in participating in the development of this asset,” Brookside chief David Prentice said.

“Brookside’s balance sheet strength and high level of free cash flow generation has made ‘sole funding’ the [four well program] an easy decision with 100 per cent of the financial returns from our production target of an estimated 2500 BOEPD to now accrue to Brookside shareholders.”

Brookside produced its one-millionth barrel of oil back in July of this year.

BRK last traded at 1.1 cents.